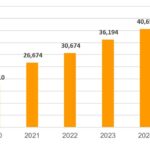

According to the Hanoi Stock Exchange (HNX), Ba Na Cable Car Services Joint Stock Company has announced positive financial results for the first half of 2025.

Ba Na Cable Car records nearly VND 1,000 billion in pre-tax profit

In the first half, the company reported a pre-tax profit of approximately VND 1,000 billion and an after-tax profit of over VND 846 billion, a significant increase compared to the same period in 2024. The after-tax profit margin on equity reached 9.3%, up from 5.6% a year earlier.

Ba Na Cable Car attributed the profit increase to the stable gross profit margin from its core business operations.

As of June 30, the company’s equity increased by nearly 26% compared to the end of 2024, reflecting its strengthened financial position.

Another highlight was the significant reduction in bond debt, lowering the bond debt-to-equity ratio to 0.32 times. Liquidity ratios also showed marked improvements. The current ratio stood at 2.24 times, up from 1.46 times in the previous year, indicating the company’s proactive management of working capital and strong short-term financial obligations.

Ba Na Cable Car’s substantial profits

Commencement of a VND 52,000 billion complex at Ba Na – Suoi Mo

In late August, alongside its financial performance, the company commenced the second phase of a hotel and entertainment complex at Ba Na, with a total investment of VND 52,000 billion.

The Ba Na – Suoi Mo Ecotourism and Urban Area covers 806 hectares in two communes of Hoa Vang district, Da Nang city. It comprises the Suoi Mo eco-urban area at the foot of the mountain and the tourist area at the peak of Ba Na.

This phase will include a 5-star hotel complex with 2,500 rooms, an entertainment area, a multi-purpose performance hall, an indoor theme park, and a convention center. The company has also initiated the construction of the Ba Na Cable Car Line 9, with a one-way length of 5.9 km, consisting of 154 cabins and a transportation capacity of 2,900 passengers per hour.

With positive financial results and the development of a large-scale project, Ba Na Cable Car continues to affirm its position as a leading tourism and service enterprise, possessing significant growth potential in the coming years.

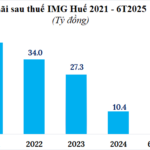

“IMG Hue Records Twelve-Fold Profit Increase in H1 2025, Freed from Bond Debt”

In the first half of 2025, IMG Hue reported a remarkable profit of over VND 30 billion, an astonishing surge of nearly 12 times compared to the same period last year. This achievement surpasses the results of both 2023 and 2024. Notably, the enterprise also made an early full repayment of four bond lots worth VND 350 billion.

“Unveiling IJC’s Strategic Move: A Near 190 Billion Dividend Declaration and the Story Behind the 17% Profit Dip”

“Infrastructure Development Joint Stock Company (HOSE: IJC) is delighted to announce a dividend payout for the year 2024. Shareholders are in for a treat as the company has declared a cash dividend, with the record date set as September 16th. Mark your calendars, as this is a date you wouldn’t want to miss out on!”

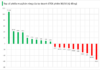

The Real Estate Renaissance: Navigating the Market with Financial Savvy

The real estate market has been through a tumultuous time, and many property businesses have had to get creative to weather the storm. With core operations struggling, these enterprises have had to look beyond their traditional realms to stay afloat, turning to financial maneuvers to navigate these challenging times.

“SHB’s Steadfast Commitment to Sustainable Growth: A Comprehensive Partnership Strategy.”

SHB, or the Saigon – Hanoi Commercial Joint Stock Bank, is committed to a strategy of comprehensive and sustainable development. We forge strong partnerships with leading state-owned and private economic groups, both domestic and international, as well as businesses with robust ecosystems, supply chains, and satellite companies. Our focus also extends to small and medium-sized enterprises, and we are dedicated to expanding our reach to individual customers.