On September 29, Fomeco, with the stock code FBC, will finalize the list of shareholders to distribute a 100% cash dividend for 2024, equivalent to VND 10,000 per share.

With 3.7 million shares circulating, the company expects to spend VND 37 billion on this dividend payment. The expected payment date is November 12, 2025.

This dividend payout aligns with the plan approved by the shareholders during the 2024 Annual General Meeting.

Looking back at its operating history, since its listing in 2017, the company has consistently rewarded shareholders with high cash dividends ranging from 30-65% annually, with an exceptional dividend of 200% in 2023.

Notably, despite the generous cash dividends, FBC’s market price has remained low. FBC shares are rarely traded due to their concentrated ownership structure, and the share price has been stagnant at VND 3,700 per share since May 2022.

Established in 1974 by the decision of the Minister of Heavy Industry, Fomeco officially transformed into a joint-stock company in 2003. Its main products include bearings, motorcycle parts, automobile parts, conveyor rollers, construction parts, and other mechanical products.

Fomeco listed its shares on the UPCoM exchange in October 2017 with a reference price of VND 15,000 per share on the first trading day. The company has a charter capital of VND 37 billion, of which the Vietnam Engine and Agricultural Machinery Corporation (VEAM) holds a 51% stake.

VEAM is the Vietnamese partner in joint ventures with Toyota Vietnam (VEAM holding 20%), Honda Vietnam (VEAM holding 30%), Ford Vietnam (25% through its subsidiary VEAM DISOCO), Mekong Auto, Kumba, and VEAM Korea.

This affiliation provides advantages to VEAM’s subsidiaries, including FBC. Over the years, FBC has been a trusted supplier of parts to Honda Vietnam and other prominent customers such as Yamaha, Suzuki, Hanwa, Nippo, Piaggio, and Panasonic.

The generous dividend policy follows the company’s positive financial performance. In 2024, Fomeco achieved a revenue of VND 1,117 billion, a roughly 6% increase from the previous year, surpassing the plan by 7%. Consequently, its net profit reached nearly VND 76 billion, exceeding the target by 26%.

For the fiscal year 2025, Fomeco forecasts a revenue of VND 1,010 billion, including an industrial production revenue of VND 931 billion. The targeted after-tax profit is VND 67 billion. These figures represent a 10% and 11% decrease in revenue and profit, respectively, compared to the 2024 performance.

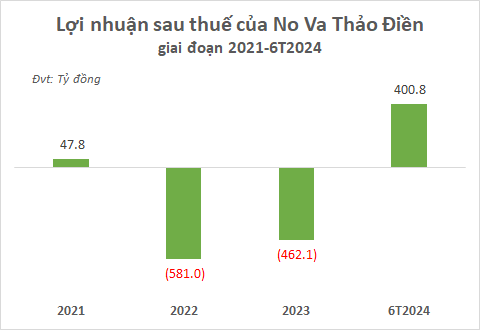

A Rewarding Quarter for CII Shareholders: Over VND 300 Billion in Dividends to be Distributed in Q4

“CII is set to reward its shareholders with a 5% dividend payout, marking a significant shift from the past two quarters, where efforts were focused on diverting resources towards the ambitious $1.7 billion highway project. This move underscores CII’s commitment to balancing growth initiatives with shareholder value.”