German luxury sports car maker, Porsche AG, is facing a significant setback as it is set to be dropped from the blue-chip DAX index – just three years after its stellar debut.

According to Deutsche Börse, from September 22, 2025, Porsche will be removed from the DAX and moved to the MDAX index, marking a notable downgrade for a brand once considered a “rising star” on the stock market. The main reason for this change is the poor performance of the company’s shares, which have plummeted by over 33% in the past year, making it one of the worst-performing stocks among Germany’s large enterprises.

“DAX is keeping up with the times, which is a good thing. Weak stocks will be removed, and strong ones will be added,” said Jochen Stanzl, market analyst at CMC Markets.

The decline reflects the growing challenges faced by the company, including a significant drop in demand in China and Germany, as well as tariff pressures in the US on imported luxury vehicles. In the first half of 2025, Porsche’s global deliveries decreased by 6% year-on-year to 146,391 vehicles. China witnessed a staggering 28% decline, while its home market, Germany, saw a 23% drop in sales.

While a 10% growth in North America provided some compensation, it was not enough to balance the overall decline, especially with the added pressure of import taxes making Porsche models more expensive. In addition, the company’s electrification strategy has been progressing slowly, causing Porsche to lose ground to competitors who have been faster in the electric vehicle race.

CEO Oliver Blume remains optimistic despite the challenges.

Despite these challenges, Porsche remains a financially robust company with a large scale. In 2024, the company generated over 40 billion euros in revenue and employed more than 42,000 people. CEO Oliver Blume remains optimistic, stating that the company’s goal is to return to the DAX “as soon as possible.” He added, “With Porsche’s new direction, we have the clear ambition to return to the DAX as soon as possible.”

However, the reality is that Porsche is facing significant pressure. The Chinese market, once a savior for European luxury carmakers, has slowed down. Tariff pressures in the US have squeezed profit margins, and the transition to electric vehicles requires massive investments that have not yet yielded proportional results.

“The slow demand for electric vehicles, a weak Chinese market, and US tariffs are challenging the German industry,” said Jürgen Molnar, an analyst at RoboMarkets.

Being dropped from the DAX is not just a blow to the company’s reputation but also a potential deterrent to institutional investors who favor blue-chip stocks. This development serves as a warning that the storied sports car brand is entering a period of significant challenge, where the glow of its glorious growth years can no longer obscure the emerging difficulties.

Source: Financial Times

Why is the S&P 500 Hitting Record Highs While the VN-Index is Stuck Below 1200 Points?

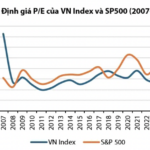

Although the Compound Annual Growth Rate (CAGR) of EPS for the VN-Index (8.4%) outperforms that of the S&P 500 (7.6%) since 2016, the S&P 500 has witnessed a more remarkable surge, attributable to a more significant re-rating. Specifically, the S&P 500’s average P/E valuation has escalated from 15.3 times to 21 times, representing a substantial increase of 37%. In contrast, the VN-Index’s re-rating has been relatively modest, rising gently from 15.4 times to 16 times, a mere 4% increase.

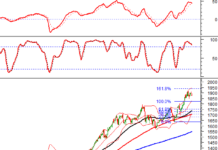

The Stock Market is Primed for a New Uptrend; VN-Index Eyes 1,350 Points by Late 2024

According to Agriseco, the second half of this year will be pivotal for the new growth cycle leading up to 2025. With potential market upgrades on the horizon, this period is crucial for attracting foreign investment and setting the stage for a prosperous future.

The Pen Is Mightier: Crafting a Captivating Headline

“Macroeconomic Brilliance Across Sectors: Why Is the Stock Market “Out of Sync”?”

“Step forward, Master Nguyen The Trung, the esteemed CEO of John&Partners, and a renowned expert in the fields of corporate consulting, capital raising, and IPO advisory. With a unique perspective on Vietnam’s ‘decoupling’ of GDP growth and stock market performance, he’s here to offer invaluable insights.”

“How This Auto Manufacturer Saved Millions by Ending a Simple Perk”

Volkswagen has just delivered a shocking demand to its executives: return the luxury cars that have served as their company vehicles for years.