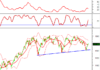

Last week, the VN-Index dropped a total of 15.24 points to 1,666.97. Meanwhile, the HNX-Index rose 0.69 points to 280.67.

On the HoSE, foreign investors net sold 77.56 million units, with a net selling value of nearly VND 5,050 billion. On the HNX, foreign investors also net sold 3.1 million units, with a net selling value of over VND 161 billion.

In the Upcom market, foreign investors net sold 3.58 million units, with a net selling value of over VND 67 billion. Thus, during the trading week from September 3-5, foreign investors net sold a total of 84.25 million units on the entire market, with a total corresponding net selling value of nearly VND 5,279 billion.

Consistent high dividend payouts

On September 29, Fomeco (mã chứng khoán: FBC) will finalize the list of shareholders for a 2024 cash dividend payout at a rate of 100%, meaning shareholders will receive VND 10,000 per share. The payment is expected to be made on November 12.

Fomeco allocates approximately VND 37 billion for this dividend.

With 3.7 million shares currently in circulation, FBC will allocate approximately VND 37 billion for this dividend. VEAM (mã chứng khoán: VEA), FBC’s parent company with a 51% stake, will receive nearly VND 19 billion.

Since its listing in 2017, FBC has consistently paid out high cash dividends, ranging from 30% to 65% annually. The highest dividend payout was in 2023, when the company distributed dividends at a rate of 200%.

Despite the consistently high dividend payout ratio, FBC’s share price has remained at VND 3,700 per share since May 2022 due to a lack of trading activity.

Established in 1974 and transformed into a joint-stock company in 2003, Fomeco’s main products include bearings, motorcycle parts, automobile parts, conveyor rollers, construction parts, and other mechanical products.

Continuous sale of DXG by Dragon Capital-related funds

Dragon Capital-related funds sold 3.75 million DXG shares of Đất Xanh Group (mã chứng khoán: DXG) to reduce their ownership to 12.67% of charter capital. Specifically, Norges Bank fund sold 2 million shares, Amersham Industries Limited fund sold 1 million shares, DC Developing Markets Strategies Public Limited Company fund sold 500,000 shares, Vietnam Enterprise Investments Limited fund sold 500,000 shares, while Samsung Vietnam Securities Master Investment Trust (Equity) fund purchased 250,000 shares of DXG.

Dragon Capital-related funds continuously sell DXG shares.

Previously, on August 25, the Dragon Capital group also sold 3.9 million DXG shares.

Additionally, from August 15-27, Ms. Do Thi Thai, Vice Chairman of DXG, sold 413,300 DXG shares to reduce her ownership to 0.05% of charter capital. From August 4-26, Mr. Ha Duc Hieu, a member of the Board of Directors, sold 6,355,000 DXG shares to reduce his ownership to 0.04% of charter capital. And from July 24 to August 19, Mr. Bui Ngoc Duc, CEO of DXG, sold 744,418 shares to reduce his ownership to 0.09% of charter capital.

From September 9 to October 8, Mr. Nguyen Duc Dung, a member of the Board of Directors of Viconship (mã chứng khoán: VSC), registered to sell 217,187 VSC shares to reduce his ownership to 0.16% of charter capital.

Previously, from August 6 to September 3, Mr. Dung had registered to sell 217,187 VSC shares but was unable to do so due to market prices not meeting expectations.

Viconship has recently released the documents for its upcoming extraordinary general meeting, scheduled for October 9 in Quang Ninh Province. The company proposes to increase its 2025 pre-tax profit plan from VND 400 billion to VND 1,250 billion, among other agenda items.

From September 9 to October 8, REE Real Estate Company, an organization related to Mr. Nguyen Van Khoa, Vice Chairman of the Board of Directors of Saigonres (mã chứng khoán: SGR), registered to sell 2 million SGR shares to reduce its ownership to 21.92% of charter capital.

REE Real Estate Company continues to sell SGR shares.

Previously, from June 27 to July 24, REE Real Estate Company registered to sell 2 million SGR shares but did not sell any shares during the registration period due to unmet price expectations.

REE Real Estate Company is a subsidiary of REE Corporation (mã chứng khoán: REE), operating in the real estate sector.

Earlier, from June 9 to July 7, Mr. Pham Thu, Chairman of the Board of Directors of Saigonres, sold 7 million SGR shares out of the registered sale of 9.8 million shares, reducing his ownership to 29.82% of charter capital.

Stock Market Update September 5th: Can the VN-Index Surpass the 1,700 Point Mark?

The stock market witnessed a substantial influx of capital, potentially setting the stage for the VN-Index to surge past the 1,700-point mark and beyond during the trading session on September 5th.

Market Beat: Profit-Taking Pressure Mounts, VN-Index Down Over 29 Points

The market closed with the VN-Index down 29.32 points (-1.73%), settling at 1,666.97; while the HNX-Index fell 3.32 points (-1.17%) to 280.67. The sell-off dominated today’s trading session, with 477 decliners against 319 advancers. The large-cap basket, VN30, mirrored the broader market with 24 losers, 3 gainers, and 3 stocks closing unchanged.