From Expectations to Disillusionment

One of the biggest challenges that JSC Quoc Cuong Gia Lai (HoSE: QCG) is currently facing is the obligation to repay more than VND 2,882 billion to the Van Thinh Phat Group, relating to the Bac Phuoc Kien residential project (formerly in Nha Be, now in Ho Chi Minh City). This is not only a huge financial burden but also a “dark shadow” that has haunted QCG for many years.

The Phuoc Kien project is the most notable project of Quoc Cuong Gia Lai in terms of scale as well as the prolonged legal disputes surrounding it.

In March 2017, Quoc Cuong Gia Lai and Sunny Island Investment JSC (a legal entity related to Van Thinh Phat) signed a contract for the sale of the Bac Phuoc Kien project. According to the contract, Sunny Island was to transfer VND 4,800 billion to QCG. However, a conflict arose when Sunny Island only disbursed VND 2,882 billion before stopping.

In response to Sunny’s actions, after the deadline for transferring the money had passed, QCG filed a lawsuit with the Vietnam International Arbitration Centre (VIAC) in late 2020 to resolve the dispute. QCG’s desire was to return the full amount of VND 2,883 billion received from Sunny Island, in exchange for Sunny Island transferring back all the land received.

In May 2023, VIAC ruled in favor of Quoc Cuong Gia Lai, stating that they did not have to refund the money received. However, when Truong My Lan was indicted, the Ho Chi Minh City People’s Court overturned VIAC’s decision and ordered Quoc Cuong Gia Lai to refund VND 2,882 billion to regain ownership of the Phuoc Kien project. The company agreed to repay the money received.

This is a significant amount for QCG, and arranging the funds to repay the debt will be a challenge for the company, given the difficulties in their core business of real estate.

To repay Sunny Island, Quoc Cuong Gia Lai had to divest from the energy and hydropower sectors, clear inventory, and develop the Marina Danang project.

This burden also fell on Mr. Nguyen Quoc Cuong’s shoulders since he took on the role of General Director (July 2024). At the 2025 Annual General Meeting of Shareholders, Mr. Cuong stated that at the time of the decision to sell the Phuoc Kien project to Sunny Land for approximately VND 2,882 billion in 2016-2017, the leadership expected that the money would help the company develop strongly in the 2017-2020 period. However, due to many changes, this did not come true.

“And then this became a difficulty for Quoc Cuong Gia Lai. We have had to “pay the price“ a lot for this Phuoc Kien project“, Mr. Cuong candidly shared.

To repay Sunny Island, the CEO of Quoc Cuong Gia Lai said that they had to divest from the energy and hydropower sectors, clear inventory, and develop the Marina Danang project. The total expected revenue from these activities is approximately VND 3,000 billion.

Regarding the repayment plan, the company will make installment payments starting from the third quarter of 2025 and concluding no later than the second quarter of 2027.

According to the reviewed semi-annual financial statements for 2025, as of June 5, the company had paid VND 100 billion, and on July 3, the company made an additional payment of VND 500 billion to the Ho Chi Minh City Department of Civil Judgment Execution. Thus, Quoc Cuong Gia Lai has paid a total of VND 600 billion to Ms. Truong My Lan.

VND 5,400 billion “idle” awaiting redemption of the Bac Phuoc Kien project

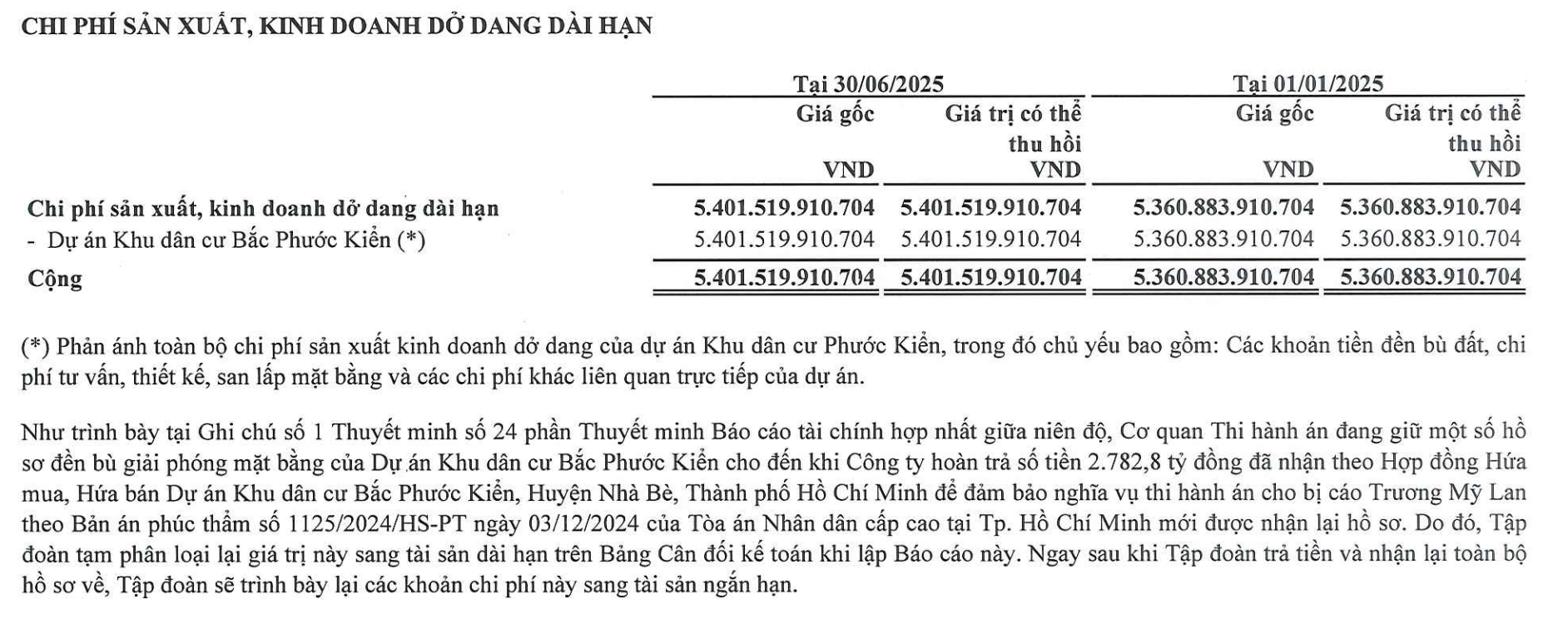

The reviewed semi-annual financial statements for 2025 also clearly show that the company’s production and business fixed assets under construction amount to VND 5,401.5 billion (accounting for 62.2% of total assets). This money is tied up in the Bac Phuoc Kien residential project, including land compensation costs, consulting fees, design fees, land leveling costs, etc.

Notably, this factor also led the auditor to question the company’s ability to continue operating. The auditing firm clearly stated that as of June 30, Quoc Cuong Gia Lai’s short-term assets totaled over VND 1,844 billion, while short-term debts amounted to nearly VND 3,815 billion. The majority of this debt comprises the amount of over VND 2,782 billion that Quoc Cuong Gia Lai must refund according to the Promise of Sale contract for the Bac Phuoc Kien residential project to ensure the enforcement of the sentence for the defendant, Truong My Lan, as per the Appellate Panel Decision No. 1125/2024/HS-PT of the Ho Chi Minh City High-Level People’s Court.

“This indicates the existence of a material uncertainty that may cast significant doubt on Quoc Cuong Gia Lai’s ability to continue as a going concern,” the auditing firm emphasized.

QCG affirmed that they are aware of this issue and have developed business and cash flow plans for 2025 and subsequent years. The management of Quoc Cuong Gia Lai is confident that the company can still ensure the payment of maturing debt obligations and maintain its ability to operate continuously in the future.

Currently, all land compensation and site clearance documents have been handed over to Sunny Island and are being kept by the enforcement agency. If the full amount of VND 2,882 billion is refunded, Quoc Cuong Gia Lai will receive back all the land compensation and site clearance documents, along with related papers for the Bac Phuoc Kien residential project.

At the 2025 Annual General Meeting of Shareholders, Mr. Nguyen Quoc Cuong shared that due to the large scale of the Phuoc Kien project compared to the company’s current capabilities (nearly 100 hectares of land), they would seek joint investment.

“The scale of this project is beyond our current capacity, and it would be challenging for QCG to implement it independently. In the South of Saigon, this is the only remaining project. With an area of 100 hectares, the project will have approximately 1.5 million square meters of floor area, equivalent to about 50% of Phu My Hung. However, it is worth noting that it took Phu My Hung about 30 years to reach its current level of development.

Meanwhile, Quoc Cuong Gia Lai always aims to ensure a high occupancy rate instead of selling the project at all costs, leading to wastefulness, as many investors are doing today,” Mr. Cuong added.

Regarding business performance, in the first half of 2025, Quoc Cuong Gia Lai recorded revenue of over VND 242 billion, four times higher than the same period last year; after-tax profit reached VND 10 billion, improving from a loss of over VND 16 billion. However, these figures are still far from the company’s set targets, as they have only achieved 12% of the revenue goal and 7% of the profit target.

Despite returning to profitability, Quoc Cuong Gia Lai still recorded a negative business cash flow of nearly VND 113 billion in the first half of 2025, compared to a negative cash flow of nearly VND 9 billion in the same period last year.

Borrowing Money from a Bank to Buy a House? Keep These 6 Things in Mind

Many individuals choose to borrow from a financial institution to acquire their first home, but this is a long-term financial decision that necessitates careful consideration. From interest rates and debt-to-income ratios to emergency funds, there are rules that prospective buyers must remember.

The Great Turnaround: From Losses to Profits – A Story of Resilience and Innovation

“Trung Thuy Joint Stock Company – Danang (TDNC), the developers of the Nam O Heritage project, revealed their financial report for the first half of 2025. The report showed a post-tax loss of over 117 million VND, a stark contrast to the 4.5 billion VND profit they achieved in the same period last year.”

The Rising Titans: HOSE Welcomes Three New Members to the $10 Billion Capitalization Club

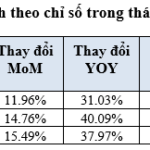

In August 2025, the HOSE witnessed a remarkable surge with key indices climbing upwards. This positive momentum was further emphasized by the growth of most sectoral indices compared to the previous month. Riding on this wave of optimism, HOSE proudly welcomed two more businesses with a market capitalization of over USD 1 billion each and an additional three enterprises with a market cap exceeding USD 10 billion.