This was shared by Mr. Nguyen Trieu Vinh – Deputy Director of Investment, Director of Equity Investment, Vietcombank Securities Investment Fund Management Company Limited (VCBF) at the Vietstock LIVE program on 09/05.

Profit growth helps maintain an attractive valuation

At the end of August, the P/E of the VN-Index was around 15.2 times, no longer a bargain compared to the historical average, although still lower than when the index rose strongly, sometimes exceeding 20 times. However, with the profit growth prospects of listed companies, the market valuation will become more attractive. According to the projected profit growth in 2025, the market’s P/E could reach 13.6 times, an attractive level compared to the average valuation over the past 10 years.

Secondly, when comparing the P/E of the VN-Index with indices in the region, it is clear that it is lower than that of India and China, but higher than Malaysia, Thailand, and the Philippines. If we also consider Vietnam’s economic growth and political stability, it can be argued that the Vietnamese stock market deserves a higher valuation than many countries in the region.

Regarding the growth drivers of the Vietnamese economy in the coming period, Mr. Vinh and VCBF expressed optimism about several supportive factors.

Firstly, the government remains committed to promoting public investment, given the favorable budget situation.

Secondly, recent growth figures have been very encouraging. As tourism recovers, many other sectors such as retail and services will also benefit.

Thirdly, the low-interest rate environment stimulates investment and consumption. Additionally, administrative reforms and streamlined bureaucracy will reduce overhead costs, freeing up resources for infrastructure development. The VAT reduction policy extension until 2026 is also a supportive factor.

Finally, the government encourages the development of this sector, thereby increasing labor productivity, accelerating project progress, and indirectly supporting the stock market.

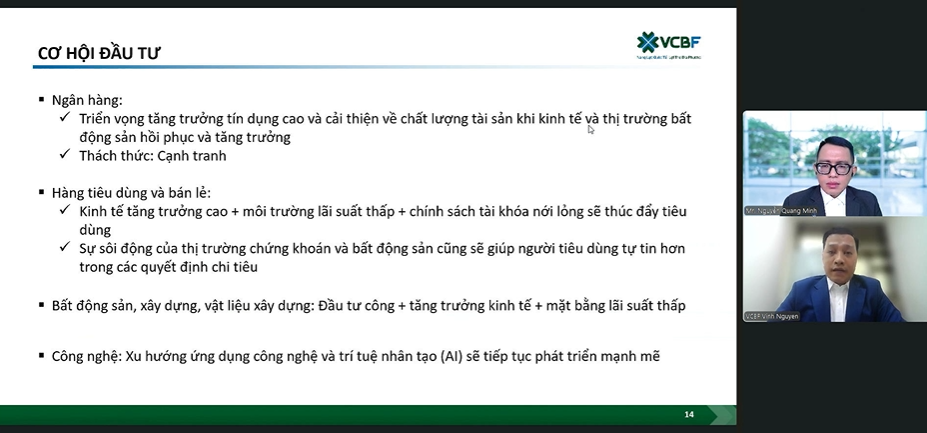

With these prospects, Mr. Vinh believes that there are many sectors that can be invested in the coming time, including consumer discretionary and retail thanks to the advantages of low-interest rates and expansionary fiscal policies. As the stock market and real estate market recover, people’s assets increase, and they will be more confident in spending. In fact, there are retail businesses that are confident in achieving their full-year plans early, or data reflecting customers returning to buy high-value products.

Real estate, construction, and building materials are expected to benefit from public investment, economic growth, and low-interest rates.

The technology sector, with the trend of AI and IT application, will continue to grow strongly, creating opportunities for businesses with sufficient potential to develop technology and AI products.

In addition, the banking sector still has potential but requires careful selection. Despite the strong share price performance in the past, some banks’ valuations are only at the historical average, while mid to long-term growth prospects remain favorable. Notably, competition in the industry is intensifying, making it challenging to improve NIM in the short term.

“At VCBF, we continue to invest in some banks with a good ecosystem, a clear strategy for digital transformation, product development, and customer retention. We also focus on asset quality and reasonable valuations,” said Mr. Vinh.

Screenshot of the event

|

In the context of no significant macroeconomic headwinds, Mr. Vinh still reminds investors not to neglect risk management, especially as many investors recently tend to invest based on market rumors or speculation rather than thorough company research.

The VCBF expert also advises against putting “all your eggs in one basket” to limit risks. When the market is vibrant, many investors tend to concentrate their capital in certain stocks, increasing concentration risk.

Exchange rate pressure will ease

Regarding the exchange rate, which has been a hot topic recently, the VCBF expert expects the pressure to ease somewhat in the coming period. The main reason for the exchange rate pressure is that Vietnam has cut interest rates significantly and maintained low rates to support and promote economic growth, while the US has kept interest rates high to curb inflation.

However, with the current inflation and interest rate levels, the Fed is expected to have room to cut rates 2-3 times this year, starting in September. When the Fed cuts interest rates, the interest rate differential between Vietnam and the US will narrow, thereby reducing exchange rate pressure.

In addition, the fourth quarter is usually the peak season for remittances (accounting for about 30% of the annual total) and international tourism, which helps increase foreign currency supply and reduce exchange rate pressure.

Upgrading will attract significant foreign capital

Regarding the outlook for an upgrade, Mr. Vinh expects the Vietnamese stock market to be decided for an upgrade by FTSE in the next ranking. This is entirely in line with the market size and liquidity of Vietnam compared to other countries in the region that have been upgraded before. At the same time, this is also a reasonable result after the efforts of the Government, regulatory agencies, and securities companies in promoting the upgrading process.

The government has set out a specific roadmap to continue upgrading and improving the market quality, not only in the immediate future but also after being recognized for the upgrade. According to FTSE, after the decision is made, it usually takes 6-9 months to implement, but for Vietnam, it may take about 1 year. Therefore, the base case scenario is that Vietnam will be decided for an upgrade in September 2025 and officially upgraded in September 2026.

According to FTSE, when upgraded, Vietnam will account for about 0.3% of the FTSE EM Index, equivalent to about $1 billion in passive capital from index funds. If the number and quality of listed companies improve, active funds could be 3-4 times higher than passive funds, bringing the total foreign capital inflow into Vietnam to about $4-5 billion.

Accordingly, the beneficiaries include securities companies, especially those with a large market share in the foreign customer segment, and large-cap companies with foreign ownership room.

However, as FTSE’s decision to upgrade depends on client feedback, there may be a scenario where some investors disagree, leading to a possibility that Vietnam may not be upgraded this September. Nevertheless, given the market capitalization, liquidity, and reform efforts in the past, Mr. Vinh remains optimistic about a positive outcome, and if not in September, the next likely timing would be March 2026.

Huy Khai

– 18:31 09/05/2025

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.

Steel Stocks: A Magnet for Investment Funds

With the strong comeback of large-cap stocks, the VN-Index surged towards the 1,700-point mark. Steel stocks attracted significant trading volume in today’s session (September 4th).