On September 5, FTSE Russell announced that the FTSE Country Classification Review September 2025 results will be published after the close of the US market on Tuesday, October 7, 2025.

The classification of markets within the FTSE Global Equity Index Series is continuously assessed. To ensure transparency, markets that are being considered for reclassification from/to Developed, Advanced Emerging, Secondary Emerging, or Frontier Market status are placed on FTSE’s Watch List.

Notably, Vietnam is currently on the Watch List as of March 2025 and is highly likely to be reclassified from a Frontier to a Secondary Emerging market, according to FTSE.

Regarding the potential upgrade of Vietnam’s stock market, the Ministry of Finance stated that FTSE Russell recognized the recent reforms, especially Circular No. 68/2024/TT-BTC, which took effect on November 4, 2024, and Circular No. 18/2025/TT-BTC issued on April 26, 2025. These circulars eliminated the pre-deposit mechanism, bringing the market closer to international standards.

Additionally, the implementation of the KRX information technology system, the issuance of a new circular on registration, depository, clearing, and payment, along with the legal framework for the new trading mechanism, were also positively assessed.

In August, the Ministry of Finance continued to implement important solutions to facilitate foreign investors’ participation in the market.

Firstly, the Ministry of Finance submitted to the Government a Decree amending and supplementing a number of articles of Decree No. 155/2020/ND-CP. Notably, public companies must complete the notification of foreign ownership ratios within 12 months from the effective date of the Decree to ensure transparency. At the same time, the Ministry of Finance is also coordinating with ministries and sectors to amend the Law on Investment and guiding documents, aiming to raise the foreign ownership ratio in industries unrelated to national security and defense. As a result, the maximum foreign ownership ratio in public companies will increase.

In parallel, the Ministry of Finance closely coordinated with the State Bank of Vietnam in amending Circular No. 17/2024/TT-NHNN. This Circular is expected to bring more benefits to foreign investors, such as allowing authorization for financial institutions to open, close, and use payment accounts; not requiring consular legalization for account opening documents; not requiring biometrics when opening accounts electronically and when withdrawing money; allowing the use of the SWIFT system; and minimizing requirements for documents and signatures. Thus, once issued, the Circular will significantly contribute to facilitating international capital flows.

According to a recent analysis by HSBC, Vietnam has met seven out of nine criteria in the FTSE’s “Market Quality” framework. Quantitative criteria such as market capitalization size, liquidity, and the presence of large-cap stocks have been achieved. The remaining two criteria related to the payment mechanism and transaction costs, which were previously considered “restricted” by FTSE, have also shown progress.

A Business Fined for Withholding Financial Information

Tùng Khánh Inc. has found itself in hot water, having been penalized for failing to disclose its audited financial reports for 2023 and 2024, including the semi-annual report for 2024.

“A Surging Foreign Investment Tide: Vietnam Attracts $26.14 Billion FDI in Eight Months, Up 27.3% Year-on-Year”

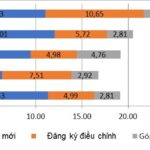

As per the latest figures released by the Statistics Bureau, foreign investment registered in Vietnam as of August 31, 2025, including newly registered capital, additional capital, and capital contributions and share purchases by foreign investors, totaled $26.14 billion, a surge of 27.3% compared to the same period last year.

Industrial Production Surges Across All 34 Regions

The industrial production index in August and the first eight months of 2025 witnessed positive growth across all 34 localities, with the manufacturing sector remaining the key driver.