Preparing for a Blockbuster IPO

VPBankS’s Extraordinary General Meeting approved an IPO plan of up to 375 million shares, equivalent to 25% of the circulating shares. Following the deal, VPBankS is expected to raise its charter capital from VND 15 trillion to a maximum of VND 18.75 trillion.

VPBankS plans to conduct the offering during Q3 2025 – Q2 2026. All offered shares (except for unsold portions) will be freely transferable after the offering.

The meeting authorized the Board of Directors to decide on the offering price per share, ensuring a minimum of VND 12,130 per share based on the reviewed semi-annual financial statements for 2025. Thus, the expected deal size is no less than VND 4.5 trillion.

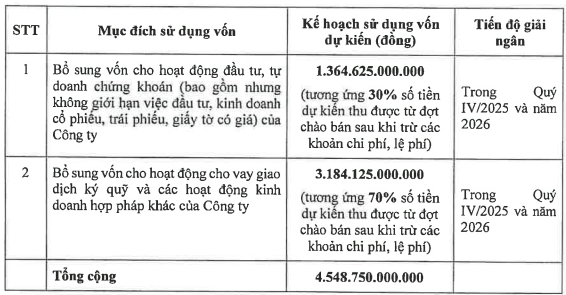

Regarding the use of proceeds, the company determined that 70% will be allocated to margin lending activities and other legitimate business operations, while 30% will be used for investment and proprietary trading in securities (including but not limited to investing and trading in stocks, bonds, and other securities). All proceeds will be disbursed in Q4 2025 and 2026.

VPBankS allocates the majority of IPO proceeds to margin activities – Source: VPBankS

|

VPBankS selected UHY Audit and Consulting Company Limited as the auditor for the reports to be submitted to the regulatory authority, including the reported chartered capital, owners’ capital contribution, and capital usage reports.

Another notable point is the appearance of consulting service contracts and distribution agency contracts in VPBankS’s IPO registration dossier, with Vietcap Securities Joint Stock Company (HOSE: VCI) as the partner.

Previously, on August 18, VPBankS’s Board of Directors passed a resolution to collect shareholders’ opinions in writing. This event stirred public attention as many sources believed it was related to the IPO plan for Q4 2025. Reuters, on August 19, reported that Vietnam Prosperity Joint-Stock Commercial Bank (VPBank, HOSE: VPB) intended to conduct an IPO for VPBankS in November.

With the recently approved plan, VPBankS is poised to create another blockbuster IPO on the Vietnamese stock market. This comes as another securities company, TCBS, also sets its IPO timeline for Q3 2025 – Q1 2026, aiming for a post-offering valuation of approximately USD 4.1 billion.

Doubling 2025 Profit Plans and Adding a Board Member

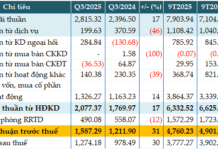

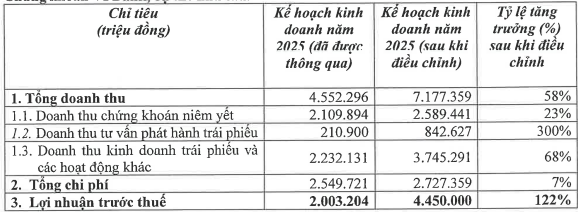

The extraordinary general meeting also approved adjustments to the 2025 business plan, targeting nearly VND 7.2 trillion in total revenue and nearly VND 4.5 trillion in pre-tax profits, up 58% and 122%, respectively, from the previous plan.

In terms of revenue structure, the bond business and other activities remain the focus, expected to contribute over VND 3.7 trillion, a 68% increase. Listed securities revenue is projected at nearly VND 2.6 trillion, up 23%, while bond issuance consulting revenue is almost VND 843 billion, making it the segment with the most significant adjustment, quadrupling the previous plan.

VPBankS significantly increases its 2025 business plan – Source: VPBankS

|

In the first half of 2025, the company recorded a pre-tax profit of nearly VND 900 billion, up 80% year-on-year, achieving 20% of the new plan. Subsequently, VPBankS’s post-tax profit reached nearly VND 722 billion in the first six months, representing an 80% growth.

In addition to the IPO and adjusted business plan for 2025, the extraordinary general meeting of VPBankS also approved the election of Mr. Nguyen Quang Trung (born in 1973) as an independent member of the Board of Directors.

With this addition, the VPBankS Board now comprises four members, including Mr. Vu Huu Dien (Chairman and CEO), Ms. Ho Thuy Nga, and Mr. Nguyen Luong Tan.

Huy Khai

– 09:33 04/09/2025

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.

Is There Still an Opportunity for Cash-Holding Investors as the VN-Index Surpasses 1,700 Points for the First Time?

The Vietnamese stock market is on a record-breaking streak, witnessing a massive influx of capital across various stock sectors.