Vietnam Stock Market: VN-Index Recovers with Improved Liquidity

The stock market witnessed a slow and divided trading session on September 4th, with VN-Index regaining momentum towards the 1,700-point mark. The session closed with VN-Index climbing 14.99 points (+0.89%) to a new peak of 1,696.29, fueled by robust buying power and improved liquidity.

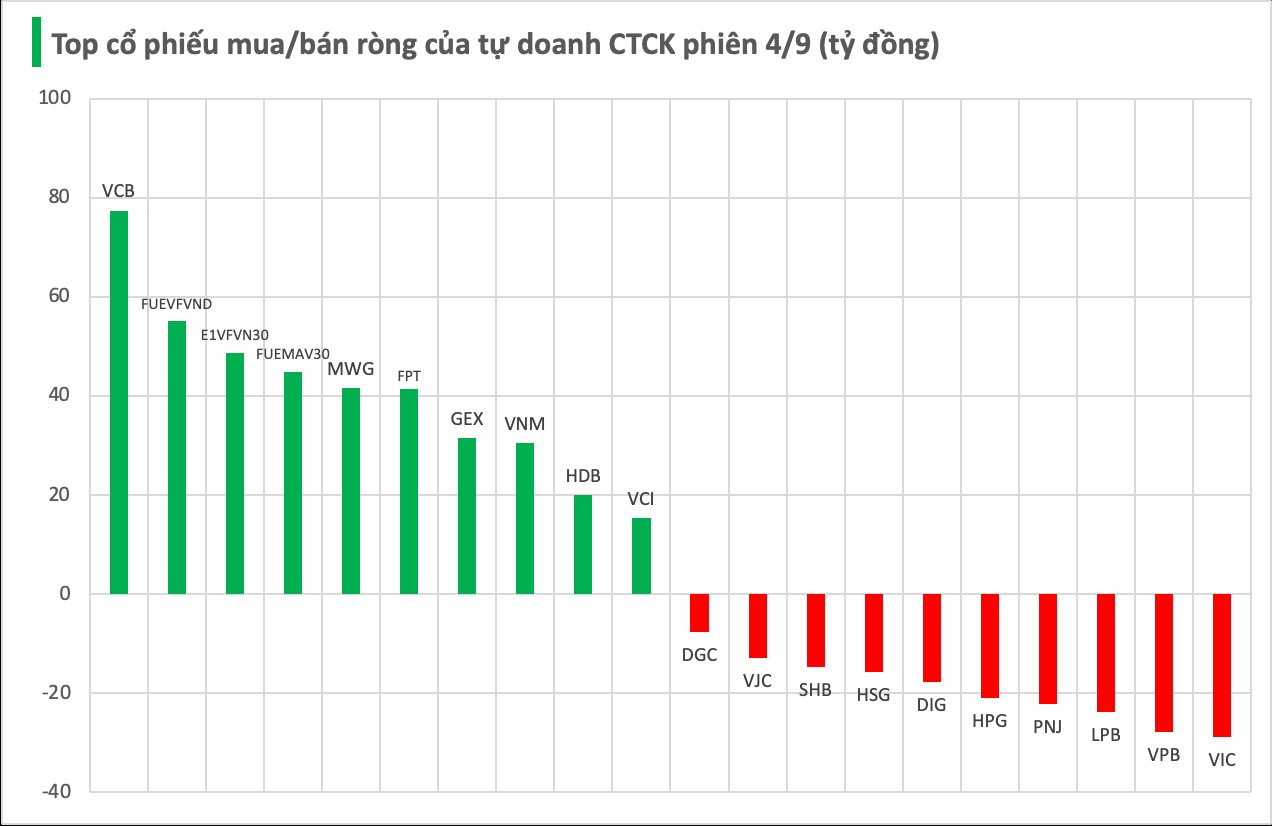

Securities firms reported a net buy of VND 121 billion.

Source: cafef.vn

Specifically, VCB and FUEVFVND were net bought with respective values of VND 77 billion and VND 55 billion. This was followed by E1VFVN30 (VND 49 billion), FUEMAV30 (VND 45 billion), MWG (VND 42 billion), FPT (VND 41 billion), GEX (VND 31 billion), VNM (VND 30 billion), HDB (VND 20 billion), and VCI (VND 15 billion).

On the other hand, VIC experienced the highest net sell-off among securities companies, amounting to VND 29 billion. This was followed by VPB (VND 28 billion), LPB (VND 24 billion), PNJ (VND 22 billion), and HPG (VND 21 billion). Several other stocks witnessed notable net selling, including DIG (VND 18 billion), HSG (VND 16 billion), SHB (VND 15 billion), VJC (VND 13 billion), and DGC (VND 8 billion).

Market Beat: Profit-Taking Pressure Mounts, VN-Index Down Over 29 Points

The market closed with the VN-Index down 29.32 points (-1.73%), settling at 1,666.97; while the HNX-Index fell 3.32 points (-1.17%) to 280.67. The sell-off dominated today’s trading session, with 477 decliners against 319 advancers. The large-cap basket, VN30, mirrored the broader market with 24 losers, 3 gainers, and 3 stocks closing unchanged.

Market Pulse, September 3rd: Foreigners’ Robust Selling of Blue-chips, VN-Index Hanging at 1,680 Points

The trading session concluded with the VN-Index dipping 0.91 points (-0.05%) to 1,681.3. In contrast, the HNX-Index climbed 2.72 points (+0.97%), finishing at 282.7. The market breadth tilted towards gainers, as 468 stocks advanced against 268 decliners. However, the large-cap VN30 index painted a different picture, with 15 stocks falling, 12 rising, and 3 unchanged, resulting in a sea of red.