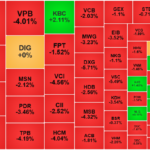

Vietnam’s stock market soars to new heights as the VN-Index reaches an all-time high during the thrilling final trading hours on September 4th, 2025. This remarkable feat was achieved thanks to the collective effort of various pillar groups of stocks.

At the closing bell, the VN-Index surged by nearly 15 points, climbing to an impressive 1,696.29, just shy of the 1,700 mark. The trading value on the HoSE remained substantial, reaching approximately VND 37.5 trillion. For the first time, the market capitalization on the HoSE surpassed the astonishing threshold of VND 7,300 trillion.

Amidst the euphoria, investors are left pondering: What is truly driving this market rally, and is there still room for the VN-Index to soar higher?

Domestic capital is the sole driving force behind this upward trend

According to Mr. Nguyen Duc Khang, Head of Analysis at Pinetree Securities Joint Stock Company, the consecutive peaks in the market are solely attributed to the strong demand from domestic investors. At present, the global macroeconomic landscape remains relatively stable, hence, the impetus for this year’s gains originates exclusively from domestic capital.

Mr. Khang points out that this year’s market surge is quite similar in magnitude to that of 2017 and 2021. In 2017, the driving force was the robust buying power of foreign investors, while in 2021, it was the influx of new individual investors (F0) entering the market.

This year, the expert observes that the upward momentum stems from a combination of supportive government policies and the active participation of large investors and business owners. Vietnam is undergoing a transformative phase, embarking on a “dragon era,” and to achieve high growth rates, the government is implementing numerous measures, including accommodative monetary policies such as maintaining low-interest rates and promoting credit growth in the banking system.

Additionally, with the anticipated market upgrade in early October 2025, foreign capital is expected to make a comeback ahead of the event. In the scenario of a successful upgrade, Vietnamese stocks will be purchased by emerging market index-tracking ETFs as early as March 2026.

Nonetheless, Mr. Khang anticipates the presence of smart foreign capital that will seize the opportunity beforehand. In the last quarter of this year, it is likely that foreign investors will re-enter the market. Should the upgrade materialize, large-cap stocks will remain the focal point. The influx of capital will continue to favor traditional sectors such as banking, securities, steel, and real estate. Moreover, large-cap stocks with significant foreign ownership room, such as VNM, MSN, and VIC, will also attract attention.

In summary, these factors collectively contributed to the VN-Index’s triumph in reaching new heights.

VN-Index has the potential to surpass the 1,700 mark and aim for higher milestones

At the current level of around 1,700 points, the VN-Index is trading at a P/E ratio of approximately 16.2 times. Within this, the P/E ratio for the banking sector stands at 11.6 times, while the non-financial sector boasts a ratio of over 19 times. This P/E level of over 16 times has only been achieved during the 2023-2024 period and is significantly lower than the peaks witnessed in 2017 (over 24 times) and 2021 (over 26 times).

Mr. Khang dismisses the 2021 data as an outlier due to the abnormally high P/E caused by the pandemic’s severe impact on corporate profits. Furthermore, the banking sector still presents reasonable valuation margins, which could continue to serve as a foundation for the VN-Index’s future advancement.

Evidently, despite the P/E being lower than that of April 2024 and October 2023, the market has witnessed remarkable progress in terms of index points. This reflects the robust profit growth of listed companies.

As of Q2 2025, listed companies reported a profit growth of over 32% year-over-year. “Combining the factors of strong profit growth and a reasonable valuation multiple (P/E), the VN-Index has the potential to surpass the 1,700-1,800 range and even aim for more ambitious milestones, such as reaching 2,000 points this year,” Mr. Khang optimistically predicts.

Mr. Khang asserts that during any uptrend, market corrections are inevitable, and a 5-10% pullback from the peak is entirely normal in a rising market. Investors are advised to refrain from excessive leverage and to keep their greed in check to minimize potential losses during market corrections.

A Bank Stock Sees Unusual Foreign Net Selling in Early September

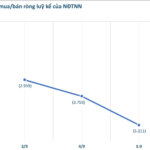

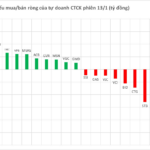

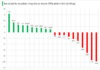

The foreign bloc continues to exert intense selling pressure, offloading thousands of billions of dong worth of stocks.

VN-Index Hits Record High, Surpassing 1,700 Points for the First Time

The Vietnamese stock market has been on a remarkable upward trajectory, and this trend has caught the attention of industry leaders and analysts alike. With the VN-Index surging, predictions are now being made that the index could reach a staggering 1,800 points this year and potentially go even higher in the near future. This has sparked excitement and interest among investors, who are now keenly watching this market’s every move.

The Ultimate Guide to High-Yield Dividend Stocks: Unveiling the Secrets to 300% Returns

Since its IPO, Co Khi Pho Yen Joint Stock Company has consistently rewarded its shareholders with high and regular cash dividends. On November 12, the company plans to distribute approximately VND 37 billion as dividends to its 3.7 million outstanding shares.