The Hanoi Stock Exchange (HNX) recently issued a document to One Capital Hospitality JSC (OCH) regarding the addition of OCH shares to the list of securities not permitted for margin trading.

The effective date of this decision is September 10, 2025; the additional reason for this decision is that the company’s audited consolidated financial statements for the first half of 2025 reviewed by CPA Vietnam Audit Co., Ltd. showed a negative net profit for the parent company.

Furthermore, OCH shares are not allowed for margin trading because the securities are under warning status.

Illustrative image

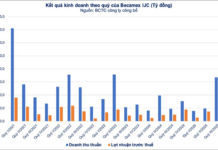

In terms of business performance, according to the reviewed consolidated financial statements for the first half of 2025, the company’s revenue was over VND 306 billion, an increase of VND 37 billion compared to the same period last year. Gross profit reached VND 99.4 billion.

However, due to high financial and management expenses, OCH recorded a net loss from business activities of nearly VND 55 billion.

After deducting taxes and fees, One Capital Hospitality’s net loss for the first half of 2025 was nearly VND 66.5 billion, an improvement from the loss of over VND 70.1 billion in the same period last year. The net profit of the parent company was negative, at over VND 34.9 billion.

Earlier, at the 2025 Annual General Meeting of Shareholders held on June 26, the company approved a plan to achieve consolidated revenue of VND 1,098 billion and pre-tax profit of VND 81.09 billion.

Mr. Nguyen Duc Minh, CEO of OCH, stated that 2025 is considered a year for OCH to focus on restructuring and more efficient utilization of existing assets, thereby boosting revenue and profit growth.

However, with the unprofitable business results in the first half of 2025, OCH is still far from its full-year profit target.

One Capital Hospitality is known for owning two famous brands, Kem Trang Tien and Banh Givral. In the hotel and real estate sector, OCH also owns two 5-star hotels, StarCity Hotel and Sunrise Nha Trang Beach Hotel & Spa.

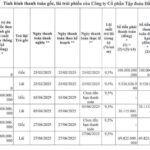

“Taseco Land Redeems a Bond Issue from 2023”

Taseco Land has just made a significant payment of VND 154.6 billion towards the principal and interest of its TALCH2325002 bond series, successfully redeeming the bond in full and on time.

“F88 Records a Net Profit of Over VND 252 Billion in the First Half of 2025”

As of the end of the first half of 2025, F88 reported a net profit of VND 252.4 billion, a remarkable 2.8 times higher than the same period last year. The company’s total liabilities stand at over VND 3,612.3 billion.