The VN-Index made a positive start post-holiday, surpassing the 1,700 mark over the past three sessions (September 3-5). However, the momentum didn’t sustain due to large-cap divergence. Selling pressure intensified during the week’s final session, causing the index to plunge below 1,670.

Specifically, on September 5, the index witnessed an unexpected reversal of over 40 points after breaching the 1,700 level. Most sectors ended in negative territory, despite a positive start, with the most notable declines in securities, resources, banking, and retail.

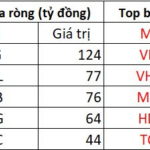

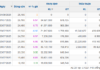

Banking stocks witnessed a sharp decline across the board, with most stocks forming a distinct double-top pattern, notably VPB, EIB, TPB, and SHB. The real estate sector also turned south, with Vingroup stocks experiencing a negative trading session. Securities stocks witnessed deep declines, and steel stocks faced corrective pressure. Foreign investors continued to offload large volumes, with net sell figures reaching VND 5,051 billion on HoSE during the week.

VN-Index breached the 1,700 resistance level but quickly reversed, plunging into negative territory.

Recent sessions have seen the VN-Index rising on low liquidity, but when the index dropped, selling volume increased. Analysts from Saigon-Hanoi Securities (SHS) suggest that the VN-Index is showing signs of forming a short-term top around the 1,690-1,710 range, signaling an end to the outstanding uptrend and a transition into a corrective and consolidative phase.

Many stocks in the market are exhibiting similar signals after a strong upward move, facing abrupt selling pressure. Historically, after a sharp rally and new all-time highs, the market tends to undergo a corrective and consolidative phase, retesting the breached highs.

As the VN-Index falters at the 1,700 level, VCBS experts agree that the market faces short-term profit-taking pressure, prompting a more cautious stance from investors in the upcoming sessions. They advise investors to closely monitor market movements and consider investing only after a confirmation of the market’s new equilibrium. Additionally, investors are recommended to proactively reduce margin exposure and maintain purchasing power to manage risk effectively and seize opportunities during market corrections for short-term trading purposes.

Anticipating three potential scenarios for the stock market in September, VFS foresees a bullish case where the market breaks out to new highs. In this case, investors should prioritize holding stocks with strong upward momentum and clear accumulation patterns. The stock allocation can be maintained at a maximum level.

In a sideways consolidation scenario within the 1,600-1,700 range, investors are advised to retain an 80% stock allocation, with funds flowing into mid and small-cap stocks, especially in the real estate sector. The suggested strategy is to pick stocks based on individual narratives, focusing on those that have recently breached historical or three-year highs. If the VN-Index slips below the 1,600 support, investors should reduce their stock exposure to approximately 50% to mitigate risks.

According to VFS, institutional demand remains stable, providing market support during corrections. The macro backdrop is also favorable, with both global and local expectations of further Fed rate cuts. Such moves would offer Vietnam additional leverage in managing its exchange rate balance.

6 Top-Tier Businesses With Robust Profit Growth Prospects and Fair Valuations for Q3 2025

“While Agriseco acknowledges potential risks, such as robust foreign net selling, profit-taking after a sharp rally, and short-term volatility arising from ETF portfolio rebalancing, it remains confident in its ability to navigate these challenges effectively.”

The Big Bank Stock Slump: 25 Out of 27 Stocks Plunge as Foreign Investors Dump VPB, TCB, and MBB Shares

As of the market close on September 5th, the banking sector witnessed a downturn with 25 out of 27 stocks trading in the red. SHB, in particular, stood out as the top loser among its peers, experiencing a significant decline and leading the sector in terms of liquidity across all three exchanges.