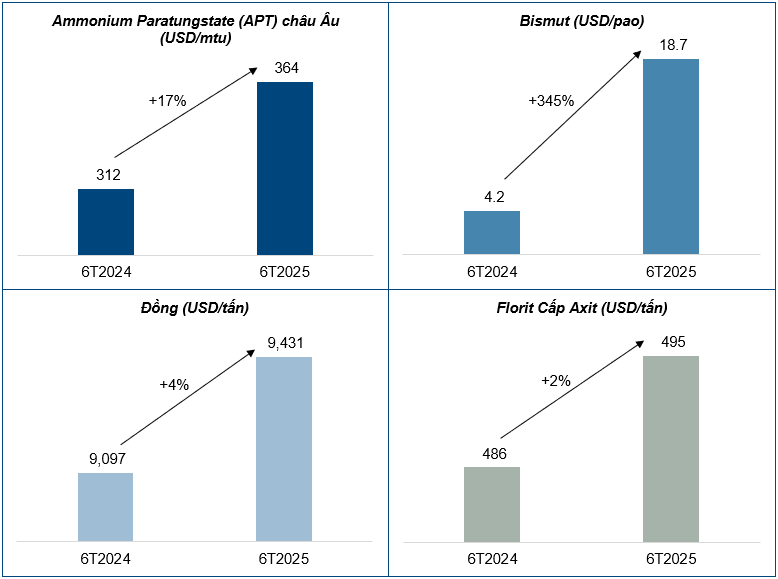

High-tech Materials Sector Benefits from Rising Commodity Prices

Masan High-Tech Materials (MHT, UPCoM: MSR) is a leading provider of strategic minerals such as tungsten, fluorspar, and bismuth – essential materials for critical industries including defense, aerospace, automotive, electronics, energy, and pharmaceuticals.

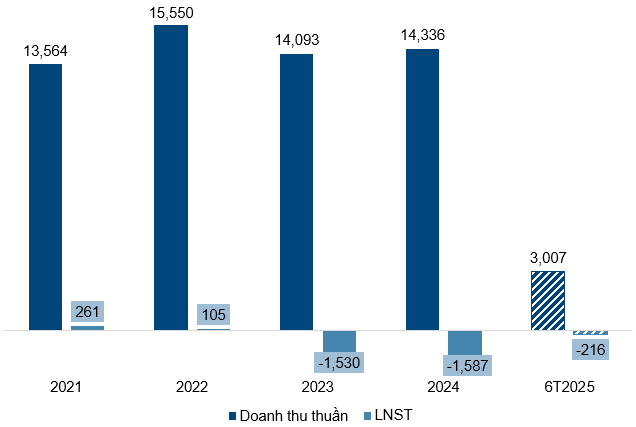

MHT’s Financial Performance for 2021-6T2025

(In trillion VND)

Source: MHT

In the first half of 2025, MHT recorded revenue of 3.007 trillion VND, a decrease from the previous period due to the deconsolidation of H.C. Starck (HCS)* after its divestment in 2024. However, on a like-for-like basis (excluding HCS), MHT’s revenue for the first half of 2025 increased by 20%, driven by surging tungsten prices, which reached their highest level in 13 years, along with strong contributions from copper and fluorspar. The prices of these key metals are expected to remain elevated amid prolonged US-China trade tensions, China’s control over a significant portion of the supply, and sustained global demand.

Notably, MHT turned profitable in the second quarter of 2025, with a net profit of 6 billion VND, a significant improvement from the net loss of 222 billion VND in the first quarter of 2025, reflecting a positive turnaround in its financial performance and prospects for recovery in the following quarters.

(*): In December 2024, MHT completed the sale of 100% of H.C. Starck’s shares for 134.5 million USD to Mitsubishi Materials Corporation, simultaneously activating a long-term APT and Tungsten Oxide offtake agreement between the two parties, ensuring stable consumption for these products.

Average Commodity Prices for the First Half of 2024-2025

Source: MHT, Metals Bulletin, Industrial Minerals

Phuc Long Heritage Reports Impressive Profit Growth

In the first half of 2025, Phuc Long Heritage (PLH) achieved revenue of 858 billion VND, a 10.3% increase year-over-year, while its after-tax profit reached 86 billion VND, a significant surge of 63.5%. This positive performance was mainly driven by strong growth in delivery channel sales and the growing contribution of the food segment (bread, pastries, ice cream, and yogurt).

As of the second quarter of 2025, PLH operated 184 flagship stores and planned to open 13 new outlets in the second half, mainly in Hanoi. Instead of focusing on rapid expansion, PLH is committed to business restructuring and optimization to enhance efficiency.

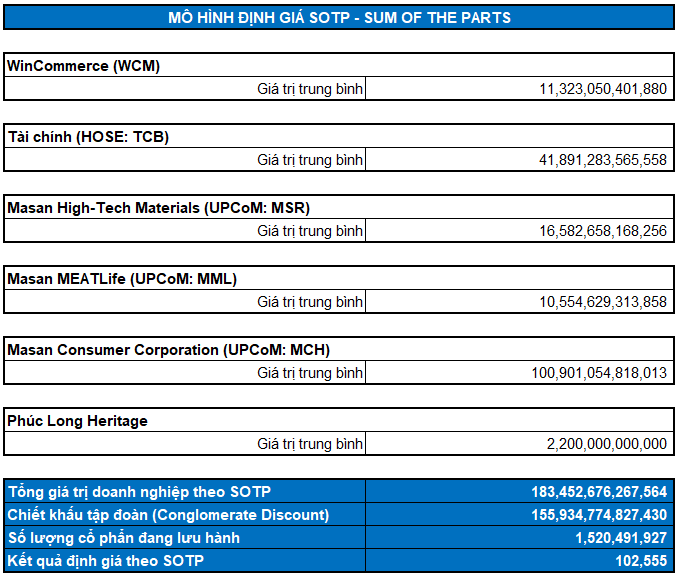

Stock Valuation

The MSN stock is valued using the Sum of the Parts (SOTP) method, taking into account the individual values of its business segments: Masan Consumer, WinCommerce, Masan MEATLife, Masan High-Tech Materials, Techcombank, and Phuc Long Heritage.

The valuation results indicate a fair value of 102,555 VND for MSN, significantly higher than its current market price. Thus, the MSN stock presents an attractive opportunity for long-term investors, especially considering the company’s sustained growth, expanding market share, and clear profit prospects across its core business segments.

Source: VietstockFinance

Enterprise Analysis Department, Vietstock Consulting

– 08:27 09/09/2025