Ms. Mariam J. Sherman, World Bank’s Country Director for Vietnam, Cambodia, and Laos, speaks at the event on September 8th. Screenshot.

|

Speaking at the launch of the World Bank’s Vietnam Economic Update Report on September 8th, Ms. Mariam J. Sherman, World Bank’s Country Director for Vietnam, Cambodia, and Laos, emphasized that Vietnam’s economic growth continued to accelerate in 2025, following a strong first half, due to early export promotion. The economic expansion significantly improved the processing and manufacturing industries and labor market conditions, contributing to economic activity and rising incomes in Vietnam.

However, global challenges continue to put pressure on export-reliant economies like Vietnam due to global trade tensions and policy uncertainties.

The World Bank forecasts that Vietnam’s economic growth will slow in the short term, with real GDP growth reaching 6.6% in 2025 and 6.1% in 2026 as export growth moderates. This outlook remains uncertain and depends on global trade developments. However, the current growth momentum could be affected by “headwinds” from the global economy and trade disruptions.

To maintain and enhance economic prospects, Vietnam can continue to assert its position as an attractive destination for businesses. Additionally, supporting domestic activities and services will become increasingly important to boost growth amid external risks. Promoting the expansion of quality public investments is crucial in this regard by creating a business-friendly environment and encouraging private consumption.

Exports and Tourism: Key Drivers of GDP Growth

According to the World Bank report, in the first half of 2025, Vietnam’s GDP grew by 7.5% year-on-year, higher than the 6.5% growth rate in the same period in 2024.

The main driver of GDP growth was exports, as businesses rushed to fulfill orders amid uncertainties in global trade policies.

Exports increased by 14.2% year-on-year, with exports to the US surging by 28.3% ahead of potential tariff increases in the coming period.

Investment rose by 8% in value terms year-on-year, higher than the 6.7% growth in the first half of 2024, thanks to stable FDI and increased public investment. Despite uncertainties in global trade, FDI into Vietnam remained stable.

Disbursed FDI capital reached US$26.2 billion (equivalent to 5.5% of GDP) in the 12 months up to June 2025, up 9.3% year-on-year. Registered FDI increased significantly by 23.8% year-on-year, focusing mainly on processing and manufacturing (51%) and real estate (22%).

However, newly registered FDI reached US$9.3 billion in the first half of 2025, down 3% year-on-year, indicating a slowdown after two consecutive years of growth.

Meanwhile, private consumption increased by 8% year-on-year, compared to 5.8% in the previous year, mainly due to a strong recovery in tourism.

Service revenues grew more robustly in 2025. In particular, accommodation and catering services increased by 16.2%. Tourism also witnessed outstanding growth, reaching 60.2%, thanks to the recovery of international visitors, especially from China, along with major festivals held in 2025.

Private consumption continues to be an essential driver of the economy, contributing about 53% of GDP in 2025. However, this proportion tends to decrease and is currently lower than the median of 63% among developing countries in East Asia.

Therefore, the World Bank forecasts that after strong growth in the first half of 2025, the Vietnamese economy is expected to cool down in the remaining months of the year as overall export growth returns to stable levels. The World Bank’s baseline forecast assumes that net exports’ contribution to GDP growth will decrease, but this outlook remains highly dependent on future trade developments.

GDP growth is projected to slow to 6.1% in 2026 as the global trade downturn starts to take effect, then rebound to 6.5% in 2027, thanks to a slight recovery in global trade and Vietnam’s continued competitiveness in global value chains.

Monetary Policy Easing Supports Economic Recovery

The World Bank report also states that Vietnam’s monetary policy remains accommodative. The State Bank of Vietnam (SBV) has maintained the refinancing rate and discount rate at 4.5% and 3%, respectively, remaining at record lows since June 2023.

The accommodative monetary policy has supported the economic recovery, with the real policy rate close to zero. The SBV has also utilized a range of other tools to achieve this objective, such as open market operations (repo contracts and issuance of SBV bills, with interest rates influencing the overnight interbank rate), ceilings on deposit and lending rates, credit growth orientation for banks, and interventions in the foreign exchange market.

Bank credit grew strongly, mainly due to the SBV’s early allocation of credit targets to banks. Credit was primarily directed towards the real estate, processing and manufacturing, and trading sectors. Aggressive lending led to tighter liquidity, pushing the loan-to-deposit ratio above 100% in many banks. Banks actively tapped the bond markets to raise medium and long-term capital amid low deposit rates.

The volume of bonds issued by banks reached nearly VND 117,000 billion (approximately US$4.5 billion), a 2.4-fold increase year-on-year, accounting for 77% of the total volume of corporate bonds issued in the first half of 2025. The credit/GDP ratio is estimated to have reached 134% at the end of 2024, compared to 90% at the end of 2015.

According to the World Bank report, asset quality remained relatively stable, but potential risks related to debt restructuring, loan term extensions, and risk provisioning persist.

“Circular 02/2023/TT-NHNN, which allowed banks to restructure loan terms and maintain debt groups that had expired in December 2024, will force banks to recognize risks for restructured loans, leading to an expected increase in non-performing loans in 2025”, the report noted. Additionally, the higher credit growth target could affect credit quality, and new non-performing loans are expected to increase in the medium term if banks relax lending standards. At the same time, loan loss provisions in the banking sector would decrease if risk management relies on collateral. The ratio of loan loss provisions to non-performing loans has almost halved in the past three years, indicating a significant decline in the banking sector’s loss absorption capacity.

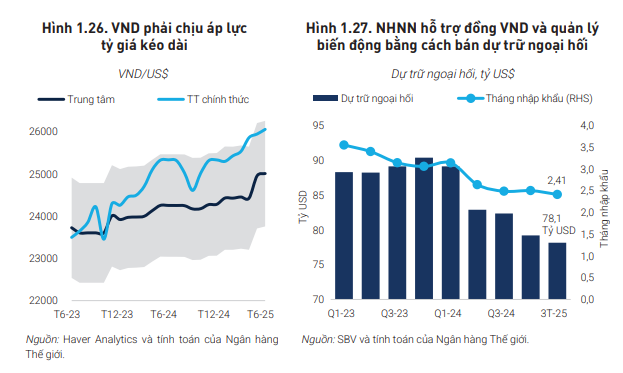

Regarding the exchange rate, the SBV eased pressure on the currency by adjusting the official central exchange rate. The VND depreciated by 2.8% in the first half of 2025 compared to the same period last year, lower than the 4.4% depreciation in the first half of 2024, with the exchange rate reaching VND 26,057/USD at the end of June 2025.

To counter the pressure on the domestic currency, the SBV devalued the currency through the central exchange rate by 3.1% in June 2025 (year-on-year), including a 2.2% devaluation in May, the most considerable adjustment since December 2022. The higher central exchange rate also widened the +/- 5% band, providing room for market adjustments.

Accelerating Economic Structural Reform and Enhancing Financial Resilience

Given the limited monetary policy space due to the prolonged interest rate differential and increasing exchange rate pressure, the World Bank recommends that fiscal policy should take the lead in boosting economic growth. Vietnam has the advantage of low public debt, allowing for increased public investment in critical sectors such as energy, logistics, and transportation infrastructure.

However, public investment management must ensure capital efficiency, risk oversight, and debt safety. The World Bank also proposes enhancing the resilience of the financial sector, including improving the capital adequacy ratio, strengthening the supervision of the banking system, and reinforcing the SBV’s role in risk management and crisis response.

Economic structural reforms need to be accelerated, focusing on improving public service efficiency, promoting green growth, enhancing human resource quality, and diversifying trade to mitigate risks from global uncertainties. At the same time, the private sector should be encouraged to deeper integrate into global value chains and increase technology application to improve productivity and competitiveness.

– 16:58 09/08/2025

A Strategic Approach to Fiscal and Monetary Policy: Steering Vietnam’s Economy Towards 8.3-8.5% Growth in 2025

“Prime Minister Pham Minh Chinh has signed Dispatch No. 159/CD-TTg on September 7, 2025, providing guidance and direction on fiscal and monetary policy frameworks. This dispatch outlines the government’s strategic approach to managing the nation’s finances and currency, with the aim of fostering economic growth and stability.”

“Steering a Course for Growth: Fiscal and Monetary Strategies for 2025 and Beyond”

Prime Minister Pham Minh Chinh has signed Dispatch No. 159/CD-TTg on September 7, 2025, providing guidance and direction for fiscal and monetary policy.

“Cash Dividends Take the Spotlight: A Week of Generous Payouts with a 40% Peak”

Let me know if you would like me to tweak it further or provide additional suggestions!

Introducing the top 19 businesses that offer cash dividends, with rates ranging from an impressive 38.7% to a modest 1%. These companies pride themselves on their financial stability and commitment to returning value to their investors. Stay tuned as we delve into the world of these dividend-paying powerhouses, uncovering their strategies and exploring the opportunities they present for savvy investors.

“From Laying the Foundations of Monetary Independence and Economic-Financial Sovereignty to the Aspiration of Making Vietnam a Prosperous and Powerful Nation.”

The State Bank of Vietnam has stood the test of time, proudly serving the nation for 74 years. Beyond its role as a financial and monetary regulator, it acts as a stalwart guardian of macroeconomic stability. Through its diligent management of inflation, exchange rates, and vigilant oversight of the banking system, the State Bank has cemented its position as a pillar of strength. This institution safeguards monetary sovereignty, fortifies the foundations of economic independence, and instills unwavering confidence as Vietnam strides forward in its international integration journey.