Vietnam’s stock market has been experiencing a downward trend due to significant profit-taking pressure, but SJS shares of SJ Group have stood out with an impressive rise of over 11% in just the last two trading sessions.

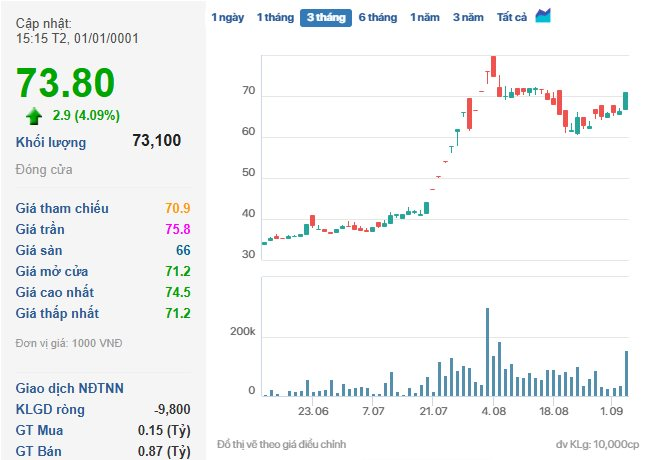

Specifically, on September 8th, the closing price of SJS shares was 73,800 VND per share, a 4.09% increase from the previous session, with a matched trading volume of 73.1 thousand units.

Notably, in the previous session on September 5th, SJS shares surged by 6.94% to 70,900 VND per share, with a matched trading volume of 155.6 thousand units.

This upward momentum of SJS shares contrasts the overall bearish sentiment in the stock market, where investors are actively offloading their positions across various sectors. In the last two trading sessions (September 5th and 8th), the VN-Index witnessed a significant drop of 71.76 points.

As a result, SJ Group’s market capitalization has significantly increased to 21,953 billion VND.

SJS shares buck the market trend and surge in the September 8th session. (Source: Cafef)

The rise in SJ Group’s share price began in early July, following the announcement of a substantial dividend and bonus share payout ratio of 159% – meaning that for every 100 existing shares, shareholders would receive 159 bonus shares.

On July 31st, SJ Group concluded the issuance of over 182.6 million shares as dividends and bonuses to 2,302 shareholders, thereby increasing the number of outstanding shares to nearly 297.5 million.

Specifically, by the end of the issuance on July 31, 2025, SJ Group had distributed over 182.6 million shares as dividends for the years 2018, 2019, 2020, 2021, and 2024, and as bonuses to 2,302 shareholders. These shares are freely transferable. The expected date for the share transfer is August 29, 2025.

In terms of business performance, for the first six months of 2025, SJ Group recorded a gross revenue of over 337.2 billion VND, a 42.2% increase compared to the same period in 2024. Net profit after tax reached over 171.2 billion VND, a 76.3% surge.

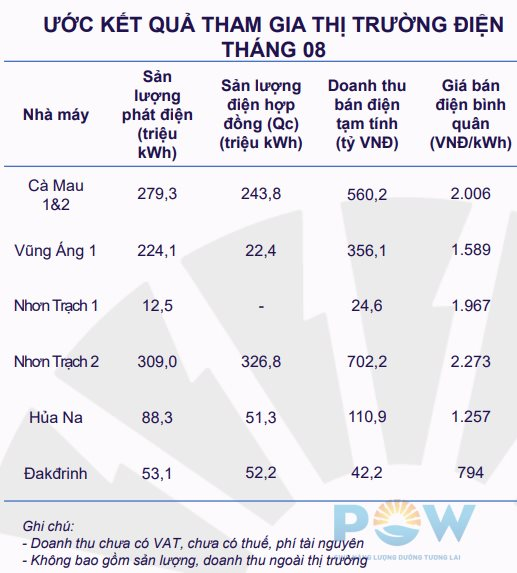

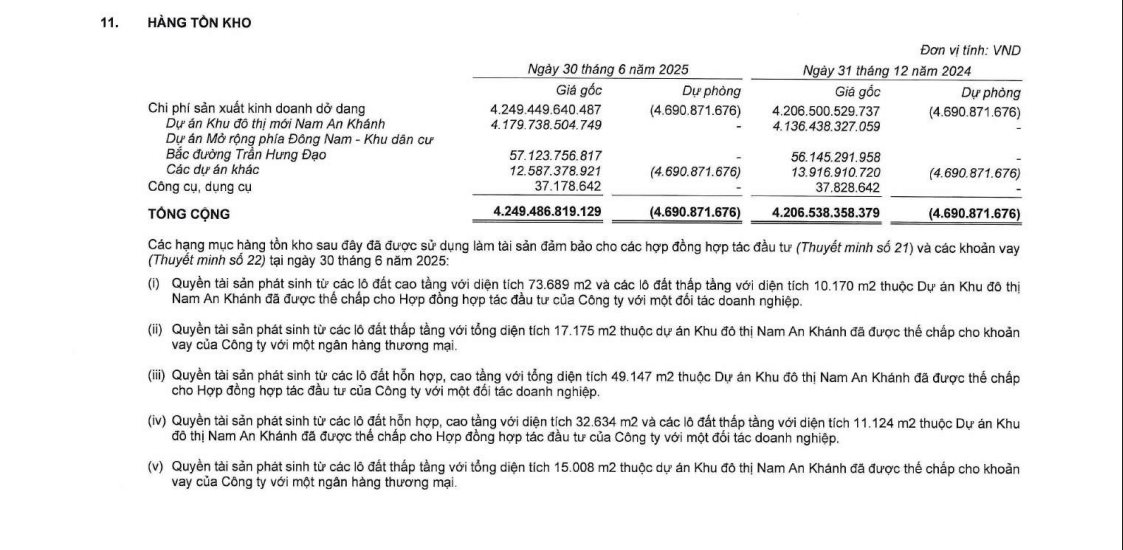

Attributing the profit variation, SJ Group explained that the audited net profit for the first six months of 2025 was higher than the same period in 2024 due to the company’s continued business operations in the Nam An Khanh project.

As of June 30, 2025, the company’s total assets increased by 120 billion VND from the beginning of the year to nearly 7,964.3 billion VND. Among its assets, Inventory accounted for 53.6%, totaling over 4,270.8 billion VND, while Long-term Work-in-Progress amounted to nearly 2,439.5 billion VND, making up 30.6% of total assets.

Source: Financial Statements

Notably, the Nam An Khanh New Urban Area project remains SJ Group’s most significant inventory item, valued at 4,179 billion VND as of June 30, 2025, accounting for 98.4% of the company’s total inventory.

On the liabilities side of the balance sheet, the company’s total liabilities stood at nearly 4,790.3 billion VND, a slight decrease from the beginning of the year. Long-term payables accounted for 39.4% of total liabilities, amounting to nearly 1,889.5 billion VND, while loans totaled over 782.2 billion VND, comprising 16.3% of total liabilities (including 148.4 billion VND in short-term loans and 633.8 billion VND in long-term loans).

The Stock Market Takes a “Nose-Dive”: What Do Brokerages Have to Say About the Consecutive Plunges?

“With a cautious approach to the current market landscape, Yuanta recommends that investors consider reducing their equity exposure to a lower level and refrain from making new purchases during this phase. This strategic move is advised to navigate the volatile market conditions and mitigate potential risks.”