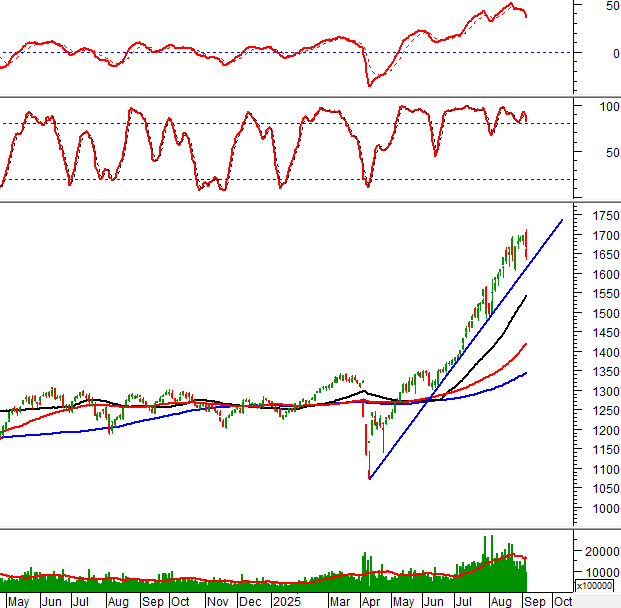

Technical Signals for VN-Index

In the trading session on the morning of 08/09/2025, the VN-Index continued its sharp decline and is preparing to test the short-term trendline (equivalent to the 1,615-1,625 point range). The result of this test will determine the short-term trend.

Both the Stochastic Oscillator and MACD indicators have given sell signals, increasing the short-term risks.

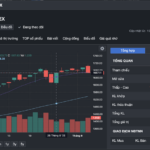

Technical Signals for HNX-Index

In the trading session on the morning of 08/09/2025, the HNX-Index fell below the Middle line of the Bollinger Bands.

The strong resistance zone of 285-289 points (equivalent to the August 2025 peak) is currently a challenging hurdle to overcome in the short term.

BSR – Binh Son Refinery Joint Stock Company

In the trading session on the morning of 08/09/2025, BSR shares fell for the third consecutive session, forming a Three Black Crows candlestick pattern, indicating a rather pessimistic investor sentiment.

Currently, BSR’s price is testing the Middle line of the Bollinger Bands while the MACD indicator continues to decline after giving a sell signal. This suggests that the short-term downtrend is still present.

PDR – Phat Dat Real Estate Development Joint Stock Company

PDR shares declined in the trading session on the morning of 08/09/2025, forming a Three Black Crows candlestick pattern, indicating a less-than-positive investor sentiment.

Currently, PDR’s price has dropped below the Middle line of the Bollinger Bands, while trading volume in recent sessions has been erratic. If the situation does not improve, the negative scenario is likely to continue.

Additionally, the Stochastic Oscillator indicator has fallen out of the overbought zone after forming a bearish divergence and giving a sell signal, further adding to the short-term pessimism.

(*) Note: The analysis in this article is based on real-time data up to the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change when the afternoon trading session ends.

Technical Analysis Department, Vietstock Consulting

– 12:07 08/09/2025

Market Pulse, September 8th: VN-Index Plunges 42 Points, Foreign Investors Net Buyers

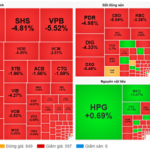

The market closed with notable losses, as the VN-Index plummeted 42.44 points (-2.55%) to 1,624.53, while the HNX-Index fell 9.1 points (-3.24%) to 271.57. It was a sea of red across the market, with 611 decliners overwhelming 159 advancers. The VN30 basket mirrored this sentiment, recording 26 losses, 1 gain, and 3 references.

Stock Market Peaks: A Short-Term High – What’s the Investor’s Strategy for the Week Ahead?

The VN-Index witnessed a remarkable surge, surpassing the 1,700-point mark, only to experience a sharp decline towards the end of the trading session. Analysts predict continued volatility in the coming week, indicating potential fluctuations in the market.

Will the VN-Index Regain its 1,700-Point Mark? A Look at Vietnam’s Stock Market Outlook for the Week Ahead.

The VN-Index surpassed the 1,700-point resistance level after the holiday, but this victory was short-lived as it swiftly turned downwards. As profit-taking pressures mounted, liquidity dried up, and foreign investors remained net sellers, the market closed the week in negative territory, sparking concerns about a potential short-term peak.