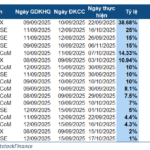

Cat Lai Port Joint Stock Company (stock code: CLL) has just announced that the ex-dividend date for 2024 dividends is September 17, 2025.

Accordingly, the company will pay a cash dividend of 26.7%/share, equivalent to VND 2,670 per share. The payment date is September 25, 2025, instead of September 22 as initially planned.

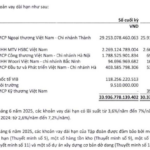

With 34 million shares outstanding, Cat Lai Port is expected to pay nearly VND 91 billion in dividends for this period.

The two largest institutional shareholders who will benefit the most are Tan Cang Sai Gon Corporation, which owns 25.64% of the capital and is expected to receive VND 23 billion, and Youth Volunteer Public Utility Service One Member Co., Ltd., which owns 22.06% and is expected to receive VND 20 billion.

Since 2013, CLL has consistently paid cash dividends. The highest rate recorded was 36.8% in 2022, which then decreased to 26% in 2023 and slightly increased to 26.7% in 2024. Since 2017, the dividend ratio has always been at a minimum of 20%.

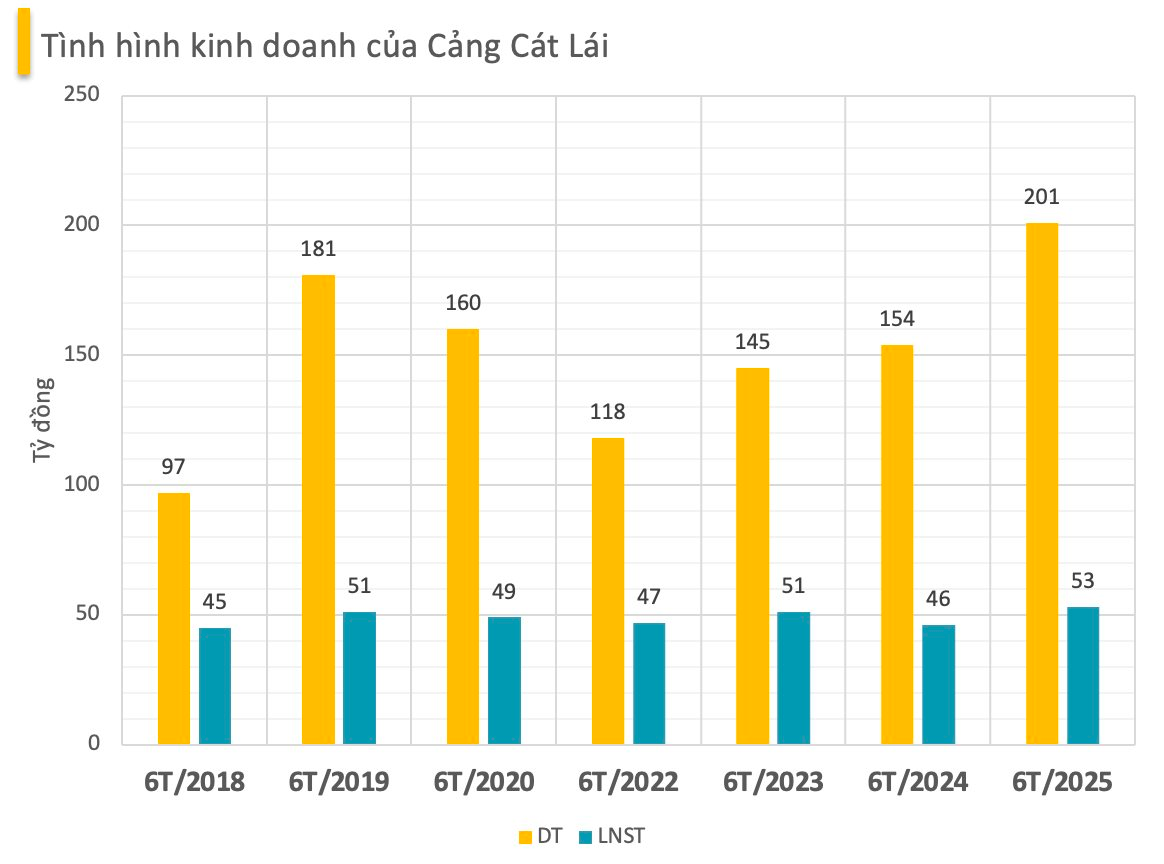

According to the audited semi-annual report for 2025, in the first half of 2025, the Company achieved a record of over VND 201 billion in net revenue and after-tax profit of VND 53.7 billion, up 30% and 16% respectively over the same period, fulfilling 63% of revenue target and 58% of profit target for the year.

Cat Lai Port’s business results in the first half of 2025 (unit: billion VND)

In the stock market, CLL stock recorded a short-term increase and returned to the price range equivalent to the end of March 2025. At the end of the trading session on September 5, CLL stock price was VND 35,500/share, up about 11% compared to the bottom in April.

“From Billion to Billions: The Story of a Struggling Cybersecurity Giant”

Since 2019, Bkav Pro has witnessed a significant decline in its profits. As of the first half of this year, the company’s return on equity (ROE) stood at a mere 0.98%.

Unveiling Hòa Phát’s Largest Creditor: A Whopping VND 30,000 Billion in Long-Term Loans

Introducing our exclusive loan offerings with competitive interest rates starting from 3.6% to 7% annually. We offer a secure way to finance your ambitions by accepting a range of collateral options, including cash deposits, inventory, and fixed assets.