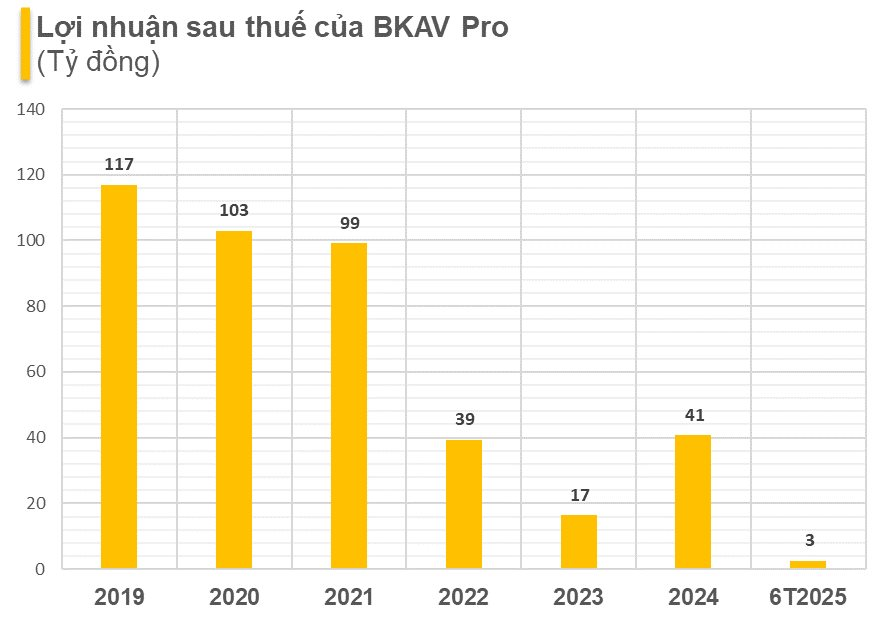

CTCP Phần mềm diệt virus Bkav (Bkav Pro) has released its business results for the first half of 2025, reporting a net profit of nearly VND 2.6 billion, a 4% decrease compared to the same period last year.

As of June 30, 2024, Bkav Pro’s total assets stood at nearly VND 614 billion, with shareholder equity amounting to over VND 264 billion. The company’s liabilities were at VND 350 billion, including VND 162 billion in bond debt.

Bkav Pro’s profits have been on a downward trend from 2019 to 2023. In 2019, the company recorded a profit of VND 117 billion, but by 2023, this figure had dropped to just one-tenth of that amount. However, in 2024, the company saw an improvement, with profits reaching VND 41 billion, the highest in three years.

According to an introduction to Bkav Pro’s bonds by VNDirect, the company achieved impressive results in 2018, its founding year, with revenue in the hundreds of billions and profits in the tens of billions, and a profit margin of 60%.

However, since 2019, Bkav Pro’s profits have taken a hit. As of the first half of this year, the company’s return on equity (ROE) stood at just 0.98%.

The audit report also included a qualification regarding a loan from Trustlink Joint Stock Company that was overdue as of June 30, 2025. Per the contract, the company is subject to late payment penalties on the overdue principal amount. However, as negotiations are still ongoing, Bkav Pro has not yet recorded these penalties. As a result, the auditors were unable to determine the necessary adjustments to the company’s financial statements, particularly the “Finance Costs” and related accounts.

The auditors also highlighted that as of June 30, 2025, the company had overdue payments totaling VND 259.16 billion to tax authorities, employees, bondholders, and partners. Similarly, as of January 1, 2025, the company had overdue payments of VND 90.51 billion to these entities.

Recently, Bkav Pro released the minutes of a meeting of bondholders. The company will seek partners to transfer the assets currently used as collateral. These assets include 6.1 million Bkav Pro shares owned by its parent company, Bkav Joint Stock Company, and 4.9 million Bkav shares owned by Chairman of the Board, Nguyen Tu Quang.

Previously, in late July, Bkav Pro obtained bondholders’ approval for a revaluation of the collateral for the BKPCB2124001 bonds. The original collateral included 5.44 million Bkav Pro shares owned by Bkav Joint Stock Company (valued at VND 178,125 per share, equivalent to nearly VND 970 billion) and 4.99 million Bkav shares owned by Mr. Nguyen Tu Quang.

The proceeds from the bond issuance were intended for the development of AI View cameras, investment in digital transformation, and the creation of a more affordable Bphone model to expand their customer base. In mid-2024, bondholders agreed to a one-year extension, pushing the maturity date to May 26, 2025, with a new interest rate of 11%. The collateral for this extension included the aforementioned Bkav Pro and Bkav shares, as well as Mr. Nguyen Tu Quang’s capital contribution to the Vietnam Digital Transformation Platform Company (DXP).

Bondholders were granted the right to request Bkav Pro, Bkav, and DXP to provide reports on their income and expenses and plans for accumulating cash flow, ensuring a minimum monthly contribution of VND 1.5 billion to Bkav Pro’s securities account at VNDirect. At the beginning of 2025, VNDirect, acting as the bondholders’ representative, reported that Bkav Pro had violated the agreement by failing to accumulate the required VND 1.5 billion in January. On February 14, VNDirect sent a request for the company to pay the outstanding amount within 15 days.

As of June 30, Bkav Pro has repaid only VND 7.53 billion of the bond principal and has yet to repay VND 162 billion in bond principal and nearly VND 9 billion in bond interest.

“Declining Profits: Bkav Pro’s Nguyen Tu Quang Under Scrutiny Over Trustlink Loan”

Ending the first half of the year, Bkav Pro earned a pre-tax profit of over 3 billion VND, yet recorded total liabilities of nearly 350 billion VND.

“Real Estate Giant Việt Hân’s Profits Plummet by Over 40%, Burdened by $400 Million Debt”

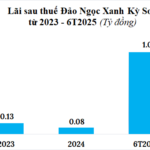

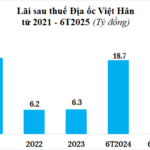

In the first half of 2025, Dia Oc Viet Han reported a net profit of nearly VND 11 billion, a significant 42% decrease compared to the same period last year. Meanwhile, the company is burdened with a staggering debt of over VND 20.1 trillion, more than half of which comprises bond debt.