Digital Culture – The Foundation for Change

The world is experiencing rapid shifts following two large-scale crises and the tremendous growth of artificial intelligence. In this context, digital transformation is no longer just a trend but an essential requirement for development, especially in the banking sector.

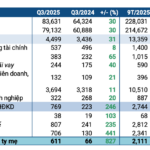

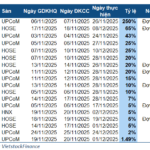

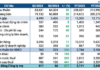

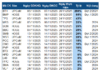

Technology and artificial intelligence are noticeably transforming banking operations, directly impacting human resource utilization in the industry. According to statistics, eight banks reduced their staff in 2024, totaling 2,503 employees. Meanwhile, according to financial reports from 27 banks as of Q1/2025, the total number of employees in the industry continued to decrease by 2,143 compared to the end of 2024.

While the labor market trend is towards leaner operations, NCB has chosen a different path: focusing on people, service quality, and digitalization capabilities.

NCB was first honored with the “Tech Empowerment Awards 2025” at the HR Asia Awards 2025

By establishing a work environment that meets the demands of the new era, NCB’s digital culture goes beyond digitizing products and processes. It encompasses how people approach, work, and collaborate. Digitalization is implemented synchronously, from automating internal tasks to integrating AI for customer behavior analysis and market trend forecasting, delivering superior customer experiences. Online platforms and tools are utilized to facilitate effective connections, enabling employees to work flexibly and optimize efficiency.

More importantly, NCB shapes its digital culture as a commitment: people-centric and technology as a tool. Technological solutions are meaningful only when they enable employees to work smarter, more efficiently, and foster greater cohesion.

NCB establishes a digital work environment to meet the demands of the new era

The ability to adapt quickly, flexibly, and decisively has driven NCB’s strong innovation over the years and earned the bank the “Tech Empowerment Awards 2025” at the prestigious HR Asia Awards 2025. This award category, introduced for the first time in Vietnam by HRAA, recognizes pioneering enterprises that leverage technology to enhance employee experience.

A Cohesive Environment on a Digital Platform

At the HRAA 2025 Awards, NCB was also consecutively recognized as “Asia’s Best Workplace” for the third time. This acknowledgment is attributed to the bank’s construction of a cohesive work environment based on six factors: compensation, development opportunities, culture and environment, open leadership, ideal jobs, and corporate reputation.

In the digital age, NCB has upgraded these six factors to keep up with the times, catering to the needs of a young workforce, particularly Gen Y and Gen Z, who constitute 90% of NCB’s current workforce. Simultaneously, the bank has cultivated a multi-generational environment rich in development opportunities, challenges, and promotions, meeting the diverse demands of the new era.

Amidst the strong fluctuations in the human resources landscape, NCB’s leadership remains steadfast in its people-centric philosophy and continues to invest in its employees. Along with enhanced HR policies and competitive remuneration packages, NCB consistently conducts comprehensive training programs covering professional skills, digital transformation capabilities, and more, ensuring that its personnel stay abreast of industry developments. This creates an environment where people, technology, and data harmonize to achieve new successes.

Human Resources Strategy for the New Era

“We focus on equipping our employees with adaptability, flexibility, and a willingness to take on more challenging tasks and providing them with opportunities for higher career advancement to meet the demands of the times,” said Mr. Ta Kieu Hung, CEO of NCB.

Notably, NCB emphasizes developing its personnel’s capabilities and fostering a “delegation” culture. The bank aims to promote 50% of its business block management positions from internal resources by 2027. In this multi-generational environment, NCB’s employees benefit from cross-generational learning: the experience of Gen X, the implementation skills of Gen Y, and the creativity of Gen Z combine to produce outstanding results.

NCB focuses on developing its next-generation leaders and talent pipeline

Furthermore, the bank maintains and expands leadership-employee dialogue programs and conducts periodic surveys to ensure that each employee feels secure and has a clear direction for their career path within the organization. Every policy change is based on the team’s practical needs, fostering a happy work environment for all personnel.

Moving forward, NCB remains committed to enhancing its human resources with diverse, flexible, and transparent policies. Tailored training curricula are designed for each functional group, from new hires to managers, to build a robust pipeline of future leaders. NCB also focuses on recruiting talent for critical areas such as business, technology, and digital transformation—the primary drivers of the bank’s growth.

In recent years, NCB has undergone a significant transformation in its human resources practices, evolving from a small-scale bank to a sought-after employer in the banking industry. Numerous senior executives, international experts, and young talents have chosen NCB as their professional home. Additionally, NCB consistently contributes high-quality new-generation personnel with the traits and skills needed to thrive in the new era’s labor market.

“Digital Transformation: Seizing the Opportunity to Soar with VNeID and the Banking Industry”

“As the nation celebrated its National Day on September 2nd, the talk of the town, from social media forums to coffee shop chatter, revolved around the thoughtful 100,000 VND gift from the Government to each citizen. People shared their experiences of receiving the money, but more importantly, they delved into its profound significance. Though a modest sum, this gesture held a strategic policy move that captured the nation’s attention.”

The 2025 Top Tax-Contributing Enterprises Awards: Recognizing Businesses Contributing Hundreds of Thousands of Billions

The 2025 Top Tax-Contributing Enterprises Recognition Ceremony was a resounding success, celebrating the immense contributions of leading businesses to the nation’s economic growth. The event not only honored these economic powerhouses but also served as a platform for discussing opportunities and challenges amidst the powerful digital transformation wave.

“Biometric Technology Slashes Bank Fraud by 60%”

The State Bank of Vietnam reported that as of August 15th, the banking industry had acquired nearly 124 million individual customer records and 1.3 million organizational customer records for entry and biometric data verification. This initiative has proven successful, resulting in a nearly 60% reduction in the number of customers falling victim to fraud and subsequent financial loss.

The Digital Revolution: Pinetree’s Comprehensive Strategy to Stay Ahead in the Evolving Financial Landscape

With its foundation in the Korean-standard Core system, comprehensive ecosystem, relentless innovation, and diverse information systems, Pinetree is spearheading the digital transformation in Vietnam’s securities industry. The company is ushering in a new era, offering investors access to a modern, secure, and efficient platform.

Prime Minister: Boosting Supply and Combating Speculation to Stabilize the Gold Market

“At the meeting on September 7, Prime Minister Pham Minh Chinh instructed the State Bank of Vietnam to immediately research and implement solutions to increase the supply of gold and balance its supply and demand dynamics. He also emphasized the need to curb speculation, smuggling, and policy exploitation in the gold market.”