17% Flat Tax Proposed for Small and Medium-sized Enterprises

The Ministry of Finance, in its assessment report of the Personal Income Tax Law (amended), has proposed a 17% tax rate on profits for individual business owners. Taxable income will be determined by subtracting production and business-related costs from the revenue generated from the sale of goods and services during the tax period.

Currently, individuals with an annual revenue of over VND 100 million are subject to personal income tax, calculated as a percentage of their revenue.

Revenue is defined as the total money earned from sales, processing fees, commissions, and service provision during the tax period, stemming from the production and trading of goods and services. In cases where an individual business cannot determine its revenue, the competent tax authority will prescribe the revenue according to tax management laws.

However, from January 1, 2026, with the planned abolition of the fixed-rate tax, the Ministry of Finance has proposed a new tax calculation based on income instead of revenue.

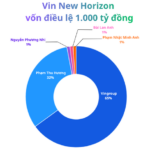

This proposed regulation is similar to the one stipulated in the Law on Enterprise Income Tax No. 67/2025/QH15 for small and medium-sized enterprises, which imposes a 17% tax rate on enterprises with an annual revenue of over VND 3 billion but not exceeding VND 50 billion.

For individual businesses with an annual revenue below the threshold set by the Government, the current method of calculating tax based on revenue, as per the existing Personal Income Tax Law, will still apply.

Starting in 2026, individual businesses with an annual revenue of less than VND 200 million will be exempt from personal income tax, and those exceeding this threshold are proposed to pay a 17% tax on profits.

This proposal has sparked discussions on forums related to taxation and online business. Individual business owners have raised questions about whether the new tax calculation method will be mandatory or optional, given the planned discontinuation of the fixed-rate tax. They also pointed out the challenges in determining costs, as they vary significantly among different business models.

Should individual businesses “upgrade” to enterprises?

In an interview with Tien Phong , Mr. Le Van Tuan, Director of Keytas Accounting and Tax Company, shared that when the Law on Personal Income Tax No. 67/2025/QH15 takes effect, enterprises will be subject to three tax rates of 15%, 17%, and 20%, depending on their revenue, resulting in a 3-5% reduction in tax rates compared to the current rates.

Mr. Tuan questioned the necessity of introducing an additional 17% tax calculation method based on taxable income, similar to that of enterprises, when such a method already exists for different types of enterprises.

“Creating a complex tax calculation method may dampen the business motivation of the people. Instead, we should aim to encourage individuals to invest in the economy rather than hoard assets in real estate, gold, cryptocurrencies, and other high-risk investments,” Mr. Tuan recommended.

Mr. Tuan also pointed out that while some business models have clear cost structures, others, particularly those that employ family members or source inputs directly from the people, may struggle to provide sufficient documentation to determine costs. For such models, applying a 17% tax rate on taxable income may not be feasible.

According to Mr. Tuan, the crucial aspect is not whether individuals operate as households or enterprises but rather their fulfillment of tax obligations, social responsibilities, and duties towards their employees. To that end, he suggested that households and individuals be required to issue invoices for their total revenue and provide social insurance for their employees, if any.

By imposing taxes on total actual revenue, the tax burden on households and individuals may exceed that of enterprises, incentivizing them to voluntarily transition into enterprises without coercion.

To effectively manage and formulate policies for households and individual businesses, Mr. Nguyen Van Duoc, Head of the Policy Department of the Ho Chi Minh City Tax Consultant and Agent Association, proposed a classification system based on industry and revenue scale.

Mr. Duoc suggested that households with an annual revenue of less than VND 1 billion be exempt from tax, regardless of their industry. For households operating in the fields of agriculture, forestry, fisheries, industry, and construction, a revenue range of VND 1-3 billion would require them to declare and pay taxes directly. Once their revenue exceeds VND 3 billion, these households must comply with full tax declaration procedures.

For the trade and service sectors, the classification is more stringent. Households with an annual revenue between VND 1-10 billion would be required to declare and pay taxes directly. If their revenue surpasses VND 10 billion, they must mandatorily follow the tax declaration procedures applicable to enterprises.

Unveiling the Hidden Meaning Behind Vietlott’s Iconic Symbol

“What is it that captivates and enthralls? It’s that elusive spark that sets your heart racing and your mind ablaze. It’s that moment when you discover something extraordinary, something that transcends the ordinary and ignites your soul. It’s that feeling of awe and wonder that leaves you breathless and inspired. It’s that ‘it’ factor that makes your website stand out from the crowd and leaves an indelible mark on all who encounter it. It’s time to unlock the potential of your online presence and reveal the ‘it’ that defines your digital destiny.”

“Raking in Billions Annually in Vietnam, H&M Sets Sights on Expanding in the Country’s Wealthiest City”

The leadership team of this corporation is eager to explore the procedures involved in leasing a space and opening a new store in the heart of Ho Chi Minh City. With a strategic vision, they aim to establish a prominent presence in this vibrant metropolitan hub. This endeavor marks a pivotal step in their expansion journey, and they are committed to navigating the intricacies of the process with diligence and efficiency.

“A Flourishing Business Landscape: 20,500 New Enterprises Across the Nation in the First Eight Months”

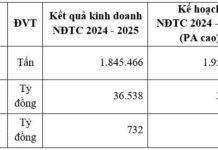

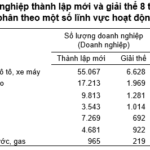

“In August 2025, Vietnam witnessed the establishment of 20.5 thousand new enterprises with a remarkable registered capital of 326.1 thousand billion VND and 106.9 thousand registered employees. These figures reflect a significant growth compared to July, with a 23.9% increase in the number of enterprises, nearly a 2.8-fold surge in registered capital, and a 35.4% rise in the number of employees.”