The market is buzzing with the news of subsidiaries going public, and it’s having a positive impact on their parent companies’ stock prices. One notable example is GEX, which has seen a boost from the planned IPO and listing of its non-financial arm, Gelex Infrastructure.

Similarly, TCH is set to benefit from its subsidiary CRV’s successful completion of HOSE listing procedures in June 2025. A potential IPO and the subsequent plan execution will bring TCH gains in cash flow, asset value, and enhanced transparency and credibility in its real estate business.

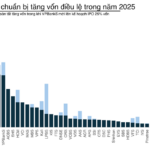

In the financial sector, Techcombank (TCB) has seen a significant boost since its chairman, Ho Hung Anh, announced the planned IPO of Techcombank Securities (TCBS) for the end of the year during the 2025 Annual General Meeting of Shareholders on April 26. Since then, TCB stock has grown by over 52%.

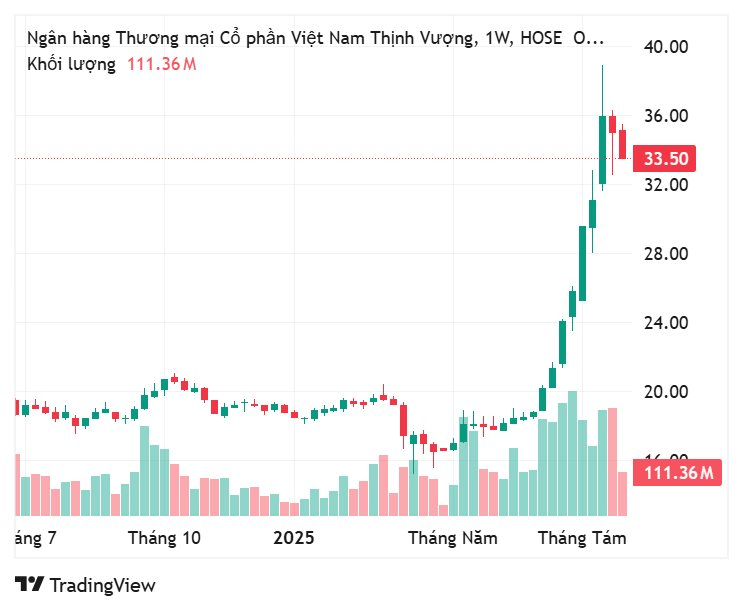

VPBank’s stock, VPB, also witnessed a surge after the announcement of VPBankS’ upcoming IPO in Q4, with the stock reaching its upper limit for two consecutive sessions on August 19 and 20. VPB has been on an impressive upward trajectory since early July, surging over 80% from the 18,500 VND region to above 33,000 VND, fueled by investors’ optimism about VPBankS’ IPO potential.

VIB stock has also been on an upward trajectory since late June and early July, following Kafi Securities’ approval of a capital increase plan for 2025. The plan includes offering 250 million shares to existing shareholders, with a 2:1 ratio, to be executed during the year. Although not a subsidiary of VIB, Kafi Securities has strong ties to the bank through strategic collaborations and shared shareholders.

Since early July, VIB has climbed approximately 22%.

Vingroup serves as a classic example of a successful “holding” model, with its subsidiaries’ public listings creating significant momentum for its stock, VIC. This year, the listing of Vinpearl (VPL) on the stock exchange propelled VIC to new heights. Additionally, in 2023, when VinFast (VFS) was listed on the Nasdaq, VIC experienced a notable surge.

Stock Trading Leadership: Who’s Backing Off and Who’s Taking Over in the First Week of September?

The first trading week of September witnessed notable movements on the stock exchange, with leadership and insider transactions grabbing attention. One such move involved the CEO of ILA, who is no longer a major shareholder, while TTA welcomed a new investor.

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

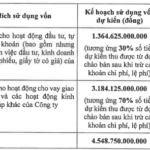

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

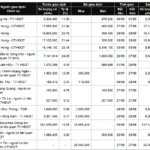

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.

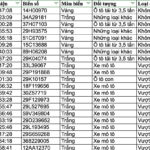

PNJ Offers Over 3 Million ESOP Shares to Employees

“PNJ, a leading jewelry brand in Vietnam, is set to release over 3.2 million ESOP shares to its dedicated staff and employees. With a share price of 20,000 VND, this move showcases PNJ’s commitment to its workforce, offering them a chance to own a piece of the company they work for. The subscription period for this exclusive employee offering runs from September 9, 2025, to September 23, 2025, providing a two-week window for employees to invest in their future with PNJ.”