Silver Soars to 14-Year Highs: A Smart Investment in a Post-Covid World

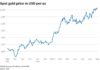

Silver prices have been on a remarkable rally, surging to their highest levels in over 14 years, with spot prices touching above $41 per ounce. Year-to-date, silver has outperformed gold, rallying over 43% compared to gold’s 32% gain. This has caught the attention of investors and traders alike.

This enthusiasm is evident in bustling silver shops across the country, with some even struggling to keep up with the high demand. On September 7, at noon, over 20 customers waited in line at Ancarat Precious Metals Company to make their silver purchases. These were mostly long-term investors, keenly monitoring the dynamic silver price movements.

Ms. Truong Thi Hoa, a resident of District 5 in Ho Chi Minh City, shared her recent profitable trade. She bought a 1kg Ancarat 999 silver bar on August 7 and sold it on the morning of September 7, pocketing a cool profit of VND 2.681 million per kilogram.

Nguyen Thanh Hieu, a resident of District 7 in Ho Chi Minh City, also shared his successful strategy. He locked in profits even before taking delivery of his order. He placed an order for 1,000 five-tael silver pieces from Ancarat Silver but took advantage of the rising prices before the manufacturer could deliver.

“I’m not surprised by silver’s continuous price surge, and I expect this trend to persist in the near future,” said Hieu.

From Savings to Investment: Silver Shines Post-Covid-19

In the post-Covid-19 era, a notable trend among Vietnamese youth is an increased focus on savings and asset allocation. With average incomes, many individuals find gold bars out of reach due to their high prices. Silver, on the other hand, offers a modern savings alternative: it’s more flexible, easier to buy and sell, and comes with lower costs.

“Previously, those who bought one tael of silver were usually individuals saving up on a monthly basis. Now, even large investors are turning to buying one-tael lots as larger quantities are no longer available,” said Trung Anh, Chairman of Ancarat Precious Metals Joint Stock Company.

Internationally, silver prices are hovering around the $40-41 per ounce mark, the highest since 2012. Analysts attribute this upward momentum to strong industrial demand and tight supply.

In Vietnam, silver is becoming an integral part of many individuals’ asset allocation strategies, ranging from personal savings to large-scale investments. Compared to gold, silver offers higher liquidity, lower prices, and easier divisibility, making it accessible to a wider range of investors.

However, this silver rush differs from previous gold frenzies. This time, the scarce commodity is large silver bars of 1kg and 500 grams, while smaller denominations like one and five taels are still available but are being quickly snapped up as substitutes.

“Due to the unavailability of large silver bars for immediate delivery, many investors are forced to turn to smaller denominations, resulting in even one-tael silver – typically meant for individual savers – being bought out,” said Nguyen Trung Anh.

Some investors are seeking to purchase silver in bulk, ranging from 100 to 200 kilograms at a time. However, with production capacities unable to keep up, they are resorting to buying smaller quantities. Notably, some transactions have involved up to 4,000 taels of silver, predominantly in one-tael denominations, an unusual phenomenon in the previous market.

No More Waiting to Buy Gold, Now It’s Silver’s Turn

Amid the relentless surge in global gold and silver prices, domestic prices of these precious metals have also skyrocketed to unprecedented levels. In a notable development, following the frenzy of gold buyers queuing up, a similar scene is now unfolding with long lines of people eagerly waiting to purchase silver.

Is it Time to Invest in Silver Instead of Gold?

While many investment avenues are deemed risky, investing in silver has gained prominence. The demand for silver investment has also increased over the past year.