Mexico has emerged as one of the most prominent import markets for Vietnamese tuna in recent times.

This is largely due to the unique consumer habits of the Mexican market, which heavily favors ready-to-eat processed products. Mexican consumers show a strong preference for pre-cleaned tuna fillets that are individually packaged, easy to prepare, and convenient to purchase from supermarkets and convenience stores. This presents a significant opportunity for Vietnamese businesses to develop product lines that cater to modern retail channels.

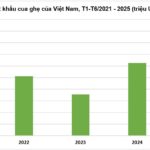

According to statistics, Mexico is currently the 12th largest import market for Vietnamese tuna. Data from Vietnamese Customs reveals that exports of Vietnamese tuna to Mexico reached nearly $12 million in the first seven months of 2025. After a decline in the first four months, exports to this market have shown a strong recovery and rapid growth.

One of the primary drivers of this growth is the tariff preferences under the CPTPP. Many frozen and processed tuna products from Vietnam are now completely exempt from import taxes (previously as high as 20%), giving them a significant competitive advantage over non-CPTPP competitors.

Concurrently, Mexico’s tuna fishing industry has been impacted by a fishing ban imposed by the Inter-American Tropical Tuna Commission (IATTC), leading to a decrease in domestic supply. As a result, Mexico has had to increase its imports, particularly of frozen tuna fillets from Asian countries, including Vietnam.

Amidst the volatile global market, Mexico is projected to be a bright spot for Vietnamese tuna exports. However, in reality, Vietnamese tuna also faces several challenges when entering this market.

One reason is that Mexico frequently implements price stabilization policies to combat inflation, including temporary tax exemptions on certain canned tuna products. These policies can sometimes diminish the advantages Vietnam gains from the CPTPP, requiring businesses to closely monitor and adapt their strategies accordingly.

The standards for exporting goods to Mexico are becoming increasingly stringent. As with many other markets, Mexican consumers and distribution systems are placing greater emphasis on sustainability and traceability. Certifications such as MSC, “dolphin-safe,” and proof of legal fishing practices are becoming crucial for products to be placed on supermarket shelves.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), this presents a significant challenge for Vietnamese businesses due to the complex and costly process of obtaining sustainability certifications. However, if successfully obtained, these certifications can be the key to deeper penetration into Mexico’s modern retail system, provided businesses seize the opportunity and prepare adequately.

The Customs Department (Ministry of Finance) reported that in the first seven months of 2025, Vietnam’s tuna exports reached nearly $542 million, a 3% decrease compared to the same period last year.

Although the tuna catch in the last months of the year is expected to meet export demands, the outlook for exports in the coming months remains challenging. VASEP predicts that it will be difficult for Vietnamese tuna to break through and maintain its market share, and the annual export turnover is unlikely to reach the $1 billion target.

The Sunken Treasure: Vietnam’s Aquatic Delicacies Shine Abroad

The product in question is highly sought-after in countries like China and Australia due to its superior quality and Vietnamese origin.

Unlocking Trade Potential Along the Asia-Pacific Corridor: Vietnam’s Entry into the CPTPP

With the United Kingdom’s accession, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has officially reached 12 members, accounting for approximately 15% of global GDP. This marks a turning point in international trade relations, offering extensive cooperation opportunities for member economies, including Vietnam.

Weaving a Brighter Future: Vietnam’s Textile Industry on Track to Achieve $44 Billion Export Target

The Vietnam Textile and Apparel Association (Vitas) asserts that the textile industry’s export target of 44 billion USD by 2024 is well within reach. The association bases this optimism on the fact that the end of the year typically sees a surge in production orders for the festive season, encompassing both Christmas and New Year celebrations.