According to a report by Vietcap Securities, Binh Minh Plastic Joint Stock Company (code: BMP) is expected to maintain its record-high profit margin in the second half of 2025 and into 2026, due to forecasted low PVC input prices. Key drivers include:

(1) The slow recovery of the Chinese real estate market, coupled with US-China trade tensions further hindering the pace of revival.

(2) India’s recent anti-dumping duty ruling on PVC imports from China, ranging from 122-232 USD/ton (equivalent to 17-33% of the selling price), redirecting Chinese PVC export supply away from India, thus lowering prices in other regions.

(3) High PVC inventory levels in China.

Vietcap further states that as India is the world’s largest PVC importer (accounting for over 15% of global imports) and the largest export market for Chinese PVC (over 35% of China’s total PVC exports), this ruling will significantly impact global PVC trade flows.

These factors will keep PVC prices low and sustain Binh Minh Plastic’s high profit margins in the latter half of 2025 and into 2026.

A potential constraint to this outlook is the possibility of PVC capacity cuts under China’s 2025 “anti-negative competition” policy.

Unlike steel, PVC has not been specifically targeted by this policy, but the oversupply and weak downstream demand make the PVC industry a potential candidate.

In the short term, Vietcap expects PVC prices to remain under pressure due to oversupply, India’s anti-dumping duties, and high inventory levels in China, outweighing the impact of capacity cuts (if they occur) – which would take time to materialize.

PVC prices surged in July due to expected production cuts but quickly adjusted downwards.

In the long term, Vietcap believes that PVC input prices will either remain stable at low levels (if no capacity cuts occur) or recover slowly (if significant capacity cuts take place).

In 2024, Binh Minh Plastic recorded revenue of VND 4,616 billion. Post-tax profit reached VND 991 billion, with a gross profit margin of 43.1%.

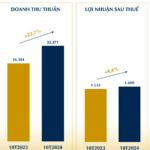

In the first half of 2025, Binh Minh Plastic’s revenue reached VND 2,741 billion, an increase of 25% year-on-year. Post-tax profit was VND 616 billion, up 31% from the previous year.

Gross profit from sales and services amounted to VND 1,200 billion, a 29% increase compared to VND 930.6 billion in the same period last year.

The company attributed this mainly to the decrease in the cost of main raw materials used in production.

Established in 1977, Binh Minh Plastic is a pioneer in Vietnam’s plastic pipe industry. Nawaplastic, a subsidiary of SCG Thailand, currently owns 54.99% of BMP. As of the market close on September 8, 2025, Binh Minh Plastic’s market capitalization stood at VND 12,500 billion.

“Illicit Tax-Evading Schemes Boost Textile Profits in Q2”

The strategy to boost orders ahead of the US’s 46% tariff implementation proved a remarkable success for Vietnam’s textile industry in Q2 2025. While the subsequent reduction to a 20% tariff provided some relief and potential for growth in Q3 and Q4, it also presented a conundrum for long-term strategic planning.

The Art of Refinancing: TCO Holdings Prepares to Issue Convertible Bonds to Restructure Debt.

“TCO Holdings JSC (HOSE: TCO) is planning to offer private bonds worth VND 180 billion (at par value) to Lighthouse Investment Fund Management and Vietnam Industrial and Commercial Bank Fund Management Joint Stock Company (Vietinbank Capital).”

The Hydration Industry’s Hottest New Bond Offering: A Dehydrated Perspective.

The company, which is over 94% owned by Biwase, JSC – Binh Duong Water – Environment Corporation (Biwase, HOSE: BWE), has successfully raised a significant amount of bonds with an impressively low-interest rate of just 5.5% per annum, undercutting the bond interest rates offered by many other enterprises.