Viettel Construction JSC (Viettel Construction – code CTR) has recently announced a resolution to pay 2024 dividends in cash at a rate of 21.5%, equivalent to VND 2,150/share.

With more than 114 million shares circulating, Viettel Construction is expected to spend about VND 246 billion on this dividend payment. The ex-dividend date is October 1st. The expected payment date is October 15th.

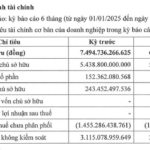

In terms of business results in July, Viettel Construction recorded a 17% increase in revenue compared to the same period, reaching VND 1,317 billion. Pre-tax profit (PBT) also increased by 17% compared to the same period to VND 67 billion. The lower PBT compared to the previous month was mainly due to slightly higher financial losses as interest expenses on short-term working capital loans increased.

Accumulated in the first 7 months, Viettel Construction achieved VND 7,332 billion in revenue and VND 402.4 billion in PBT, up 8% and 11% over the same period last year, respectively. With these results, the company has completed 52% of the revenue plan and 56% of the profit target for the whole year.

Revenue from the construction segment increased by 31% compared to the same period last year and the previous month, reaching VND 496 billion in July/2025, totaling VND 2,399 billion in the first 7 months of 2025, up 14% over the same period. This positive business result has effectively supported B2B projects and residential real estate.

The infrastructure rental segment grew by 40% compared to the same period last year and 3% compared to the previous month, reaching VND 74 billion in July/2025, while increasing by 45% over the same period to VND 485 billion in the first 7 months of 2025.

In the first 7 months of 2025, Viettel Construction added 930 new BTS stations, bringing the total number of BTS stations to 10,930 as of the end of July. With this result, the company continues to consolidate its position as the leading TowerCo provider in Vietnam. Of which, there are 370 co-location stations with an average sharing rate of 1.03 times.

Revenue from integrated solutions and technical services increased by 29% compared to the same period last year (and 2% compared to the previous period) to VND 197 billion in July/2025 and increased by 14% compared to the same period to VND 990 billion in the first 7 months of 2025. This revenue growth was driven by the demand for solar installation solutions from businesses and households.

In July/2025, Viettel Construction signed and implemented a total of 15.6 MW of solar power projects for manufacturing companies, with a contract value of VND 133 billion, the highest revenue month since 2019.

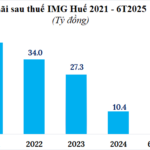

“IMG Hue Records Twelve-Fold Profit Increase in H1 2025, Freed from Bond Debt”

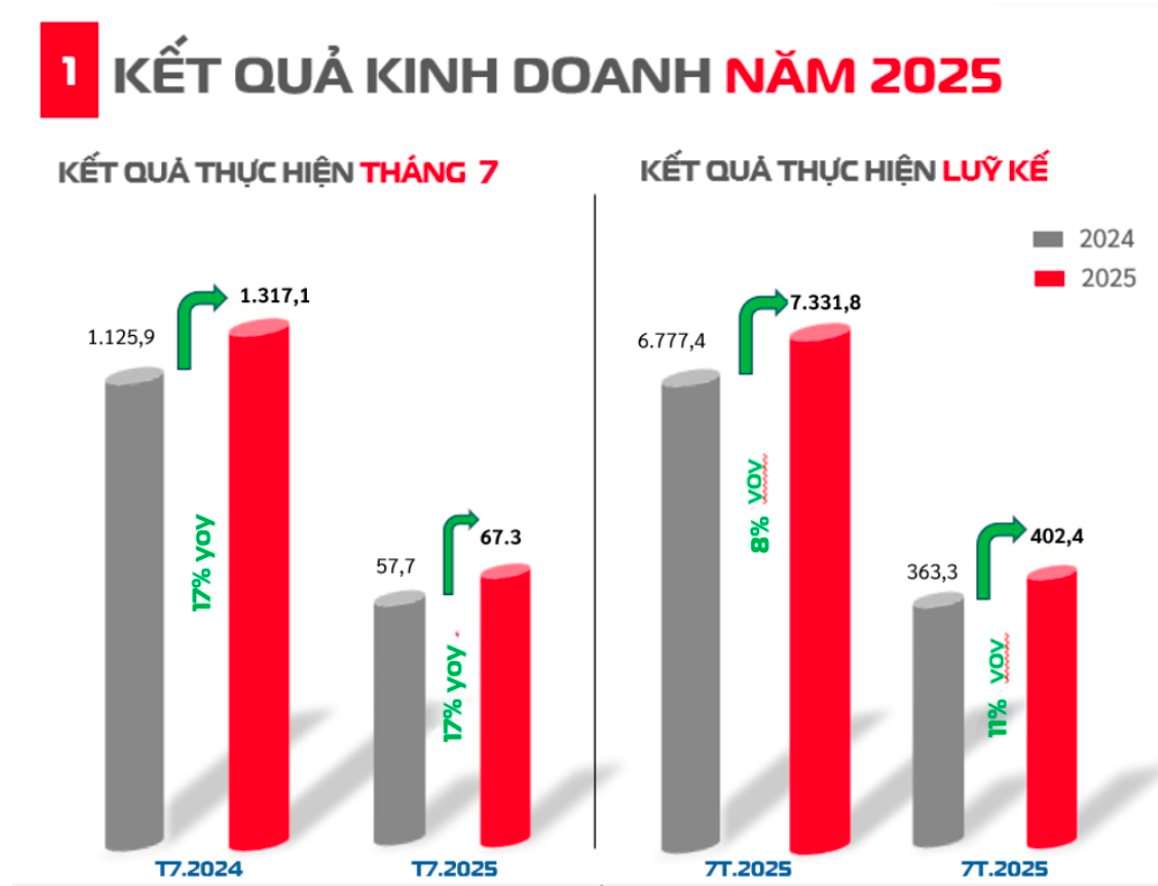

In the first half of 2025, IMG Hue reported a remarkable profit of over VND 30 billion, an astonishing surge of nearly 12 times compared to the same period last year. This achievement surpasses the results of both 2023 and 2024. Notably, the enterprise also made an early full repayment of four bond lots worth VND 350 billion.