The stock market faced corrective pressures and hovered around the 1,600-point level during the week of September 8-12, following a short-term peak in the first week of September. The market witnessed two strong recovery sessions at these levels, with increased buying interest at lower prices, resulting in decent trading volume. The VN-Index ended the week with a slight gain of +0.02%, closing at 1,667.26 points and holding the psychological support level of 1,600 points. Meanwhile, the VN30 index outperformed, rising by +1.08% to 1,865.45 points, approaching the previous peak level of around 1,880 points.

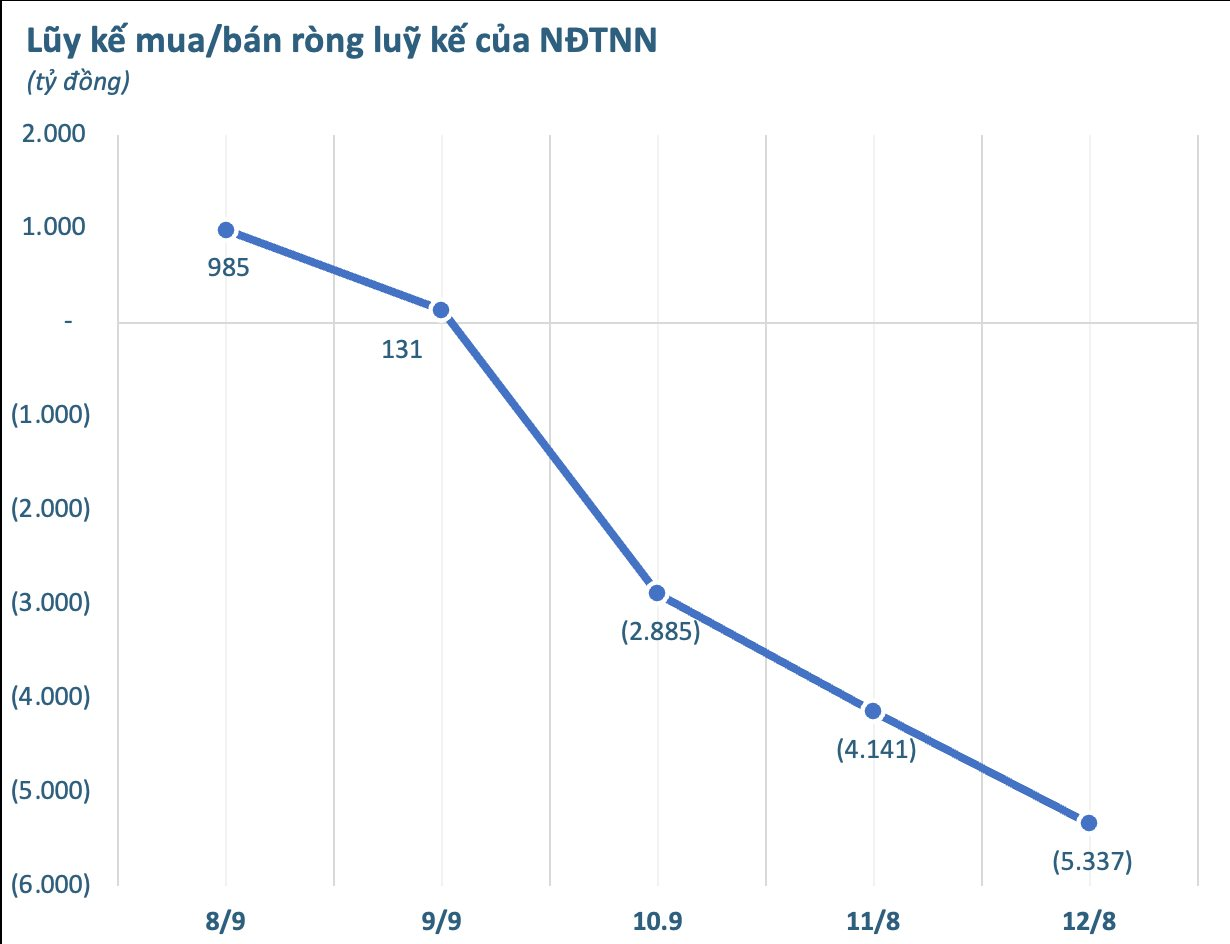

In terms of foreign investment value, foreign investors continued to strongly net sell in the billions of VND. Cumulatively over the three sessions, foreign investors net sold more than VND 5,337 billion.

Looking at each exchange, foreign investors net sold VND 5,023 billion on HoSE, VND 196 billion on HNX, and VND 117 billion on UPCoM.

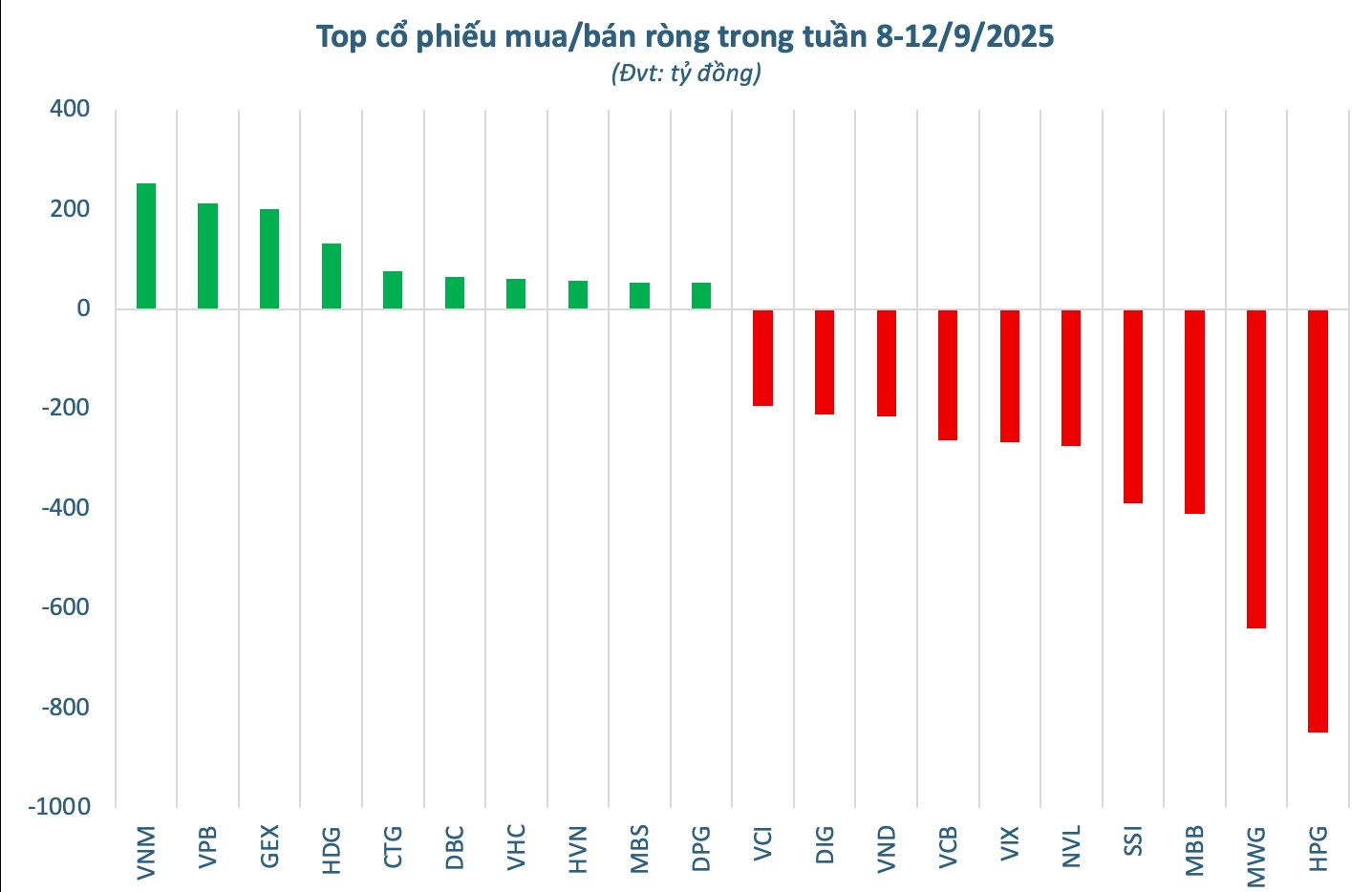

Analyzing the individual stocks, HPG was the main focus of net selling during the past trading week, with a value of VND -848.5 billion, far exceeding the other stocks. MWG followed with net selling of VND -638.9 billion, then MBB (-VND 409.7 billion), and SSI (-VND 388.9 billion). Several other large-cap stocks also experienced capital outflows, including NVL (-VND 274 billion), VIX (-VND 266.5 billion), VCB (-VND 261.6 billion), VND (-VND 214.8 billion), and DIG (-VND 210.5 billion). The stocks VCI, KBC, and NKG also recorded net selling in the range of VND -151 billion to VND -192 billion.

On the buying side, VNM led with a net buying value of VND 254 billion. This was followed by VPB (VND 213.8 billion), GEX (VND 202 billion), and HDG (VND 132.7 billion). CTG (VND 76.3 billion), DBC (VND 65.4 billion), and VHC (VND 61.4 billion) also attracted notable foreign investment. Additionally, HVN, MBS, DPG, TCB, and BAF all recorded net buying values ranging from VND 34 billion to nearly VND 58 billion.

Unlocking the Potential: Removing Barriers to Foreign Investment in the Stock Market

Introducing a transformative initiative: the proposal to abolish the regulation permitting general shareholder meetings to lower foreign ownership ratios below the statutory limit. This move empowers shareholders, fostering a dynamic and inclusive business environment. By removing this regulation, we unlock the potential for greater foreign investment, driving innovation and growth.

The Stock Market’s Cash Crunch: A Capital Conundrum

The VN-Index witnessed yet another volatile trading session, with the benchmark index swinging back and forth before closing slightly lower on September 10th. Trading activity waned, as the value of transactions on the Ho Chi Minh Stock Exchange dipped below the VND 30 trillion mark.

Market Pulse September 9: Late Session Surge Fueled by Real Estate and Financial Stocks

The stock market witnessed a volatile session today, but a strong rally in the final 5 minutes of trading firmly established the day’s gains. At the closing bell, the VN-Index surged by nearly 13 points, finishing at 1,637.32, while the HNX-Index climbed over 3 points to reach 274.80.