Bách Hoá Xanh Recruits Talent for Northern Expansion

In its latest update on its Facebook recruitment page, Bách Hoá Xanh, a subsidiary of Mobile World Investment Corporation (MWG), is seeking male specialists for the role of “Finding and Developing Northern Locations.” The job entails scouting and proposing potential business locations, negotiating and signing leases, liaising with local authorities, and managing and monitoring contracts and related issues. Bách Hoá Xanh is offering attractive incentives for each successful lease signed.

This recruitment drive is part of Bách Hoá Xanh’s strategic “Northern Expedition.” At the recent Investor Meeting for Q2 2025, MWG’s CEO, Vu Dang Linh, announced that 2026 will mark the official expansion of Bách Hoá Xanh into Northern Vietnam. Mr. Linh also revealed their ambitious goal of opening 1,000 new stores every year, starting in 2026.

“Bách Hoá Xanh has laid the groundwork by optimizing costs and refining our business model in Central Vietnam,” said Mr. Linh. “We’ve significantly reduced the investment required for new stores, and this will be the springboard for our nationwide expansion.”

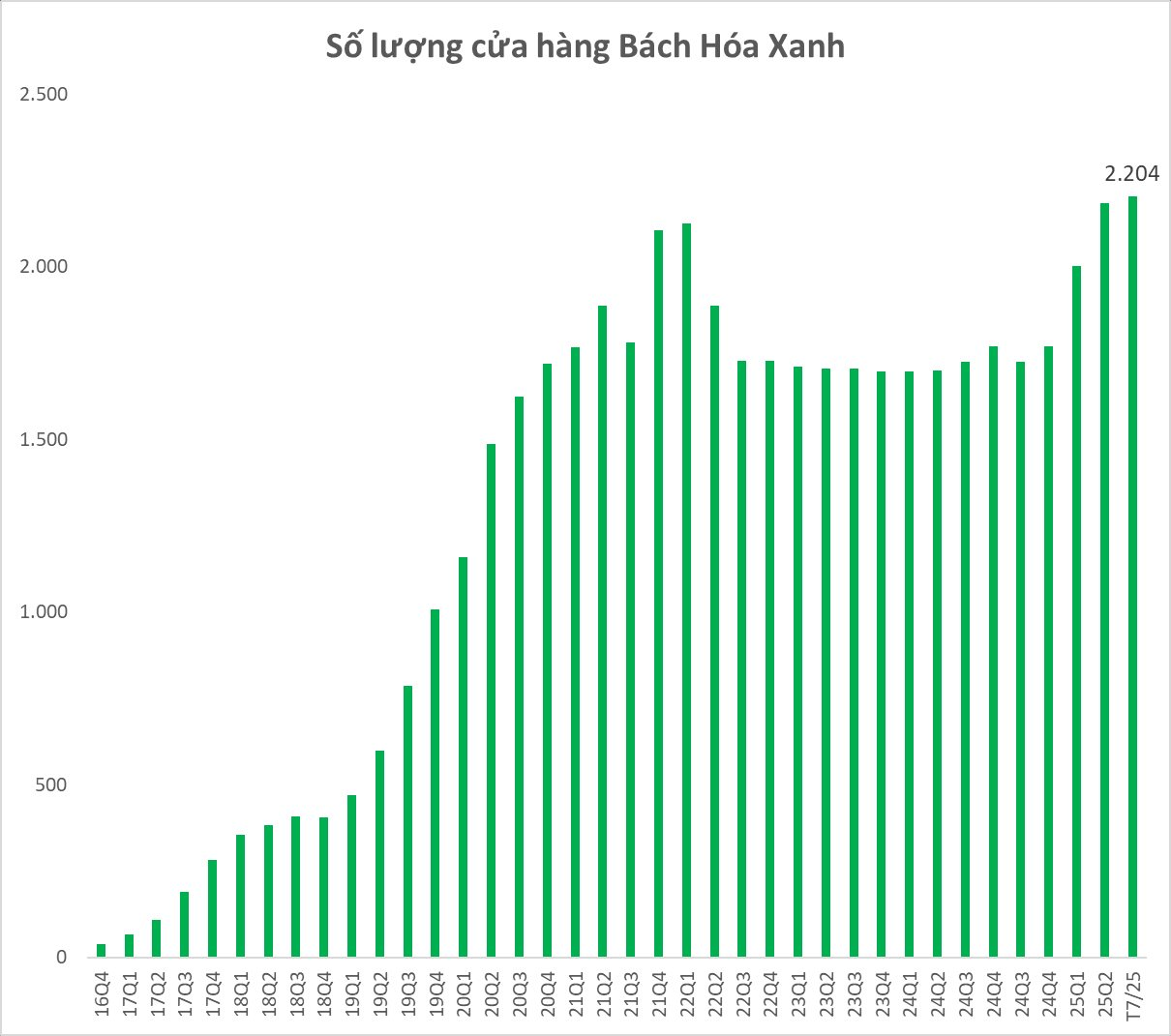

For 2025, MWG aims to open 400 new Bách Hoá Xanh stores. However, by the end of the first nine months, the chain had already exceeded its target, opening 414 new stores, with over 50% of the new openings in Central Vietnam. From now until the end of the year, the chain plans to inaugurate an additional 200 stores, bringing the total number of new openings in 2025 to 620.

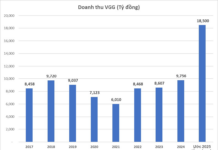

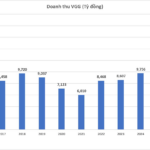

In terms of financial performance, Bách Hoá Xanh achieved impressive results, with cumulative revenue of nearly VND 26,500 billion in the first seven months of 2025, a 15% increase compared to the same period last year. This growth was driven by both key product categories: fresh food and FMCG. As of the end of July 2025, the chain operated 2,204 stores nationwide.

Bách Hoá Xanh’s IPO and the $10 Billion Revenue Goal

Regarding the planned IPO of Bách Hoá Xanh in 2028, Mr. Linh affirmed their commitment to going public, aiming for rapid revenue growth to offset accumulated losses quickly. They also aim to optimize production, warehousing, display, and after-sales services, with an expected profit margin of 4-5%.

MWG’s Chairman, Nguyen Duc Tai, emphasized that the $10 billion revenue target is Bách Hoá Xanh’s vision. However, to achieve this scale, the chain must diversify its store models beyond the current 150 sq. m. standard.

“BHX will develop flexible models, including stores dedicated to dry goods or fresh produce and mini-stores in apartment building basements,” explained Mr. Tai. “With an average revenue of VND 2.5-3 billion per store per month, BHX could potentially operate tens of thousands of stores to reach the $10 billion mark.”

Additionally, one of Bách Hoá Xanh’s strategic focuses is expanding its online presence. Currently, online sales account for 5% of total revenue. A significant advantage for BHX is its extensive store network, enabling swift order processing and reduced delivery times.

“We aim to increase the proportion of online revenue from 5% to 10%,” shared Mr. Tai. “The tight integration of online and offline channels will be BHX’s key competitive advantage in the coming period.”

“Faith and Aspiration: Meey Group’s IPO Journey”

As the Strategy Director of Meey Group, a pioneering proptech enterprise that has cemented its market leadership, Ms. Nguyen Ly Kieu Anh firmly believes, “There’s no room for regrets. The important thing is whether you want to do it or not.”

“VPBank’s Upcoming IPO: 375 Million Shares to Double 2025 Profit Plans”

With the written shareholder vote concluded on September 3rd, the plan to initiate an initial public offering (IPO) of VPBank Securities Joint Stock Company (VPBankS) has been approved. The IPO will offer a maximum of 375 million shares to the public. In addition, shareholders have also agreed to double the profit plan for 2025 and appoint an additional member to the board of directors.

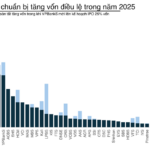

The New Race for Stockbrokers: IPOs, Capital Raises, and the Digital Asset Pivot

In just two months, the market has witnessed a string of significant events from industry-leading companies. TCBS led the way with a massive IPO of over VND 10,000 billion, followed by the entries of VPS and VPBankS, while HSC, SSI, MB ecosystem, and VIX made strategic moves to strengthen their positions.