I. MARKET ANALYSIS OF SECURITIES ON 09/09/2025

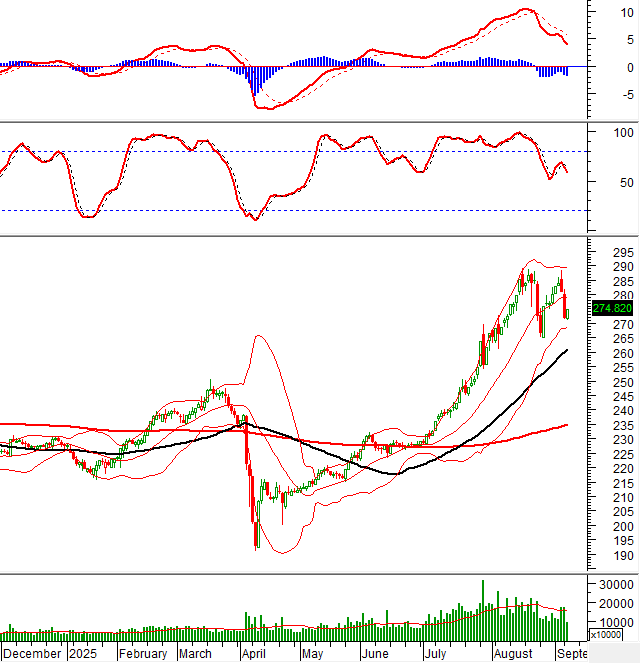

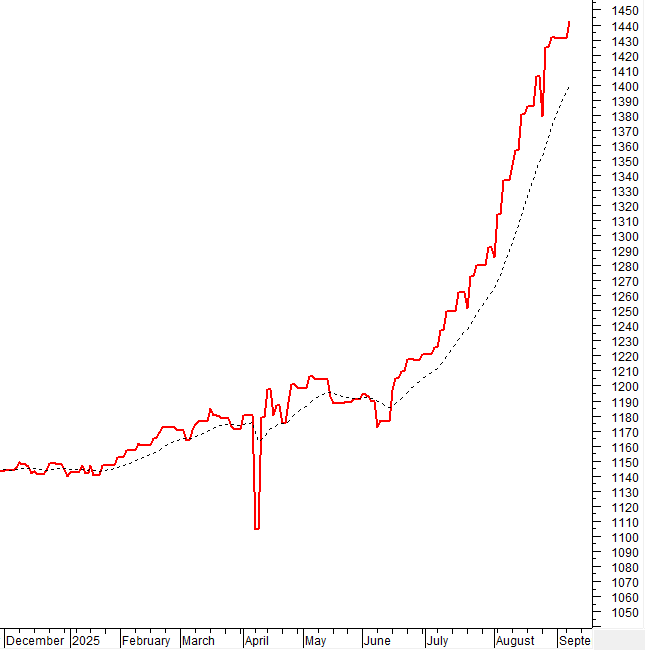

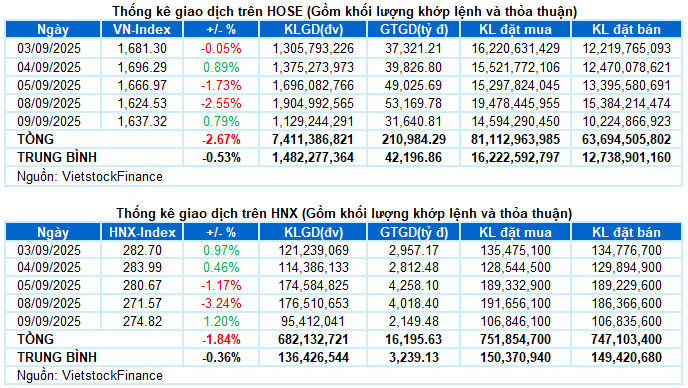

– The main indices recovered in the trading session on 08/09. Specifically, VN-Index increased by 0.79%, reaching 1,637.32 points; HNX-Index also increased by 1.2%, reaching 274.82 points.

– Liquidity fell sharply compared to the previous session. The matched order volume on the HOSE floor decreased by 42.8%, reaching 1 billion units. Meanwhile, HNX recorded over 93 million units, a decrease of 46.2%.

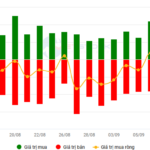

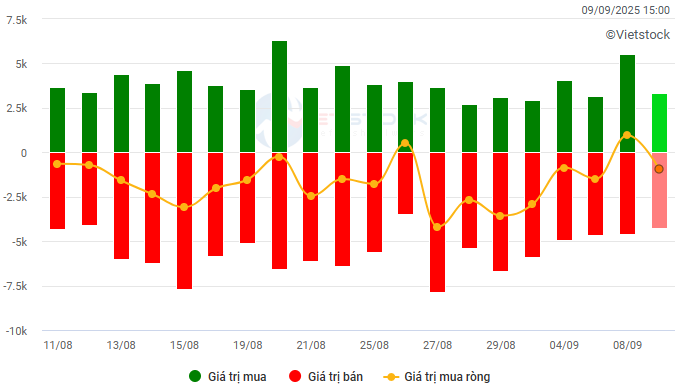

– Foreign investors net sold VND 959 billion on the HOSE and net bought VND 21 billion on the HNX.

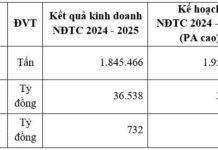

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

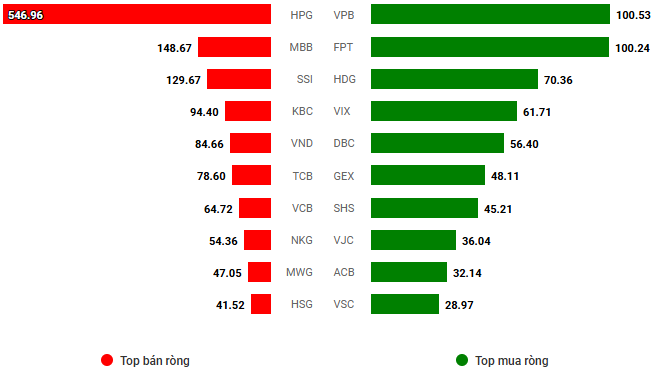

Net trading value by stock code. Unit: VND billion

compared to the sharp drop in liquidity after the previous 2 sessions. VN-Index mainly fluctuated around the reference level for most of the trading time, and the buying force quickly balanced the index when it adjusted but was not strong enough to break through. However, a surprise once again happened at the end of the session, but this time in a positive direction. The strong pull of leading groups such as real estate, banks, and securities pushed the VN-Index up nearly 13 points at the close, stopping at 1,637.32 points.

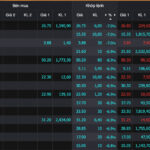

– In terms of impact, VIC led on the positive side, bringing nearly 4 points to the VN-Index. Following were VPB and VHM, which also contributed a total of 3.6 points. On the contrary, VCB and LPB were the two codes with the most negative impact, causing the index to lose more than 1 point.

– VN30-Index closed up nearly 18 points, reaching 1,825.17 points. The breadth of the basket was balanced with 15 stocks rising, 11 falling, and 4 standing.

On the positive side, SSI topped the table with an outstanding increase of 4.5%. Following were VPB, VIC, MWG, VJC, HDB, and SHB, which also increased by more than 2%. On the opposite side, SSB, LPB, and SAB were at the bottom of the table with an adjustment of more than 1%.

Most industry groups closed in the green. The real estate group led the market with a 1.6% increase. The main contributors were outstanding buying demand in VIC (+3.36%), VHM (+1.4%), BCM (+1.49%), DXG (+4.21%), PDR (+1.07%), DIG (+1.04%), TCH (+1.63%), CEO (+1.69%), and DXS (+4.35%).

In addition, the industrial and financial groups also made significant contributions to today’s gain with many bright spots such as GEX (+2.99%), CII (+3.24%), VJC (+2.18%), GMD (+3.02%), HBC (+2.56%), DPG (+1.78%); SHB (+2.03%), SSI (+4.48%), VIX (+5.97%), VPB (+3.85%), SHS (+5.93%), HDB (+2.1%), and VCI (+4.3%).

On the contrary, media & publishing services “bottomed out” with a decrease of 0.6%, with the main pressure coming from the large-cap stock in the industry, VGI, with an adjustment of 1.23%. Similarly, red appeared in many codes such as HPG (-0.17%), GVR (-0.69%), DGC (-0.62%), KSV (-1.1%), HGM (-1.92%), and NKG (-1.1%), which also caused the materials group to decrease by 0.32%.

VN-Index surged at the end of the session and formed a Hammer candlestick pattern. Thus, the index remains above the short-term trendline (equivalent to the 1,615-1,625-point range). However, trading volume fell sharply below the 20-session average, indicating that investors remain cautious. At the same time, the Stochastic Oscillator indicator continued to fall after giving a sell signal and exiting the overbought zone.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Standing Firm Above the Short-Term Trendline

VN-Index surged at the end of the session and formed a Hammer candlestick pattern. Thus, the index remains above the short-term trendline (equivalent to the 1,615-1,625-point range).

However, trading volume fell sharply below the 20-session average, indicating that investors remain cautious. At the same time, the Stochastic Oscillator indicator continued to fall after giving a sell signal and exiting the overbought zone.

HNX-Index – Trading Volume Fluctuates Significantly

HNX-Index recovered but trading volume fluctuated strongly in recent sessions, indicating investors’ unstable psychology.

The risk of short-term fluctuations remains in the context that the Stochastic Oscillator and MACD indicators continue to fall after giving sell signals.

Analysis of Capital Flows

Fluctuations in Smart Money Flows: The Negative Volume Index indicator of VN-Index is currently above the EMA 20-day. If this status continues in the next session, the risk of an unexpected drop (thrust down) will be limited.

Fluctuations in Foreign Capital Flows: Foreign investors net sold in the trading session on 09/09/2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

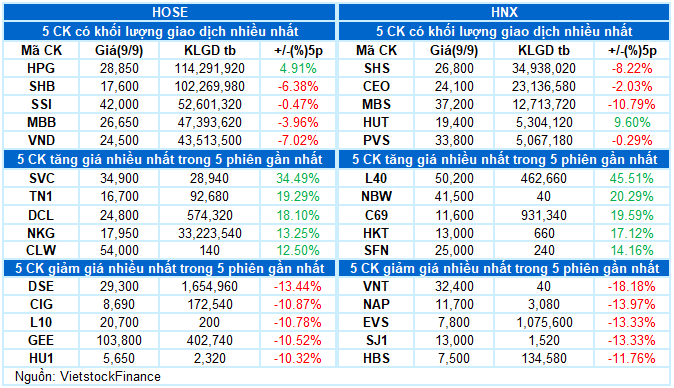

III. MARKET STATISTICS ON 09/09/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:10 09/09/2025

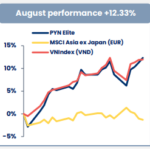

Stock Market Week Sept 08-12, 2025: The Roaring Comeback

The VN-Index extended its gains in the final session of the week, recovering all losses incurred during the week’s initial downturn with four consecutive rebound sessions. While the index staged a strong comeback, trading volume remained below the 20-day average, and persistent net selling pressure from foreign investors remains a concern in the near term.

The Bank Stock Market Crash

The sea of red deepened across the market as selling pressure intensified during the afternoon session on September 8th. The VN-Index plummeted over 42 points, with numerous bank and real estate stocks hitting their daily lower limits.

“Should Investors Take the Plunge as VN-Index Dips Over 70 Points from its Peak?”

The Aseansc expert believes that the current corrective rhythm should be viewed as a ‘breather’ in the market’s larger bullish wave.