Deputy Governor of the SBV Doan Thai Son

At the regular August Government meeting held on September 6, SBV Deputy Governor Doan Thai Son announced that credit outstanding at the end of August reached VND 171.4 million billion, up 11.08% from the previous year-end. For the full year, credit growth stood at 20.19%, the highest in many years, whereas it typically hovers around 14.5%.

According to the Deputy Governor, this leads to two consequences. Firstly, banks are compelled to increase capital mobilization, potentially driving up deposit rates and subsequently lending rates. Secondly, robust credit growth implies a surge in money supply, exerting long-term inflationary pressures.

The Deputy Governor also revealed that core inflation has remained above 3% over the past period. This figure is concerning, as a 3% threshold is typically considered a warning signal for policy management.

He attributed this to both domestic and international factors. Externally, global inflationary pressures persist, with energy and raw material prices, along with unpredictable market fluctuations, driving up production and import costs. Domestically, rising housing rents and dining-out expenses, coupled with adjustments in gold prices and a range of State-managed commodities, have further fueled inflationary pressures.

“Given this trend, the SBV concurs with the Ministry of Finance on the necessity of close monitoring and flexible management. When new developments arise, we need to stay ahead of the curve. If inflation continues to show signs of escalation, proactive governance measures must be implemented immediately, rather than waiting reactively. Experience tells us that once inflation surpasses a certain threshold, subsequent control measures come at a steep cost. The SBV will maintain vigilant surveillance and take timely actions within its authority, as well as propose solutions to the Government,” affirmed Deputy Governor Doan Thai Son.

Additionally, the Deputy Governor emphasized that, particularly in August, exchange rates have been under significant pressure. This is attributed to the prevailing high USD interest rates coupled with low VND interest rates, creating an incentive for capital shifting. Moreover, while foreign loan disbursements decreased, debt repayment obligations increased.

In response, the SBV has been proactively managing exchange rates in tandem with interest rates, liquidity, and foreign currency sales as needed. As of September 4, 2025, the exchange rate stood at VND 26,380 per USD, reflecting a 0.09% decrease from August 22 but a 3.45% increase compared to the 2024 year-end rate.

Furthermore, given the objective reasons stemming from global developments, exchange rate pressures are anticipated to persist in the foreseeable future.

iDepo VIB – Elevate Your Savings with Attractive Interest Rates and Flexible, Secure Digital Transfers

The iDepo from VIB International Bank is an innovative short-term savings solution, offering a competitive interest rate of up to 6.2% annually. What sets iDepo apart is its unique feature that allows you to withdraw your money early while still retaining the interest earned. This smart savings account ensures you have access to your funds whenever you need them, without sacrificing the benefits of a fixed-term deposit.

“Electricity and Rent Prices Surge: What’s the Impact on Vietnam’s August CPI?”

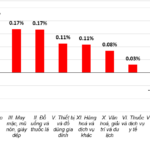

The latest figures from the General Statistics Office on socio-economic development in August and the first eight months of 2025 reveal that out of the total increase in the CPI [Consumer Price Index] in August compared to the previous month, there were eight groups of goods and services that experienced a rise in their price index, while three groups witnessed a decrease.

The Crypto Market Today, September 7: Bitcoin Loses Key Support

The crypto market is ever-evolving, and analysts predict that Bitcoin could very well revisit the $75,000 mark. This prediction is not far-fetched, given the volatile nature of the cryptocurrency market and Bitcoin’s proven resilience. As we navigate these dynamic times, investors and enthusiasts alike await with bated breath, eager to witness Bitcoin’s next move.