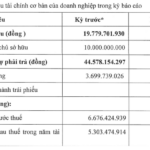

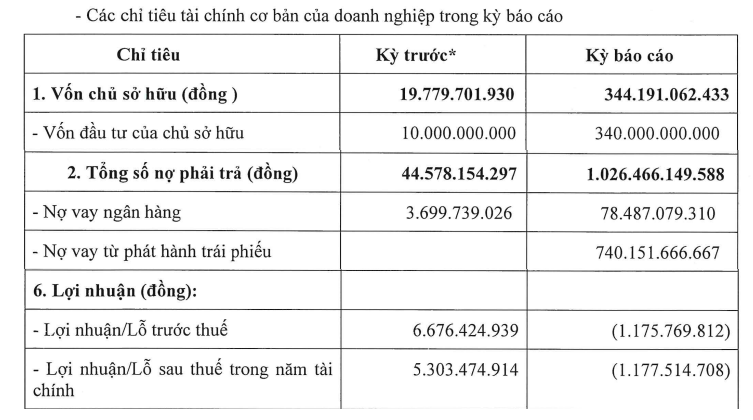

Crystal Bay Vietnam’s financial picture witnessed significant fluctuations with a surge in both capital and debt. As of the end of June, equity reached VND 344 billion, a more than 17-fold increase from the previous reporting period, thanks to a capital increase from VND 10 billion to VND 340 billion.

Concurrently, payables soared to over VND 1,000 billion, a 23-fold increase, including VND 740 billion in bonds. Bank loans amounted to VND 78 billion, and other debts totaled VND 208 billion.

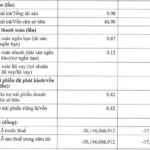

The debt-to-equity ratio increased from 2.25 to 2.98, and the debt-to-asset ratio rose to 0.75, higher than the previous 0.69. Liquidity ratios improved, with the current ratio at 1.9 and the quick ratio at 1.7. However, the interest coverage ratio declined from 138 to 0.79.

Crystal Bay Vietnam reports loss for the first half of 2025. Source: HNX

|

Currently, CBVN has issued CRB12501 bonds worth VND 755 billion with a five-year maturity. The initial interest rate is set at 9.5%/year, with interest payable every 24 months and secured by assets. The next interest payment is expected on 06/27/2027.

CBVN is a subsidiary of Crystal Bay Tourism Group, specializing in package tours and charter flight operations for international guests. The company transitioned to a joint-stock model in April 2025, with a ownership structure comprising Crystal Bay (a company chaired by Mr. Nguyen Duc Chi, who also serves as its legal representative) holding 90%, Mr. Nguyen Duc Chi and Ms. Le Minh Ha each owning 5%. On June 12, just over two weeks before the bond issuance, the chartered capital was raised to VND 340 billion. The company has three legal representatives: Mr. Nguyen Duc Chi – Chairman of the Board, Mr. Huynh Ngoc Duy – General Director, and Ms. Nguyen Thu Trang – Deputy General Director.

According to Saigon Ratings, CBVN caters to the package tour and charter flight needs of international guests, primarily from Kazakhstan, Uzbekistan, and Kyrgyzstan. They are also expanding their reach to markets in Russia, Mongolia, Taiwan, and South Korea.

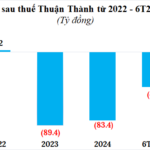

It’s not just CBVN; another company associated with Mr. Nguyen Duc Chi, Sunbay Ninh Thuan JSC (SBPC), also incurred losses. For the first half of 2025, SBPC reported a record loss of over VND 289 billion, continuing a streak of unprofitable financial results since its initial public disclosure on HNX in 2021.

Crystal Bay Eliminates Bond Debt as Subsidiary Raises Funds

Sunbay Ninh Thuan Reports a Loss of Nearly VND 290 Billion in the First Half

– 09:28 10/09/2025

“Crystal Bay Vietnam: Navigating Through Turbulent Tides”

Crystal Bay Vietnam JSC (CBVN) suffered a post-tax loss of nearly VND 1.2 billion in the first half of 2025, a stark contrast to the profit of over VND 5.3 billion in the same period last year, as per audited financial statements.

The Pearl Island Villa Owner Profits Over $50,000 in the First Half

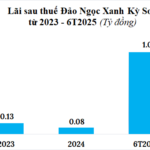

The Green Pearl Island of Ky Son has turned a corner, reporting its highest net profit since 2023. With a remarkable performance in the first half of 2025, the island recorded a net profit of over 1 billion VND, a staggering 16.6 times higher than the same period last year.