Mr. Nguyen Duy Hung, Chairman of SSI, has shared his insights on digital assets, a field that has been attracting much attention in Vietnam and worldwide. “Digital assets are an appealing but highly risky field with many pitfalls. Everyone needs to understand this before participating!” Mr. Hung emphasized.

Mr. Hung’s statement was posted just a day after Deputy Prime Minister Ho Duc Phoc issued Resolution No. 5/2025/NQ-CP on September 9, 2025, on the pilot implementation of the encrypted asset market in Vietnam.

This resolution takes effect from the signing date, and the pilot period is five years. It regulates the pilot offering and issuance of encrypted assets, the organization of the encrypted asset trading market, and the provision of encrypted asset services. It also outlines the state management of the encrypted asset market in Vietnam.

The pilot participants include organizations providing encrypted asset services, organizations issuing encrypted assets, and Vietnamese and foreign organizations and individuals investing in encrypted assets and operating in Vietnam’s encrypted asset market within the resolution’s scope.

Notably, entities granted licenses to organize the encrypted asset trading market must have a minimum charter capital of 65% contributed by institutional shareholders. Of this, over 35% must be held by at least two institutions, including banks, securities companies, fund management companies, insurance companies, and enterprises in the technology field.

Previously, several securities companies, including SSI, have made moves to prepare for this potential opportunity by establishing subsidiaries in the Blockchain and digital asset sectors.

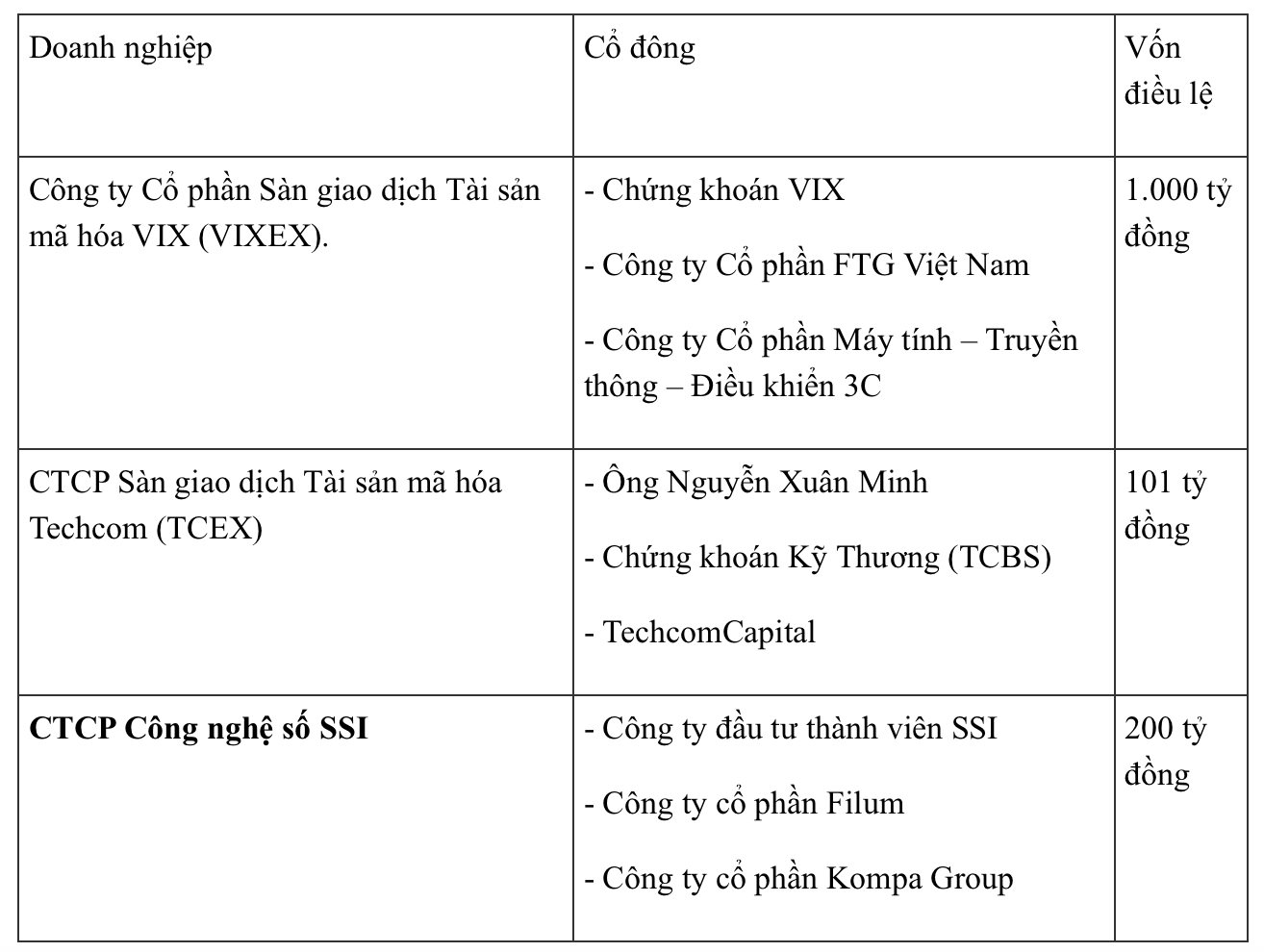

Since 2022, SSI has contributed capital to establish SSI Digital (SSID) with a charter capital of VND 200 billion. Recently, SSID and SSI Asset Management Company signed a cooperation agreement with Tether, U2U Network, and Amazon Web Services to develop digital finance, blockchain, and cloud computing infrastructure in Vietnam.

Most recently, VIX Securities contributed VND 150 billion to establish VIXEX, a digital asset company, with a charter capital of VND 1,000 billion, headquartered in Hai Ba Trung District, Hanoi.

Earlier, on August 8, Techcom Encrypted Asset Exchange (TCEX) increased its charter capital from VND 3 billion to VND 101 billion. The initial shareholder structure included Mr. Nguyen Xuan Minh holding 89%, Techcom Securities (TCBS) contributing 9.9%, and TechcomCapital owning 1.1%. TCEX is located in Techcombank Tower at 6 Quang Trung, Hanoi, with Mr. Nguyen Xuan Minh, Chairman of TCBS, TechcomCapital, and Wealthtech Innovations, as its General Director and legal representative.

At a recent event on encrypted assets, Mr. Phan Duc Trung, Chairman of the Vietnam Blockchain and Digital Asset Association (VBA), revealed that Vietnam plans to license approximately five exchanges to pilot the trading of digital assets. These exchanges are expected to connect with international exchanges to ensure liquidity and competitiveness.

Unlocking the Potential: Removing Barriers to Foreign Investment in the Stock Market

Introducing a transformative initiative: the proposal to abolish the regulation permitting general shareholder meetings to lower foreign ownership ratios below the statutory limit. This move empowers shareholders, fostering a dynamic and inclusive business environment. By removing this regulation, we unlock the potential for greater foreign investment, driving innovation and growth.

The Crypto Investor’s Guide to Navigating the New Regulatory Landscape: Unlocking Opportunities Post-Resolution 05.

Investing in cryptocurrencies is a risky business, especially when done on an illegal platform. Investors who engage in such activities may face stiff financial penalties or even criminal prosecution.