US Dollar (USD). (Photo: Getty Images)

|

On September 10, the exchange rate of the Vietnamese Dong (VND) against the US Dollar (USD) and Chinese Yuan (CNY) at banks reversed course and declined.

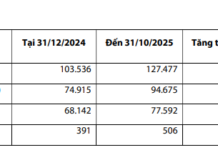

Specifically, the central exchange rate set by the State Bank of Vietnam stood at 25,221 VND per USD on September 10, down 15 VND from the previous day.

With the permitted trading band of +/- 5%, the ceiling and floor rates applicable for the day are 26,482 VND/USD and 23,959 VND/USD, respectively.

At the State Bank’s foreign exchange trading arm, the buying and selling rates were quoted at 24,025 VND/USD and 26,447 VND/USD, respectively.

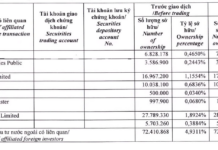

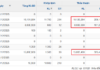

As of 8:25 am on the same day, Vietcombank and BIDV listed the buying rate for USD at 26,192 VND/USD and the selling rate at 26,482 VND/USD. Compared to the previous day, Vietcombank reduced its buying and selling rates by 25 VND and 15 VND, respectively, while BIDV lowered its buying and selling rates by 38 VND and 15 VND, respectively.

In contrast to the movement in USD rates, Vietcombank raised its buying and selling rates for CNY by 5 VND and 4 VND, respectively, quoting them at 3,647-3,763 VND/CNY. Conversely, BIDV decreased its buying rate by 1 VND but increased its selling rate by 2 VND, resulting in rates of 3,661-3,750 VND/CNY.

– 08:45, September 10, 2025

“Credit Growth and Inflation: The Vice Governor’s Perspective on Monetary Policy”

“Vice Governor Doan Thai Son cautioned that robust credit growth could lead to two significant ramifications. Firstly, banks would be compelled to ramp up their capital mobilization efforts, which might entail hiking up deposit rates and subsequently pushing up lending rates. Secondly, robust credit growth effectively translates to an increased money supply, exerting inflationary pressures over the long haul.”

The Art of Steering Through Interest Rates, Exchange Rates, and Gold Prices

Inflation has remained persistently above 3% for several months, with high credit growth, volatile exchange rates, and fluctuating gold prices exerting significant pressure. This dynamic situation calls for agile and proactive governance to effectively tackle these challenges.