This is the aftermath from 2022 when Ho Chi Minh City Foreign Trade and Investment Development Joint Stock Company (Fideco, HOSE: FDC) recorded a historic loss of nearly VND 198 billion after making provisions for doubtful accounts receivable.

As a state-owned enterprise established in the 1980s in Ho Chi Minh City, Fideco was entrusted with developing prime location projects, generating revenue of hundreds of billions of VND annually, with profits of up to several dozen billion VND, and even reaching hundreds of billions of VND in some years. However, since 2016, FDC has experienced unstable business performance, reporting losses for the first time. To generate profits and avoid consecutive years of losses (which could lead to stock warnings, or forced delisting), FDC had to rely largely on project transfers and sales of subsidiaries.

| FDC’s interspersed years of profits and losses |

Specifically, in 2017, FDC avoided losses by transferring its entire 93.4% stake in Thong Duc JSC to Luc Yen Investment and Development JSC – a company related to a non-controlling shareholder of FDC. With a cost of over VND 212 billion, FDC recognized a profit of VND 11 billion. Thong Duc JSC was the investor of the La Sapinette Hotel Da Lat commercial center and hotel project at 1 Phan Chu Trinh, Ward 9, Da Lat (former), Lam Dong province.

| It is also worth noting that when selling Investment Phuc Thinh Duc to Dệt may Lien Phuong, FDC did not immediately receive the payment but instead recorded it as accounts receivable (short-term from customers), amounting to over VND 261 billion by the end of 2019. |

In 2019, FDC made a profit of VND 66 billion after a heavy loss in 2018 thanks to the divestment of its entire 95% stake in Phuc Thinh Duc Investment JSC to Lien Phuong Garment JSC. The total value of the transfer was over VND 261 billion, and FDC recorded financial income of over VND 69 billion in its financial statements. Phuc Thinh Duc Investment JSC was the investor of the TDH – Phuc Thinh apartment building in Phuoc Long A ward, District 9 (former), Ho Chi Minh City.

A similar scenario played out in 2021, when FDC fortuitously turned a profit thanks to financial revenue of nearly VND 68 billion from the transfer of its subsidiary. Specifically, in the middle of the year, FDC completed the transfer of Thong Duc’s shares to its partner, recording a profit of over VND 29 billion in financial revenue. In mid-December 2021, FDC also managed to divest its entire capital in Bach Kinh Production and Trading JSC, recording a profit of VND 29.5 billion. However, the buyer, Med Tech An An Joint Stock Company (a company with the same key member) did not make immediate payment but instead “committed to payment”, and this was guaranteed by Mr. Tran Bao Toan (Swiss nationality) – Chairman and General Director of Med Tech An An. The amount to be paid by this enterprise was recorded by FDC as nearly VND 119 billion in “other short-term receivables” and VND 40 billion in “short-term receivables from customers” as of the end of 2021. At the same time, FDC still had “short-term receivables from customers” from Lien Phuong of over VND 204 billion.

|

According to our understanding, the N&T Tower high-rise apartment project on Vo Van Kiet Street in 2022 was acquired by Haxaco Joint Stock Company (HOSE: HAX). HAX bought the land from N&T Investment Joint Stock Company and Mr. Bui Trung Quan (co-founder and General Director of N&T) for a maximum price of VND 470 billion. Currently, HAX is offering the land for sale at a price of no less than VND 1,131 billion. As for the Son My beach resort – villa and golf course project, the People’s Committee of Binh Thuan province granted the investment license to Son My JSC at the end of 2006. This enterprise has gone through numerous ownership changes, with Mr. Pham Van Meo, Vice Chairman and General Director of Tan Dai Hung Plastic JSC, serving as its General Director at one point. The company also once sold 55.696% of its capital to the Korean investor Daewon Cantavil Pte.Ltd. in mid-2022, only to later transfer it back to domestic investors. |

In 2022, FDC incurred a record loss of VND 198 billion. This was a consequence of recording “short-term receivables from customers” for Lien Phuong, but in reality, the amount was uncollectible, forcing the Company to make provisions of over VND 199 billion. As a result, management expenses soared to over VND 214 billion, leading to FDC‘s massive loss.

As for the receivables from Med Tech An An, FDC wiped them off the books by offsetting them against the debt in the capital transfer agreement.

In this year, FDC contributed VND 280 billion to cooperate with Hung Vuong Ben Luc JSC in investing in a project on land in Thanh Phu commune, Ben Luc district, Long An province (former).

Capital mobilization plan to expand the project

At the 2022 Annual General Meeting of Shareholders, in addition to the private offering of 157.1 million shares, FDC also planned to offer 77.2 million shares to existing shareholders at a price of VND 10,500/share to raise over VND 811 billion for investing in two projects, including: Son My beach resort – villa and golf course in Binh Thuan province (former), with a 5-year implementation period, an area of 182.2ha, and a total investment of VND 900 billion; and the N&T Tower high-rise apartment project on Vo Van Kiet Street, Tan Binh district (former), Ho Chi Minh City, with an area of over 8,909m2.

At the extraordinary general meeting of shareholders in mid-2022, FDC adjusted the plan for the private placement from 157.1 million shares to 47.6 million shares at a price of VND 10,500/share – half of the market price at that time. FDC expected to raise VND 500 billion and use VND 450 billion to cooperate with Leadgroup Residential Area Joint Stock Company in developing the Leadgroup residential area and resettlement project with an area of over 33.6ha in Long An, with a total investment of VND 500 billion; and over VND 50 billion to build the Company’s office building.

Moreover, Fideco also intended to issue VND 1,500 billion worth of non-convertible bonds with no warrants, with a term of 5 years, to buy back and invest in the project in Ben Luc, Long An.

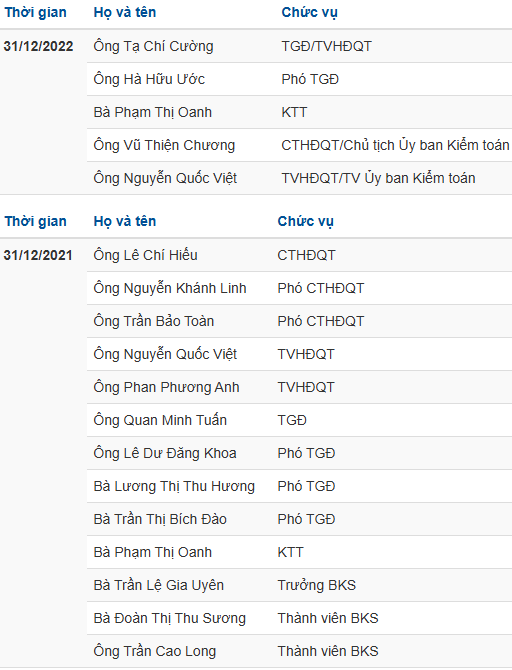

Changes in the management board

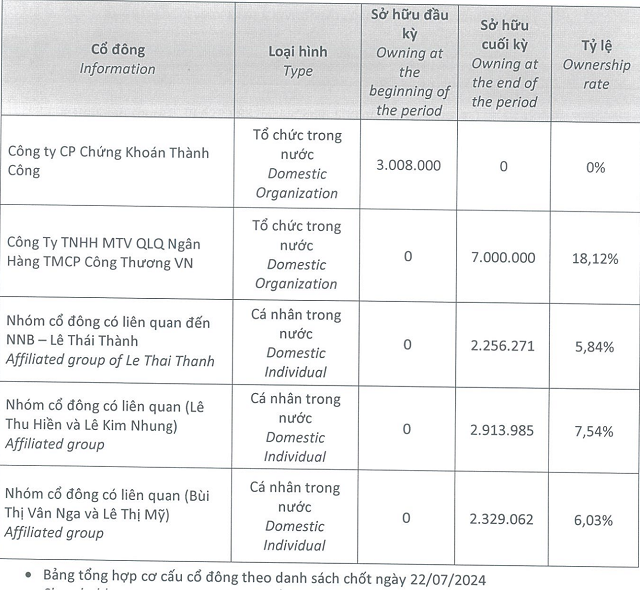

2022 also marked a period of leadership changes for FDC after its management board was prosecuted in a case related to Thuduc House (HOSE: TDH). Having once held up to 43% of FDC‘s capital, TDH completely divested in 2021. Taking its place was the group of Thanh Cong Securities Joint Stock Company (HOSE: TCI) and some other individual investors who kept a low profile.

|

FDC’s Board of Directors and Management

Source: VietstockFinance

|

In 2022, Mr. Vu Thien Chuong, born in 1981 and a native of Nam Dinh province, assumed the role of Chairman of the 30-year-old Ho Chi Minh City-based real estate company. Mr. Chuong had experience working as a project manager and workshop supervisor, and notably, he did not hold any shares in FDC. Meanwhile, Mr. Ta Chi Cuong, born in 1981 and a native of Phu Tho province, took on the role of General Director; he is the Chairman of the Board of Directors of Techhaus Vietnam Joint Stock Company and a Member of the Board of Directors and General Director of Bach Phu Thinh Joint Stock Company.

This management team remained stable for only two years. In 2024, with the reason of term expiration, the key positions were replaced. Around this time, TCI was no longer a major shareholder of FDC. Mr. Nguyen Quoc Viet, Vice Chairman of the Board of Directors of TCI, also divested his entire FDC holdings.

In contrast, VietinBank Capital Joint Stock Company quickly purchased shares to increase its ownership in FDC to 18.12% (7 million shares) by the end of November 2024. However, on September 9, this Fund also announced its complete divestment from FDC. On this day, nearly 14.3 million shares, equivalent to more than 37% of FDC‘s capital, were transferred through a matched transaction.

Ms. Nguyen Thi Mai Anh, a low-profile female entrepreneur born in 1982 and a native of Hai Phong, was nominated by a group of shareholders holding 11.31% of the capital and was elected as Chairman of the Board of Directors at the 2024 Annual General Meeting of Shareholders. She continues to hold this position until the present term.

FDC’s Board of Directors elected at the 2025 Annual General Meeting of Shareholders, from left to right: Ms. Nguyen Thi Mai Anh (nominated by 2 shareholders holding 18.93% of the capital) – Chairman of the Board, Mr. Tran Ngoc Dat (nominated by 4 shareholders holding 12.26% of the capital) – Member of the Board, Mr. Ho Anh Tuan (nominated by 3 shareholders holding 12.76% of the capital) – Member of the Board and General Director, Ms. Nguyen Thi Thuy Nga (nominated by 3 shareholders holding 14.03% of the capital) – Member of the Board, and Mr. Ha Huu Uoc – Deputy General Director.

|

Source: FDC

|

“If at first you don’t succeed, try, try again”

On April 5, 2023, HOSE officially placed FDC stock on the warning list, as the undistributed post-tax profit at December 31, 2022, on the audited 2022 financial statements was negative, amounting to nearly VND 193 billion.

In 2023, FDC achieved a meager post-tax profit of VND 724 million. In 2024, the profit of over VND 5 billion was still insufficient to help FDC eliminate the accumulated loss.

After the failure to mobilize thousands of billions of VND in 2022, three years later, at the 2025 Annual General Meeting of Shareholders, FDC proposed to issue a maximum of 38 million shares to professional securities investors at a price of VND 10,000/share. FDC plans to use VND 370 billion to invest in the Long Hoa residential area project in Can Gio district (former) and other real estate projects where the Company is the investor or in a joint venture/association; and VND 10 billion to supplement the Company’s business capital.

FDC’s business plan for 2025 sets a revenue target of VND 73.5 billion and a post-tax profit of nearly VND 40.5 billion.

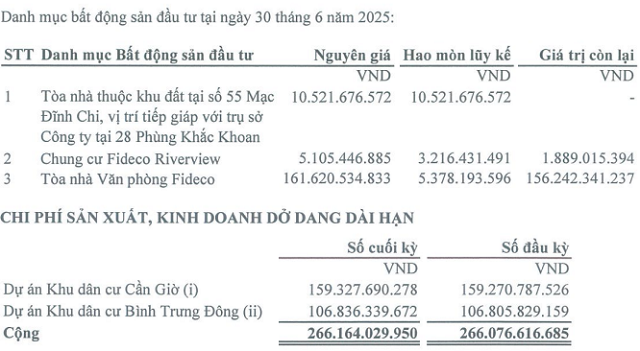

Thanks to the rental income from the office building at 28 Phung Khac Khoan, Tan Dinh, Ho Chi Minh City, FDC achieved a post-tax profit of over VND 22 billion in the first half of this year.

Source: FDC

|

FDC’s current real estate investment portfolio includes 5 projects, all located in Ho Chi Minh City. Among them is the 29.8ha residential area project in Can Gio district, in which the Company is the investor and cooperates with SVC. There is also the 136.9ha residential area project in Binh Trung ward, in which the Company partners with 14 other units.

The provision for the receivables from Lien Phuong remains at VND 199 billion, along with FDC’s capital contribution of VND 280 billion to the project in Ben Luc, Long An, in cooperation with Hung Vuong Ben Luc JSC.

Additionally, in January 2025, FDC contributed over VND 107 billion under a cooperation contract with Tan Thai Binh Duong Urban Development and Construction Investment Joint Stock Company to develop a project in Quang Ngai province. The contract duration is 48 months from the signing date. After the investment and construction phase, the parties will agree on the costs to determine profit-sharing.

– 08:58 12/09/2025

“Sunbay Ninh Thuận: A Troubled Resort’s Financial Woes Persist with a Staggering First-Half Loss of VND 290 Billion”

The first half of 2025 saw Sunbay Ninh Thuan JSC (SBPC) plunge into a staggering loss of nearly VND 290 billion, marking yet another period of relentless losses for the company. This persistent streak of unprofitability dates back to 2021 when the enterprise first started disclosing its financial reports on HNX, and profitability remains elusive.

“Devastating Losses for TTC Phu Quoc: A Grueling First Half with a Staggering $150 Million Deficit, Erasing Four Years’ Worth of Profits”

The first half of 2025 saw a surprising turn of events for Toàn Hải Vân (TTC Phú Quốc, THVC), as the company reported a record loss of nearly VND 150 billion. This stark contrast to the previous year’s profits of VND 21 billion during the same period wiped out the cumulative gains of the four years from 2021 to 2024, which totaled just under VND 64 billion.