The Vietnamese stock market ended the week on a positive note, with the VN-Index gaining over 9.5 points to close at 1,667.26. While liquidity on HoSE decreased, with a matching value of approximately VND 28,900 billion, it was a vibrant session after the “roller coaster” session.

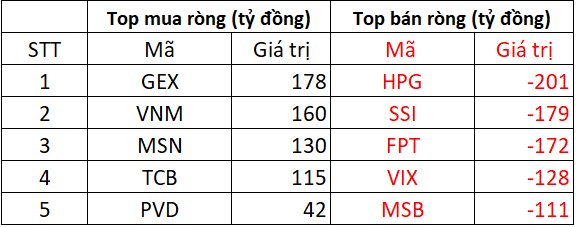

Foreign transactions continued to be a downside, with a total net sell of VND 1,196 billion in this session. Specifically:

On HoSE, foreign investors net sold about VND 1,145 billion

In the buying side, GEX was the most net bought stock in the market with a value of VND 178 billion. Following that, a series of stocks were net bought over a hundred billion VND each: VNM (+160 billion), MSN (+130 billion), and TCB (+115 billion). PVD was also net bought for about VND 42 billion.

On the opposite side, foreign investors heavily sold HPG shares, with a net sell value of about VND 201 billion. In addition, SSI, FPT, VIX, and MSB were net sold from VND 111 billion to VND 179 billion.

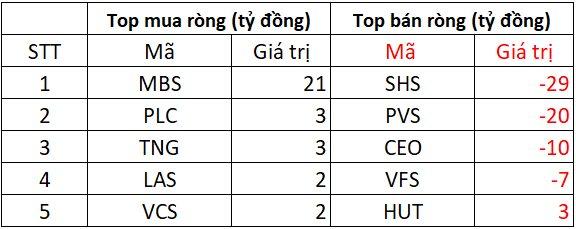

On HNX, foreign investors net sold about VND 40 billion

MBS was the most net bought stock on the HNX floor, with a value of about VND 21 billion. Following that, PLC, TNG, LAS, and VCS were net bought in this session with values ranging from VND 2 billion to VND 3 billion.

On the selling side, SHS and PVS were heavily net sold, respectively, VND 29 billion and VND 20 billion. In addition, CEO, VFS, and HUT were also net sold from VND 3 billion to VND 10 billion.

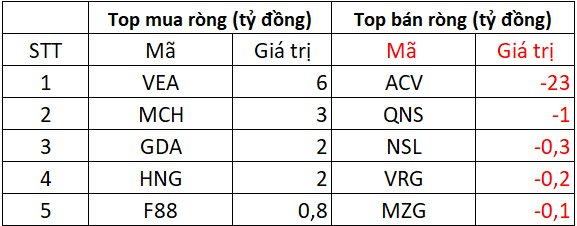

On UPCOM, foreign investors net sold about VND 11 billion

In terms of net bought value, VEA led with VND 6 billion. Following that, MCH, GDA, HNG, and F88 were net bought from a few hundred million to a few billion VND.

On the contrary, ACV was heavily net sold with a value of VND 23 billion, while QNS, NSL, and VRG were net sold from a few hundred million to VND 1 billion.

Searefico (SRF): Post-Review Profits Soar by 76%, but HOSE Delisting Looms

Let me know if you would like me to provide any additional revisions or if you have another writing task for me!

The audited consolidated financial statements for the first half of 2025 of Searefico Joint Stock Company (HOSE: SRF) revealed a remarkable 75.58% surge in post-tax profits compared to their self-prepared reports.

What’s Next for the VN-Index After Reaching All-Time Highs?

“With a harmonious blend of robust profit growth and a still-reasonable price-to-earnings ratio, the VN-Index has the potential to soar beyond the 1,700-1,800 level,” asserted the expert.