The Flying Dutchman: Exploring Vietnam’s Evolving Investment Landscape

Overcoming the Final Hurdles: Vietnam’s Journey to Market Upgrade

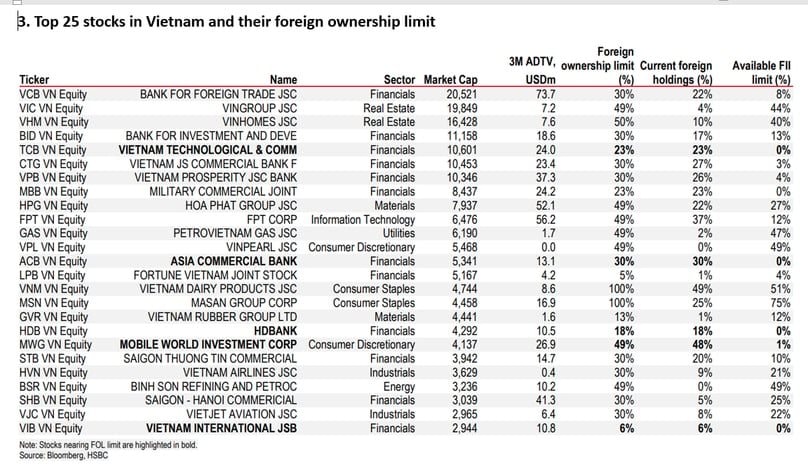

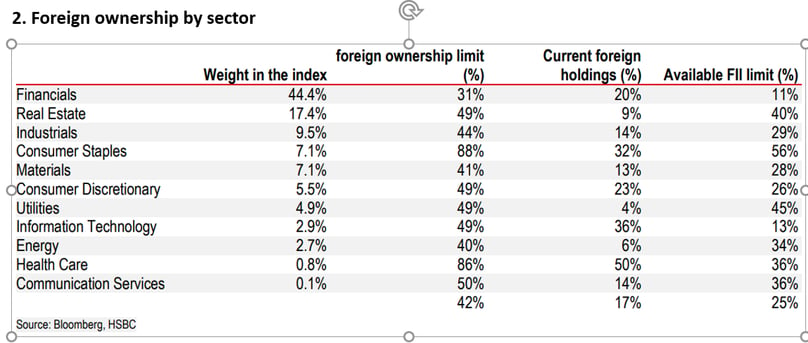

In their latest report, “The Flying Dutchman – Vietnam’s changing frontier”, HSBC analysts identified two remaining obstacles that are holding Vietnam back from a market upgrade: foreign ownership limits (FOL) and pre-funding requirements. These issues are hindering the country’s progress and keeping it at a “Restricted” rating.

Among the 25 largest-cap stocks on the Vietnamese stock market, many leading bank and retail stocks like TCB (0% room), VIB (0%), and MWG (1%) offer limited investment opportunities for foreign investors. This significantly restricts their options for large-scale investments. Other stocks like VCB (8% room), BID (13%), CTG (3%), VPB (4%), LPB (4%), STB (10%), and FPT (12%) also have limited room for foreign investment.

The issue is particularly acute in the financial sector, which accounts for

44.4%

of the VN-Index weight but has only about

11%

of foreign room left.

Source: HSBC

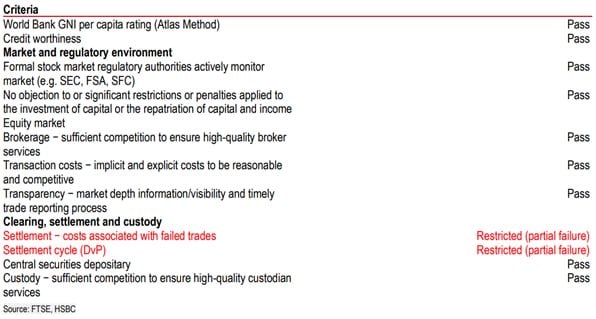

The second obstacle relates to the settlement process. The requirement for investors to pre-fund 100% of their trades goes against international norms for Delivery versus Payment (DvP), where the transfer of securities and payment occur simultaneously. This is considered the biggest operational hurdle for global financial institutions.

Source: HSBC

Forecasting Capital Inflows: A Multi-Billion Dollar Opportunity

A market upgrade will unlock two main sources of foreign capital: passive and active. Passive capital from ETF funds tracking the FTSE EM index is expected to bring in approximately

$1.5 billion

with an initial weight of 0.5%.

However, the larger potential lies with active funds. In an optimistic scenario, the total inflows from both sources could reach up to

$10.4 billion

. This capital will not be spread evenly but will target stocks that meet three core criteria: large market capitalization, high liquidity, and sufficient room for foreign investment.

The most direct beneficiaries will be leading companies with significant room for foreign investment. These include large-cap stocks like Hoa Phat (HPG) with 27% room, Vingroup (VIC) with 44%, Vinhomes (VHM) with 40%, and especially Masan (MSN) with 75% room for foreign investment.

The biggest wildcard lies with private banks that have self-imposed foreign ownership limits, such as TCB and VIB. If new regulations force them to reopen their room, they could become real magnets for foreign capital, potentially changing the dynamics of capital flows.

HSBC maintains a positive outlook on Vietnam’s market upgrade prospects. They state:

”

We believe that developments on the two criteria – the Securities Law and the launch of the KRX trading system – are bringing Vietnam closer to an upgrade.”

However, they also offer a word of caution:

“While we are in the optimistic camp, we note that FTSE also consults investors and brokers before making a final decision,”

HSBC adds. This highlights that, alongside technical reforms, feedback from market participants will be a crucial factor.

Vietnam’s Progress: 7 out of 9 Criteria Met

Source: HSBC

HSBC’s optimism is rooted in Vietnam’s achievement of 7 out of 9 criteria set by FTSE Russell, recognizing the country’s persistent reform efforts to create a reliable investment environment.

Firstly, Vietnam has passed fundamental tests on

legal and macroeconomic frameworks

. By meeting the criteria on GNI per capita and sovereign credit ratings, Vietnam has established a foundation of trust. Additionally, the presence of an effective market regulator and the commitment to not restrict the repatriation of investment capital and profits are key to retaining long-term capital.

Secondly, there have been remarkable improvements in the

trading environment

. The market is recognized to have sufficient competition among securities companies to ensure reasonable service quality and fees. Notably, the transparency criterion has been fulfilled, indicating timely disclosure of market depth and trading data, partly thanks to the stability of the KRX trading system.

Lastly, the

post-trade infrastructure

, which is the backbone of investor asset protection, has met the required standards. The presence of the Vietnam Securities Depository (VSDC) and competitive custodian banks provides international financial institutions with confidence in holding assets in Vietnam.

Learning from International Experiences: Managing Expectations and Facing Reality

Historical market upgrades around the world show that this is not a “silver bullet” for sustainable growth. Experiences from other countries have demonstrated the “buy the rumor, sell the news” psychological effect.

Pakistan’s Stock Index After Market Upgrade – Source: Bloomberg

The cases of

UAE and Qatar (upgraded in 2014)

illustrate this dynamic, as their markets surged before the event but quickly corrected afterward. Notably, this upswing was significantly boosted by the context of oil prices above $100 per barrel. Similarly,

Pakistan (upgraded in 2017)

witnessed its market peak at the time of the upgrade, followed by a prolonged downward cycle, partly due to underlying economic issues.

The most significant difference between Vietnam and these cases is that our market has already “run ahead” with a

40%

increase since the beginning of the year. This implies a considerably higher risk of adjustment once the official announcement is made, requiring investors to maintain a cool-headed approach. The most important lesson is that long-term growth depends on the health of the domestic economy and corporate profits, as foreign capital will not flow in blindly if fundamental issues arise.

“State Bank: CIC does not expose customer account numbers, deposit balances, or CVV codes”

The State Bank of Vietnam (SBV) has received a report from the Vietnam Credit Information Center (CIC) regarding an incident related to credit information at the CIC. The SBV has promptly directed the CIC to report and closely coordinate with relevant state authorities to investigate and address the issue, while also ensuring the continuous and smooth operation of the CIC.

“THACO and South Korean Giant Join Forces for Urban Railway Development”

“THACO (THA) is proud to announce its proposal for a strategic partnership with Hyundai Rotem, Korea’s leading mechanical engineering conglomerate. With a shared vision for innovation and excellence, the collaboration aims to revolutionize Vietnam’s transportation landscape by developing a high-speed rail system. Through this partnership, THACO aims to harness Hyundai Rotem’s expertise in technology transfer, skill development, and localization of production to create a world-class transportation network that will drive Vietnam’s economic growth and connectivity.”

Today, September 8: Gold Ring and SJC Gold Prices Drop Sharply

The relentless rally in gold prices has finally taken a breather, with gold rings and SJC gold witnessing a unanimous decline today.

The Rice Exporters’ Capital Conundrum

In the first eight months of the year, Vietnam exported nearly 5.9 million tons of rice, valued at $3 billion. Despite this impressive performance, the Vietnam Food Association highlights the challenges faced by rice exporters, particularly in accessing credit and collateral-free loans, as well as low credit limits.