Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 1 billion shares, equivalent to a value of more than 30.3 trillion VND; HNX-Index reached over 88.8 million shares, equivalent to a value of more than 2.1 trillion VND.

VN-Index opened the afternoon session quite favorably with buyers continuing to dominate, pushing the index up sharply despite sellers reappearing at the end of the session. In terms of impact, VIC, HPG, MSN, and VNM were the most positive influences on the VN-Index, with an increase of over 5.6 points. On the other hand, VPB, VHM, SSB, and SSI were still under selling pressure, taking away 2.1 points from the overall index.

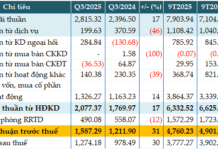

| Top 10 stocks with the strongest impact on the VN-Index on September 12, 2025 (in points) |

Similarly, the HNX-Index also had a rather optimistic performance, with positive influences from stocks such as PVS (+3.51%), KSV (+1.32%), NTP (+3.34%), and NVB (+2%)…

|

Source: VietstockFinance

|

At the close, the materials sector was the best-performing group in the market, with a gain of 2.18%, mainly driven by stocks such as HPG (+2.92%), GVR (+2.09%), DGC (+0.52%), and KSV (+1.32%). Following the recovery were the consumer staples and industrial sectors, with increases of 1.81% and 1.48%, respectively. On the other hand, the information technology sector recorded the most significant decline in the market, falling by 0.2%, mainly due to FPT (-0.39%) and CMT (-0.7%).

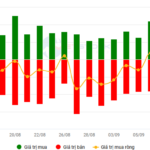

In terms of foreign trading, they continued to be net sellers on the HOSE exchange, with a net sell value of more than 1,137 billion VND, focusing on stocks such as HPG (197.91 billion VND), SSI (179.49 billion VND), FPT (171.86 billion VND), and VIX (127.15 billion VND). On the HNX exchange, foreign investors net sold more than 39 billion VND, focusing on SHS (29.23 billion VND), PVS (19.54 billion VND), IDC (9.94 billion VND), and VFS (7.18 billion VND).

| Foreign Trading – Net Buy/Sell |

Morning Session: Fluctuating around the 1,662-point level, foreign investors heavily sold HPG

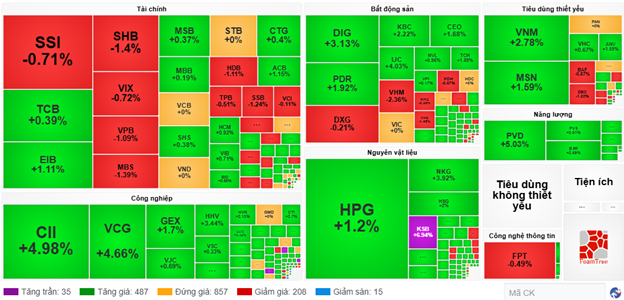

VN-Index fluctuated around the 1,662-point level in the late morning session. At the midday break, the VN-Index increased by 3.75 points (+0.23%), reaching 1,661.5 points; HNX-Index rose by 0.62%, reaching 275.87 points. The market breadth witnessed 522 gainers, 223 losers, and 857 unchanged stocks.

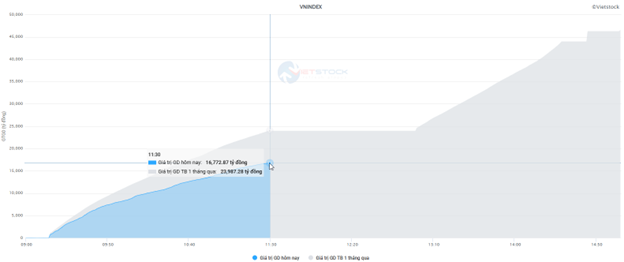

Market liquidity has not shown signs of improvement this morning. The trading value of the HOSE reached over 16 trillion VND, a decrease of 30% compared to the 1-month average. HNX also recorded a volume of over 51 million units, equivalent to more than 1.2 trillion VND.

Source: VietstockFinance

|

In the top 10 stocks influencing the VN-Index, VHM was the most negative stock, taking away 2.3 points from the index. In contrast, VNM, BID, and HPG were the most positive contributors, bringing in a total of over 2 points.

Considering the sector performance, green dominated most industry groups. The energy sector temporarily led the market in the morning session with positive contributions from stocks such as BSR (+2.59%), PLX (+1.13%), PVS (+3.51%), PVD (+5.03%), OIL (+5.26%), PVT (+1.96%), and PVC (+3.36%).

Moreover, the materials and industrial sectors also witnessed active trading as buying interest concentrated on stocks like KSB, which hit the ceiling price, HPG (+1.2%), NKG (+3.92%), HSG (+2%), GVR (+1.39%); CII (+4.98%), VCG (+4.66%), GEX (+1.7%), GEE (+2.88%), and HHV (+3.44%).

On the other hand, the real estate and information technology sectors remained subdued as selling pressure dominated large-cap stocks in these industries, including VHM (-2.36%), VRE (-1.45%), BCM (-0.74%), KDH (-0.57%); FPT (-0.49%). In the financial sector, although the overall index remained in positive territory thanks to gains in stocks such as BID (+0.98%), ACB (+1.15%), EIB (+1.11%), and BVH (+1.21%), several stocks experienced notable corrections, including VPB (-1.09%), LPB (-0.91%), HDB (-1.11%), SSB (-1.24%), and SHB (-1.4%).

Source: VietstockFinance

|

Foreign investors continued to be net sellers, with a net sell value of over 971 billion VND on the three exchanges. The selling pressure was mainly on HPG, with a net sell value of 301.77 billion VND. Meanwhile, VNM and TCB were the top net bought stocks, with net buy values of 119.41 billion VND and 94.37 billion VND, respectively.

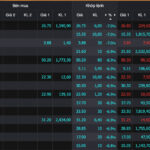

| Top 10 stocks net bought/sold by foreign investors in the morning session of September 12, 2025 |

10:35 am: Financial sector diverged, VN-Index fluctuated around the reference level

Selling pressure increased, causing the main indices to reverse sharply. As of 10:30 am, the VN-Index rose 1.46 points, trading around 1,659 points. The HNX-Index gained 1.76 points, trading around 275 points.

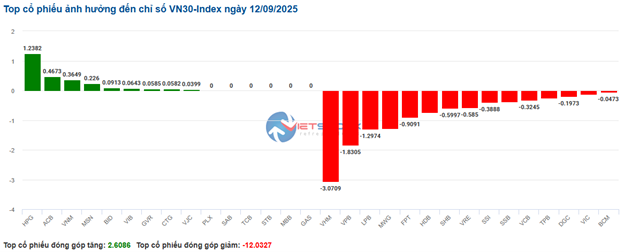

HPG, ACB, and VNM were the three representative stocks that positively impacted the VN30 index, contributing 1.23 points, 0.46 points, and 0.36 points, respectively. Conversely, the group of stocks, including VHM, VPB, LPB, and MWG, faced strong selling pressure, respectively taking away 3.07 points, 1.83 points, 1.29 points, and 1.27 points from the overall index.

Source: VietstockFinance

|

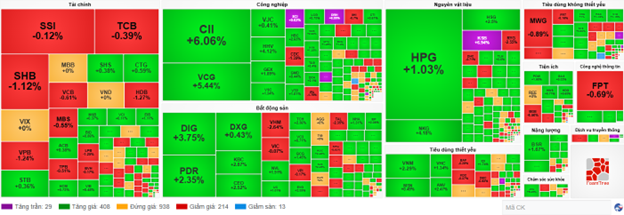

Selling pressure reappeared in the financial sector, causing it to diverge significantly, with most financial stocks trading in negative territory. Specifically, VCB fell by 1.07%, TCB declined by more than 0.13%, VPB dropped by 1.71%, LPB decreased by 1.48%, and SSI slipped by 0.71%….

However, the overall market uptrend was supported by the industrial and materials sectors, which rose by 0.75% and 0.9%, respectively. Within these sectors, buying interest concentrated on mid-cap stocks such as CII, which surged by 6.06%, VCG climbing by 5.44%, HHV advancing by 3.78%, HPG increasing by 1.03%, HSG rising by 2.5%, and NKG gaining by 4.18%.

Compared to the opening, the market witnessed slight divergence, mainly in the financial sector, but overall, buyers continued to dominate with over 400 stocks in the green and around 200 stocks in the red.

Source: VietstockFinance

|

Opening: Steel stocks surged at the beginning of the session

After the previous session’s gains, the VN-Index opened the morning session in positive territory, mainly driven by the financial sector.

Among financial stocks, banks and securities firms started the day in the green, with MBB rising by 0.56%, ACB and SSI increasing by 0.76% and 0.35%, respectively. Additionally, VCB gained 0.15%, BID climbed by nearly 0.74%, TCB advanced by 0.26%, and others, contributing significantly to the index’s rise.

Furthermore, steel stocks witnessed a strong surge from the opening bell, with HPG soaring by 2.23%, NKG jumping by 4.44%, and HSG rising by 3%.

In contrast, information technology stocks opened on a weak note, with FPT and ELC declining by 0.39% and 0.69%, respectively, significantly impacting the sector’s performance. The remaining stocks in this group mostly traded around the reference level, except for a few gainers, including CMG, which rose by 0.5%, DLG climbing by 1.75%, and POT surging by 5.56%.

Overall, the market opened on a positive note, with most sectors trading in positive territory, notably materials, financials, consumer staples, energy, etc.

– 15:25 September 12, 2025

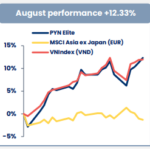

Stock Market Week Sept 08-12, 2025: The Roaring Comeback

The VN-Index extended its gains in the final session of the week, recovering all losses incurred during the week’s initial downturn with four consecutive rebound sessions. While the index staged a strong comeback, trading volume remained below the 20-day average, and persistent net selling pressure from foreign investors remains a concern in the near term.