|

Source: VietstockFinance

|

Financial stocks were the main driver of the late-session rally. Securities stocks witnessed a strong surge, with SSI climbing 4.5%, while VIX and SHS rose nearly 6%. VCI also gained 4.3%, making the sector one of the most positive influences on the stock market.

Large-cap stocks such as VIC, VHM, VPB, and TCB further bolstered the upward momentum. Additionally, aviation stocks (VJC and HVN) featured among the top 10 contributors to the VN-Index’s strong performance today.

On the flip side, VCB, LPB, and GAS exerted mild downward pressure on the index.

Despite the return of green across various sectors, materials stocks failed to rebound. Steel stocks remained predominantly in the red. HPG, NKG, HSG, SMC, and VGS all posted slight losses. Chemicals and fertilizers stocks also exhibited caution, with DCM, DPM, and DGC edging lower during the session.

Telecommunications stocks emerged as the worst-performing sector of the day, primarily due to the impact of VGI.

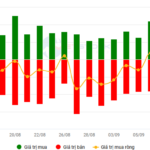

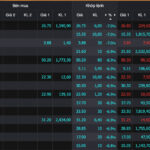

Foreign investors net sold nearly VND 1,000 billion in the session, with HPG accounting for nearly half of that amount (nearly VND 550 billion). Market liquidity was relatively thin compared to recent sessions, reaching nearly VND 35,000 billion.

| Top 10 stocks with the highest foreign net buying and selling in the session on September 9, 2025 |

Morning Session: Several sectors recover, but liquidity remains subdued

The VN-Index edged up 0.12 points to close the morning session at 1,624.65. The HNX-Index gained 2.11 points to reach 273.68.

The real estate sector witnessed a notable recovery, led by prominent stocks such as VIC, HDC, DXG, and CEO, which contributed to improving market conditions. Meanwhile, financial stocks continued their rebound, with TCB, VPB, SHS, SHB, and VCI rising between 1% and 2%, providing support to the indices.

DBC stood out in the consumer staples sector, climbing 5%.

On the other hand, industrial stocks regained their footing, with GEX, VJC, VCG, GMD, and HBC serving as the main pillars of the sector.

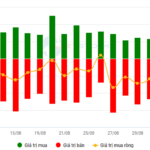

Liquidity remained subdued, indicating potential tug-of-war dynamics in the remaining trading hours. Foreign investors net sold over VND 770 billion, focusing on HPG (nearly VND 280 billion) and SSI (VND 190 billion).

| Foreign capital flow in recent sessions (up to the morning session of September 9) |

10:40 AM: Weak liquidity prevents market recovery

Liquidity showed a significant downward trend in the trading session on September 9. By 10:30 AM, the total trading value of the market stood at over VND 10,600 billion, roughly half of the previous day’s level.

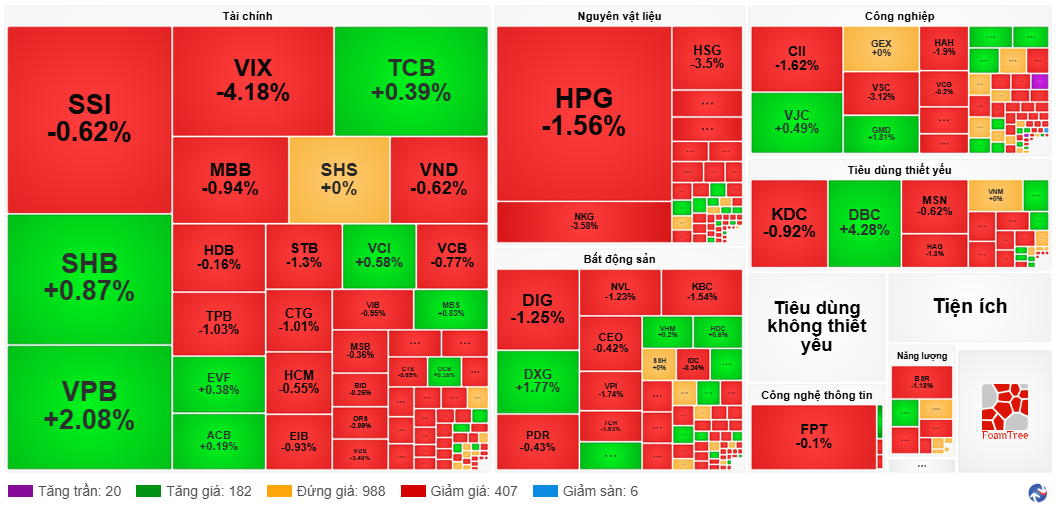

Lacking the support of strong liquidity, the indices exhibited more pronounced weakness, with the VN-Index sinking to lower lows during the session. At 10:30 AM, the index was down nearly 9 points, with nearly 400 declining stocks outweighing around 200 gainers.

In the financial sector, red dominated the landscape. However, several pillars managed to stay in positive territory, including SHB, VPB, TCB, VCI, and MBS, which posted modest gains to prevent a deeper sectoral decline. Moreover, the absence of significant losers in the sector alleviated some pressure on the market.

Materials stocks, particularly steel, remained mired in red territory. HPG, NKG, HSG, VGS, and others recorded losses ranging from 1% to 4%.

Market heatmap as of 10:45 AM. Source: VietstockFinance

|

VPB, VIC, and TCB were the main supporters of the VN-Index, collectively contributing nearly 3 points to the index. Conversely, VCB, HPG, LPB, CTG, and VIX were the most significant detractors, with VCB alone shaving off nearly 1 point from the HOSE benchmark.

Opening: Cautious sentiment persists

After two consecutive days of declines, the stock market displayed cautious sentiment, opening with modest gains and some back-and-forth movements on September 9. As of 9:20 AM, the VN-Index had climbed over 4 points to reach 1,628.81.

Green prevailed across most sectors in the initial minutes of the session.

However, caution soon returned, bringing selling pressure back into play. By 9:25 AM, numerous stocks had slipped below the reference level, and the market breadth turned negative, with nearly 200 gainers versus around 220 losers. Financials, real estate, materials, and information technology sectors uniformly turned red.

Stocks like CTG, LPB, VIX, HPG, FPT, and GVR exerted notable downward pressure on the VN-Index.

By 9:30 AM, the index confirmed the cautious sentiment by slipping nearly 4 points.

– 3:42 PM, September 9, 2025

Market Pulse, September 12: VN-Index Surges Nearly 10 Points Despite Foreign Outflows

The trading session concluded with significant gains, as the VN-Index rose by 9.51 points (+0.57%), closing at 1,667.26. Meanwhile, the HNX-Index also witnessed a notable increase of 2.33 points (+0.85%), ending the day at 276.51. The market breadth was strongly positive, with 581 advancing stocks against 216 declining ones. Similarly, the VN30 basket saw a slight edge for gainers, as 16 stocks climbed, 12 stocks dipped, and 2 stocks remained unchanged.

Cautious Optimism: Vietstock Daily’s Take on the Market Recovery

The VN-Index surged towards the end of the trading session, forming a prominent Hammer candlestick pattern. This indicates that the index remains firmly above the short-term trendline, which corresponds to the 1,615-1,625 range. However, a sharp decline in trading volume below the 20-session average suggests that investors are exercising caution. Meanwhile, the Stochastic Oscillator continues its downward trajectory after issuing a sell signal, departing from the overbought territory.

Stock Market Week Sept 08-12, 2025: The Roaring Comeback

The VN-Index extended its gains in the final session of the week, recovering all losses incurred during the week’s initial downturn with four consecutive rebound sessions. While the index staged a strong comeback, trading volume remained below the 20-day average, and persistent net selling pressure from foreign investors remains a concern in the near term.

The Stock Market Boom in Vietnam: PYN Elite Fund Reaps the Rewards

The PYN Elite investment fund from Finland has had a stellar performance this year, with four consecutive months of growth. With a remarkable 31.51% gain in the first eight months of 2025, the fund has outperformed its total gains for 2023 and 2024 combined (23.48%).