I. MARKET DEVELOPMENT OF WARRANTS

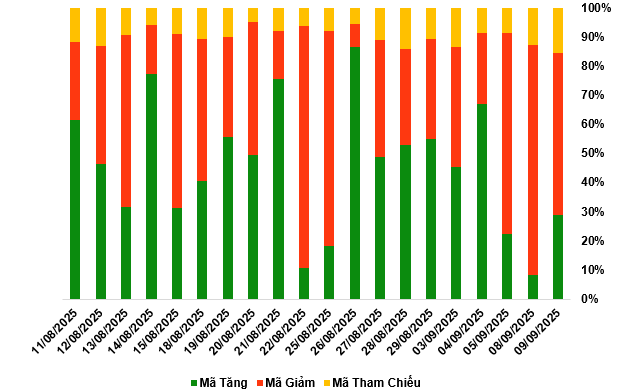

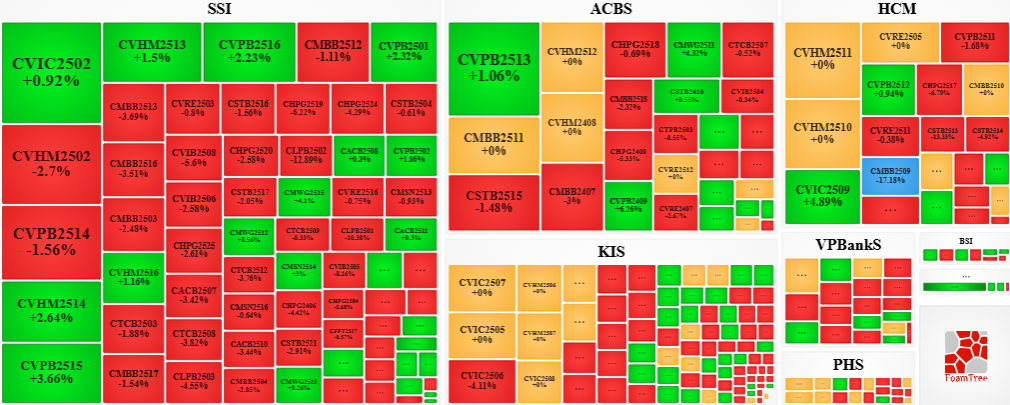

As of the close of the trading session on 09/09/2025, the market witnessed 75 advancing codes, 144 declining codes, and 40 reference codes.

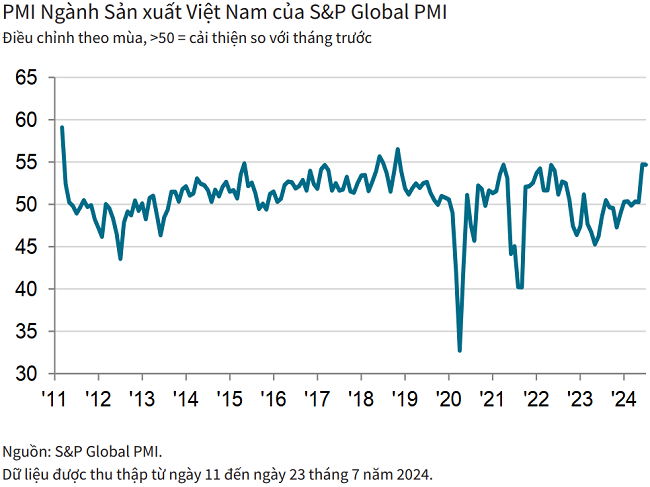

Market breadth over the last 20 sessions. Unit: Percentage

Source: VietstockFinance

In the trading session on 09/09/2025, sellers continued to lead the market, causing most of the warrant codes to decline in price. Specifically, the large-cap warrant codes in the declining group were CVHM2502, CVPB2514, CSTB2515, and CMBB2407.

Source: VietstockFinance

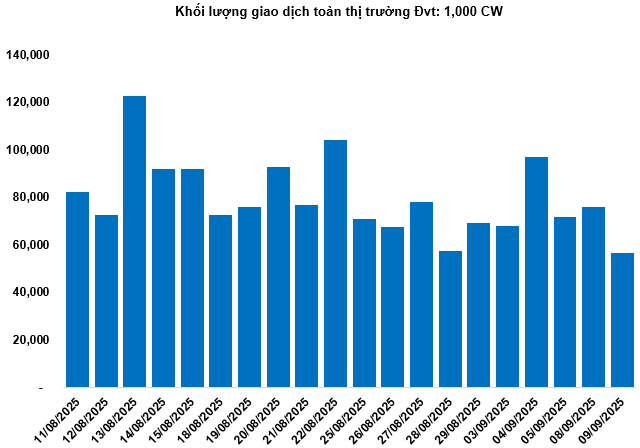

The total market volume in the 09/09 session reached 56.64 million CW, down 25.32%; the value of transactions reached VND 125.76 billion, down 36.42% compared to the previous session. Of which, CHPG2528 was the code leading the market in volume with 2.47 million CW; CMWG2511 led in value with VND 6.52 billion.

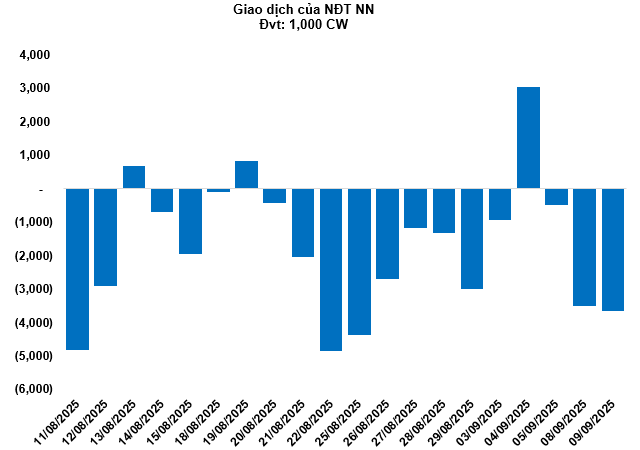

Foreign investors continued to sell a net in the 09/09 session with a total net selling volume of 3.65 million CW. In particular, CSTB2523 and CMSN2508 were the two codes that were net sold the most.

Securities companies SSI, ACBS, HCM, KIS, and VPBank are currently the organizations with the most warrant codes in the market.

Source: VietstockFinance

II. MARKET STATISTICS

Source: VietstockFinance

III. WARRANT VALUATION

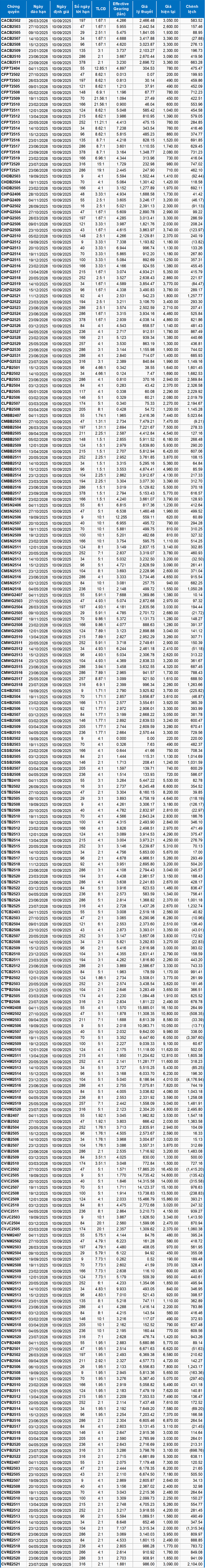

Based on the valuation method suitable for the initial period of 10/09/2025, the reasonable prices of the warrants currently traded in the market are as follows:

Source: VietstockFinance

Note: The opportunity cost in the valuation model is adjusted to suit the Vietnamese market. Specifically, the risk-free bill interest rate (government bills) will be replaced by the average deposit interest rate of large banks with term adjustments suitable for each type of warrant.

According to the above valuation, CVHM2515 and CVHM2508 are currently the two warrant codes with the most attractive valuations.

The higher the effective gearing ratio of a warrant code, the greater its increase/decrease relative to the underlying stock. Currently, CMSN2506 and CVNM2512 are the two warrant codes with the highest effective gearing ratios in the market.

Economic Analysis and Market Strategy Division, Vietstock Consulting Department

– 18:58 09/09/2025

The Stock Market Rally: Unlocking Profits for Open-End Funds

The VN-Index soared by almost 12% in August, with record-breaking liquidity. Several open-ended funds on Fmarket also witnessed impressive growth, outperforming the market with substantial profits, as the market buzzed with excitement.

What Stocks Usually Rise in the Last Month of Q3?

The VN-Index surpassed the 1,600-point milestone in an exhilarating August, but September brings a shift in sentiment as stocks trend downwards. This month poses a challenge for investors, with a cautious tone setting in.