Submit a report to the Prime Minister on the implementation of monetary policies by September 14, 2025.

|

The dispatch was sent to: Minister of Finance and Governor of the State Bank of Vietnam.

The dispatch states: To timely grasp the situation, assess the impact, and devise appropriate and effective management and administration solutions for the monetary market, gold market, and securities market, Deputy Prime Minister Ho Duc Phoc requests the Governor of the State Bank of Vietnam to report on the implementation of monetary policies, especially exchange rates, gold prices, interest rates, and real estate credit, along with proposing management solutions. The report should be submitted to the Prime Minister and Deputy Prime Minister Ho Duc Phoc before September 14, 2025. Based on this report, the Deputy Prime Minister will hold a meeting with the Governor of the State Bank of Vietnam, the Deputy Governor in charge, and relevant ministries and agencies on this matter.

At the same time, the Deputy Prime Minister requested the Minister of Finance to report on the securities market (stocks, derivatives, and bonds) and propose management solutions. The report should be submitted to the Prime Minister and Deputy Prime Minister Ho Duc Phoc before September 15, 2025. Subsequently, the Deputy Prime Minister will meet with the Minister of Finance, the Vice Minister in charge, and relevant ministries and agencies regarding this issue.

– 23:09, September 11, 2025

“Credit Growth and Inflation: The Vice Governor’s Perspective on Monetary Policy”

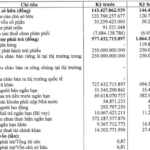

“Vice Governor Doan Thai Son cautioned that robust credit growth could lead to two significant ramifications. Firstly, banks would be compelled to ramp up their capital mobilization efforts, which might entail hiking up deposit rates and subsequently pushing up lending rates. Secondly, robust credit growth effectively translates to an increased money supply, exerting inflationary pressures over the long haul.”

Today, September 8: Gold Ring and SJC Gold Prices Drop Sharply

The relentless rally in gold prices has finally taken a breather, with gold rings and SJC gold witnessing a unanimous decline today.

The Golden Opportunity: Mapping the Route to a Vibrant Gold Exchange

Introducing the visionary initiative to revolutionize the gold trade in our nation: the proposal to establish a National Gold Exchange or enable gold trading on the Commodity Exchange, including the formation of a dedicated Gold Trading Floor. This ambitious endeavor aims to create a transformative platform that elevates the gold market to new heights, offering unparalleled opportunities for investors and traders alike. With a focus on innovation, transparency, and security, this exchange promises to be a game-changer, fostering a vibrant and robust gold trading ecosystem.

Unlocking Golden Opportunities: The Central Bank’s Imminent Move to Grant Gold Import and Bar Manufacturing Licenses to Businesses and Banks

The State Bank of Vietnam is expediting the release of guidelines for the implementation of Decree 232/2025/ND-CP. According to Vice Governor Pham Quang Dung, these guidelines will provide detailed instructions on the registration process for enterprises and commercial banks to obtain licenses for gold imports and gold bar production. The aim is to ensure a swift entry into the gold market for these entities.

iDepo VIB – Elevate Your Savings with Attractive Interest Rates and Flexible, Secure Digital Transfers

The iDepo from VIB International Bank is an innovative short-term savings solution, offering a competitive interest rate of up to 6.2% annually. What sets iDepo apart is its unique feature that allows you to withdraw your money early while still retaining the interest earned. This smart savings account ensures you have access to your funds whenever you need them, without sacrificing the benefits of a fixed-term deposit.