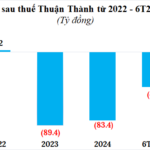

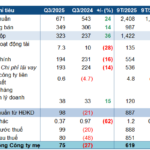

Investment and Development Company My Khanh (MKHC) announced its financial results for the first half of 2025, with a significant surge in profit after tax to over 595 billion VND, in contrast to a loss of nearly 157 billion VND in the same period last year.

This performance not only made up for the accumulated loss of more than 483 billion VND in 2023-2024 but also brought the undistributed profit after tax at the end of June to nearly 121 billion VND.

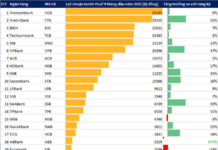

Source: Consolidated by the author

|

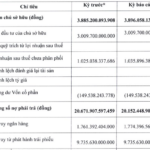

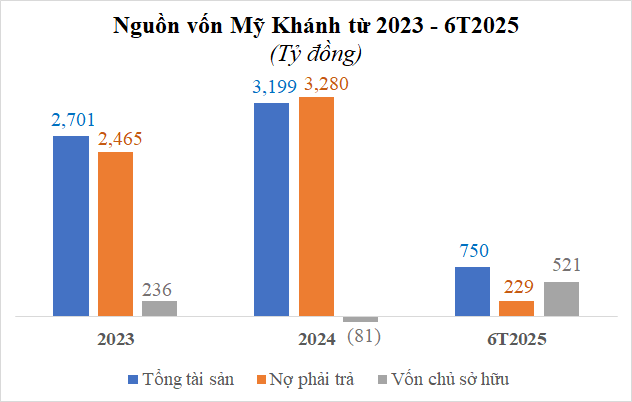

As of the end of June, MKHC’s total assets stood at nearly 750 billion VND, a decrease of 77% compared to the beginning of the year. Owners’ equity was nearly 521 billion VND, while payables decreased by 93% to over 229 billion VND, all of which were other payables, and notably, there was no longer any bond debt.

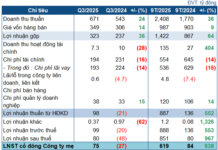

Source: Consolidated by the author

|

The turning point came with the decision to repurchase in advance all 2,245 billion VND of bonds with the code MKHCH2329001 on 04/28/2025. This was the only lot of bonds issued by Investment and Development My Khanh, offered on 06/30/2023 with a term of 72 months, maturing on 06/30/2029. The bonds had a par value of 100 million VND/bond and were repurchased at a price of nearly 125.5 million VND/bond, including interest. Thus, with 22,450 bonds, the Company spent a total of 2,816 billion VND to repurchase them all, thereby clearing its bond debt.

Investment and Development My Khanh was established in 2021 with an initial charter capital of 600 million VND, of which Mr. Tran Hai Nam held 67% and Mr. Pham Thanh Tung held 33%. After several changes in ownership structure, by mid-2023 (the time of bond issuance), the Company raised its capital to 400 billion VND, in which Investment Consulting Services Company VT held 96.7%, and Mr. Pham Bao Trung owned 3.3%. The current Director and legal representative is Mr. Tran Kien.

Investment Consulting Services Company VT was established in May 2016, initially named VT Energy Company Limited with a charter capital of 2 billion VND, of which Ms. Nguyen Thi Cuu Chi contributed 51% and Ms. Nguyen Thi To Quyen contributed 49%. Ms. Chi is the wife of Mr. Nguyen Thanh Lap, the founder of Tien Phuoc Real Estate Joint Stock Company (Tien Phuoc Group).

– 16:23 09/11/2025

“The Rise of Thaco Agri: A Billionaire’s Enterprise Soars with a Skyrocketing Net Worth of Over VND 67,000 Billion, Surpassing Becamex and Tripling HAGL.”

Thaco Agri reported a profit after tax of over 10 billion VND in 2024, a 75% decrease compared to the same period last year, when it posted a profit of nearly 42 billion VND. The company’s accumulated loss at the end of 2024 was nearly 1,316 billion VND.

“Heavily Indebted Investor: Goldmark City’s Liabilities Outstrip Equity by Over Five Times”

“Goldmark City’s developer, Dia Oc Viet Han, has announced a 42% drop in its half-yearly profit for 2025 compared to the previous year. The company’s total liabilities stand at 20,152 billion dong, a figure 5.17 times higher than its equity.”