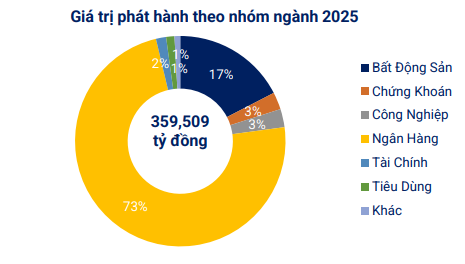

According to data aggregated by the Vietnam Bond Market Association (VBMA) from HNX and SSC (recorded based on bond issuance and buyback dates from HNX’s specialized page and subject to information disclosure on HNX), as of the information announcement on August 31, 2025, there were 37 private placements of bonds worth VND 39,357 billion and 6 public issuances worth VND 6,332 billion in August 2025.

Cumulatively, for the first eight months of the year, the value of private corporate bond issuances was VND 311,725 billion, and the value of public issuances was VND 47,785 billion.

Source: VBMA

On the other hand, in August, businesses repurchased VND 27,032 billion worth of bonds ahead of schedule, a 70% increase compared to the same period in 2024.

In the remaining four months of 2025, an estimated VND 69,740 billion worth of bonds will mature, with real estate bonds accounting for the majority at VND 29,883 billion, or 49%.

Regarding abnormal information disclosure, there were four bond codes with delayed interest and principal payments totaling VND 313 billion in August.

In the secondary market, the total trading value of private corporate bonds in August 2025 reached VND 109,288 billion, averaging VND 5,204 billion per session, a 9% decrease compared to the average in July.

Regarding future issuance plans, the Board of Directors of VNDirect Securities Joint Stock Company has approved a plan to issue private placement bonds in the third quarter of 2025 with a maximum total value of VND 250 billion. These are non-convertible bonds, without warrants, without collateral, and with an expected par value of VND 100 million per bond. The bonds have a term of 1 year with an interest rate of 7.5%/year.

In addition, the Board of Directors of Saigon-Hanoi Commercial Joint Stock Bank (SHB) has approved a plan to issue private placement bonds in the third quarter of 2025 with a maximum total value of VND 5,000 billion.

These are non-convertible bonds, without warrants, without collateral, and with an expected par value of VND 1 billion per bond. The bonds have a term of 7 years with a combination of fixed and floating interest rates.

In the primary market, in August 2025, the State Treasury held 18 auctions of government bonds with a total call value (TCV) of VND 48,000 billion, and a bid-to-cover ratio of 23.9%.

KBNN called for bids for 5-year, 7-year, 10-year, 15-year, 20-year, and 30-year maturities. Among these, the 10-year maturity accounted for 86.8% of the awarded value (AV), reaching VND 9,950 billion. The 5-year, 15-year, and 30-year maturities respectively won VND 350 billion (bid-to-cover ratio of 14%), VND 1,105 billion (9.6%), and VND 60 billion (3%). The average winning interest rate increased compared to the previous month.

The total value of government bonds issued through auctions in the first eight months of 2025 was nearly VND 238,714 billion, equivalent to 47.7% of the full-year plan (VND 500,000 billion). Of this, the value of government bonds issued in the third quarter reached 31.1% of the quarterly plan (VND 120,000 billion).

The average issuance term in August was 10.43 years, and the average winning interest rate was 3.37%/year.

“HAGL’s Subsidiary Reworks Bond Terms to Venture into Sericulture and Coffee Cultivation”

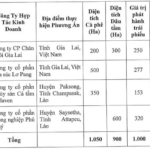

HGLC, a prominent agricultural enterprise majority-owned by Hoang Anh Gia Lai (HAGL), has refinanced its bond offering of 1,000 billion VND. This strategic move will redirect capital allocation towards an ambitious endeavor: expanding silkworm and coffee cultivation projects across Vietnam and Laos.

“Paris Baguette: A Tasty New Venture for the Founder of Highlands Coffee”

Paris Baguette, a delightful culinary gem, is owned by the renowned SPC Group, a leading food and confectionery conglomerate in South Korea. With a global revenue of approximately $5.7 billion in 2020, SPC Group has established itself as a powerhouse in the industry. Paris Baguette, a shining star in their portfolio, captivates patrons with its exquisite offerings.

“Faith and Aspiration: Meey Group’s IPO Journey”

As the Strategy Director of Meey Group, a pioneering proptech enterprise that has cemented its market leadership, Ms. Nguyen Ly Kieu Anh firmly believes, “There’s no room for regrets. The important thing is whether you want to do it or not.”