|

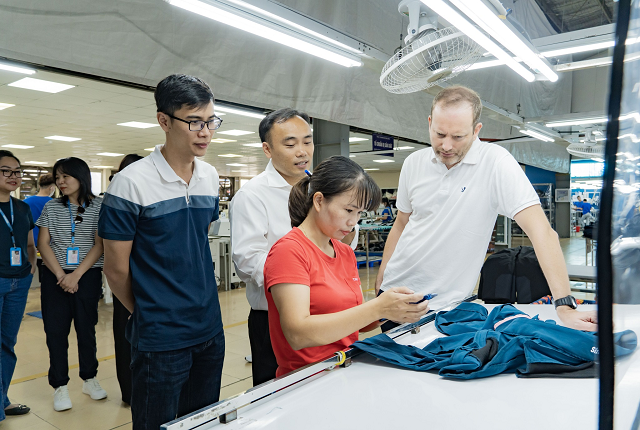

Inside SCL’s Fly Ash Factory – Illustrative image |

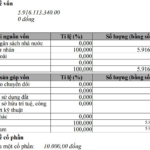

The Board of Directors of Song Da Cao Cuong has just approved a plan to offer 8 million shares to existing shareholders at a ratio of 28:10, meaning that for every 28 shares owned, shareholders will have the right to purchase 10 new shares. The issue price is VND 12,500 per share, and the shares will be freely transferable.

If the offering is successful, the Company’s charter capital will increase from nearly VND 224 billion to nearly VND 304 billion. Previously, in April 2025, SCL had raised capital to its current level by paying 2023 dividends in shares at a ratio of 20%.

The Company expects to raise about VND 100 billion from this offering. This amount will be used to repay loans and financial leases at BIDV – Bac Hai Duong Branch, with expected disbursement from Q4/2025 – Q1/2026.

SCL stated that it would prioritize repaying credit contract No. 02/2023/1605829/HDTĐ first, followed by contract No. 03/2023/1605829/HDTĐ. In case the mobilized capital is not enough, the Company will use other legitimate capital sources to ensure payment obligations.

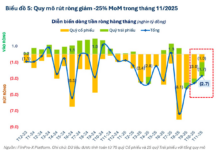

On the stock exchange, SCL shares traded around VND 23,200 per share on the morning of September 12, nearly double the offering price. However, the share price has fallen more than 23% in the past four months, from the 30,000 VND per share range in early May 2025. Compared to the historical peak of nearly VND 34,000 per share in May 2024, the market price is still more than 30% lower.

| SCL Share Price Movement from 2024 up to now |

|

|

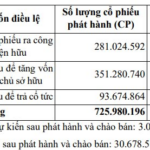

Record first-half 2025 results

Song Da Cao Cuong (SCL) operates in the field of mineral and building materials processing and owns a factory in Chi Linh, Hai Duong with a capacity of 400,000 tons of wet fly ash and 300,000 tons of dry fly ash per year, accounting for about 80% of the market share in the industry.

In the first half of 2025, the Company recorded revenue of VND 234 billion and net profit of VND 25 billion, both of which were the highest ever, up 6% and 25% over the same period last year, respectively. These results helped SCL achieve 31% of its revenue plan and 41% of its profit target for the year, thanks to the recovery of the real estate market and public investment.

| Business results for the first half of 2025 of SCL |

|

|

“Vietjet Completes Capital Increase to $246 Million, Expanding into Aircraft Maintenance and Repair”

On August 19th, Vietjet inaugurated its state-of-the-art Aircraft Maintenance Center in Long Thanh, comprising Hangars 3 and 4. With an impressive capacity to simultaneously accommodate up to ten aircraft, this new facility is set to revolutionize aircraft maintenance services, adhering to the most stringent international standards.

“VPS Securities Plans to Issue 710 Million Bonus Shares to Boost Chartered Capital”

At the upcoming Extraordinary General Meeting, VPS Securities will propose to its shareholders a plan to issue 710 million bonus shares, thereby increasing its charter capital to VND 12,800 billion.