Searefico Joint Stock Company (HOSE: SRF)

The reviewed semi-annual financial statements for the first half of 2025 of Searefico recorded a consolidated after-tax profit of VND 5.57 billion, up 75.58% compared to VND 3.17 billion in the self-prepared report. Compared to the same period in 2024 (profit of VND 671 million), profit in the first half of this year increased by 830%. According to SRF’s explanation, the difference from the self-prepared report mainly comes from the adjustment of consolidation entries after the company divested a subsidiary and recognized it as an associate.

Consolidated Business Results for the First Half of 2025 – Searefico (in billion VND)

| Before Review | After Review | Difference | |

| Revenue | 393.38 | 432.72 | 10% |

| After-tax profit | 3.17 | 5.57 | 76% |

In terms of business activities, consolidated revenue for the first six months reached VND 432.72 billion. The company said that the value of signed but unexecuted contracts (backlog) as of mid-2025 reached VND 1,310 billion, ensuring a workload for the second half.

However, Searefico’s biggest challenge comes from legal listing issues. SRF stock faces the risk of mandatory delisting if the 2025 audited financial statements continue to receive a qualified opinion, following two consecutive years of 2023 and 2024 in this situation.

In early September 2025, the Ho Chi Minh City Stock Exchange (HOSE) officially notified Searefico of the risk of mandatory delisting of SRF stock in accordance with regulations.

The core reason for the qualified opinion stems from the fact that the auditing firm, AASC, could not obtain sufficient confirmation letters for the accounts receivable of VND 33.6 billion as of June 30, 2025.

Facing the risk, SRF’s management said they are making efforts to address the outstanding issues. The report noted that the items previously noted, such as inventory and accounts payable, have been fully resolved. Specifically, the accounts receivable that led to the qualified opinion has decreased by 71%, from VND 114 billion as of December 31, 2023, to VND 33.6 billion.

To strengthen risk management, the company has made provisions of VND 39.9 billion for inventory devaluation and VND 55.8 billion for doubtful accounts. These provisions may be reversed in the future when the related projects are settled.

With only six months left in the year, the pressure on Searefico’s management is immense to completely eliminate the qualified opinion and maintain its listing status on the HOSE.

Mr. Le Tan Phuoc, Chairman of the Board of Directors of Searefico Joint Stock Company (SRF)

Searefico is one of the leading contractors in Vietnam in the field of Mechanical and Electrical Engineering (M&E) and Industrial Refrigeration, with a history of over 47 years. The company’s business activities are closely linked to the cycles of the construction and real estate industries.

Searefico’s difficult period began in 2022 when the real estate market started to slow down. As a contractor dependent on the progress of payments from investors, SRF faced an increase in difficult-to-collect accounts receivable.

As a result, in 2022, the company reported a loss for the first time in nearly three decades of operation, with a consolidated after-tax loss of up to VND 141.3 billion. The main reason was a provision for doubtful accounts of VND 77.3 billion. The prolonged issue of accounts receivable was also the direct cause of the qualified audit opinion in 2023 and 2024, which continues to the present, creating the most significant legal risk for the business.

“SMC Vows to Recover All Troubled Debt from Novaland Amid Operational Viability Concerns Raised by Auditors”

In March and April of 2025, SMC and the Novaland Group entered into several contracts and agreements for the purchase and sale of real estate. As a result, SMC recognized an increase in construction work-in-progress of VND 279 billion and made advance payments to sellers related to the long-term purchase/lease of real estate totaling VND 156 billion, offsetting the Group’s receivables from the Novaland Group.

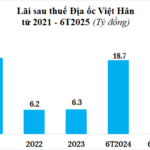

“Real Estate Giant Việt Hân’s Profits Plummet by Over 40%, Burdened by $400 Million Debt”

In the first half of 2025, Dia Oc Viet Han reported a net profit of nearly VND 11 billion, a significant 42% decrease compared to the same period last year. Meanwhile, the company is burdened with a staggering debt of over VND 20.1 trillion, more than half of which comprises bond debt.