Market Timing is Key

In SSI Securities Corporation’s (SSI Research) newly released September strategic report, they anticipate that the market could be supported by expectations of a Fed rate cut on September 17th and the potential for a market upgrade in early October.

However, as the main index has seen impressive growth in the last two months, there may be significant pressure for a correction. “In a more cautious scenario, a strong corrective phase could occur during the September – early October period, with a potentially larger amplitude than the corrections since the April low,” SSI Research forecasts.

Looking back, the VN-Index has shown relatively positive growth in September, with 7 increases in the past 10 years. However, the past 4 years have shown a distinct change: since the implementation of the 4-day holiday in September (since 2021), the market has often traded sideways or declined sharply – specifically falling 6% and 11.6% in 2022 and 2023, and rising less than 1% in 2021 and 2024.

Several factors could contribute to a market correction, including increasing exchange rate pressure (VND depreciated by an average of 3% in the September-October period from 2022-2024). Additionally, the season for Q3 business results announcements is usually less vibrant, and profit-taking pressure after a strong recovery in August could also lead to a corrective phase.

“Statistics show that the market often goes through corrections of more than 7% in an uptrend, especially after a rapid increase of more than 20% within 3 months. Currently, the VN-Index has risen 50% in the past 3 months and has not recorded a decrease of more than 4.5% since the April low,” the SSI report stated.

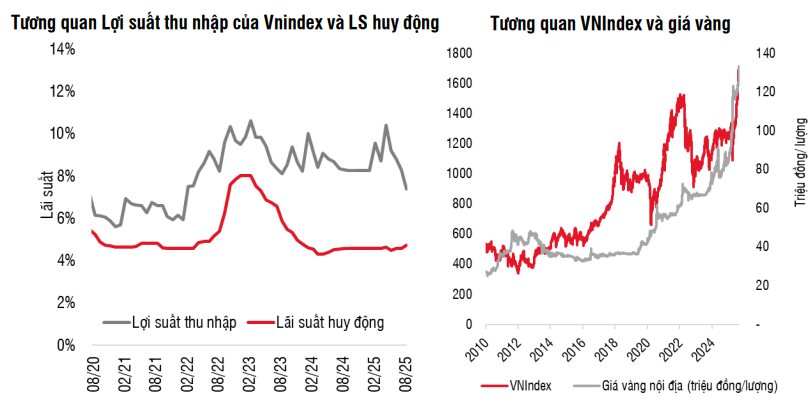

At present, the Vietnamese stock market is offering an earnings yield of 7.7%, which is superior to other main investment channels such as bank deposits (common interest rates of 5-6%), real estate (rental yield of 3-4%), and gold (after recent price increases).

Therefore, a strong corrective phase in the coming time, if it occurs, could open up opportunities to accumulate stocks for long-term investment horizons.

This outlook is reinforced by: (1) expectations of double-digit GDP growth in the next 5-10 years, driven by comprehensive institutional reforms and a focus on promoting the development of the private economic sector, (2) prospects for solid profit growth of over 14%/year in the 2025 – 2026 period, (3) market upgrade prospects that will attract more international capital, and (4) supportive monetary policies that maintain a favorable interest rate environment for the stock market.

Foreign Capital will Return Soon

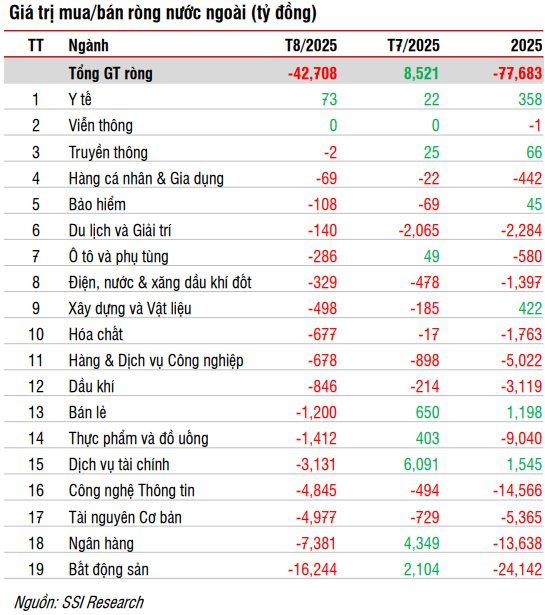

Regarding foreign transactions, foreign investors net sold strongly in August with a value of VND 42.7 trillion, contrary to the net buy of VND 8.5 trillion in July, bringing the total net sell since the beginning of the year to VND 77.7 trillion.

In the context of global capital flowing back to the US and Chinese markets, along with the strong increase of VN-Index by +32.7% in the first 8 months of the year, foreign investors’ profit-taking is understandable. However, SSI assesses the medium and long-term prospects to remain positive.

Additionally, the launch of new indices by HOSE, such as VN50 Growth, VNMITECH, and the renaming of Xtrackers FTSE Vietnam Swap UCITS ETF to reflect a change in the underlying index from FTSE Vietnam to STOXX Vietnam Total Market Liquid, will also create certain short-term incentives. The analytics group expects the Vietnamese market to soon welcome the return of foreign capital in the coming period.

What Stock Code Was at the Center of Securities Companies’ Proprietary Trading “Sell-Off” on the Last Trading Day of the Week?

“Local brokerage firms turned net sellers on the Ho Chi Minh Stock Exchange (HoSE), offloading a total of VND224 billion ($9.5 million) worth of shares.”

The Stock Market’s Volatile Week: What’s Next?

Today (September 12th) marks the fourth consecutive session of stock market gains, propelled by Vingroup stocks, real estate, and steel sectors. While the market extended its positive momentum, trading liquidity weakened as foreign investors continued to offload holdings. Amid this upbeat performance, the market also received a boost from positive news on potential upgrades.

A Surprising $35 Million Foreign Sell-Off of Blue-Chip Stocks in the Week of September 8-12.

The foreign bloc continues to exert significant selling pressure, recording yet another week of net selling exceeding VND 5,000 billion.