I. VIETNAM STOCK MARKET WEEK 08-12/09/2025

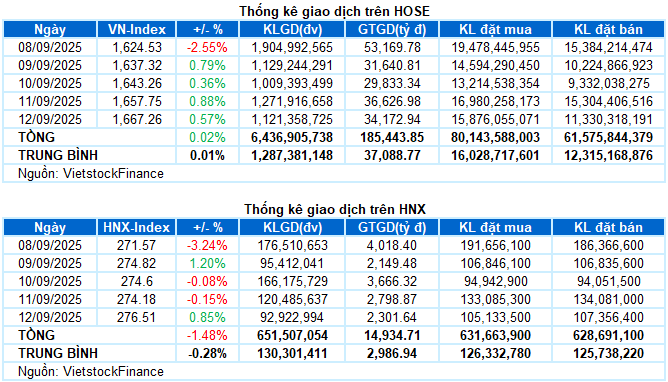

Trading: The main indices maintained their upward momentum during the trading session on September 12th. The VN-Index ended the week at 1,667.26 points, a 0.57% increase from the previous session; while the HNX-Index also rose by 0.85% to reach 276.51 points. For the week, the VN-Index remained relatively flat with a slight gain of 0.29 points (+0.02%), and the HNX-Index decreased by 4.16 points (-1.48%).

Vietnam’s stock market concluded a dynamic trading week. After a significant drop at the beginning of the week, the VN-Index gradually regained its balance with four consecutive recovery sessions, despite strong fluctuations within the sessions and persistent net selling pressure from foreign investors. The market continued to witness a polarized performance as capital rotated between sectors. The VN-Index ended the week at 1,667.26 points, up slightly by 0.02% compared to the previous week.

In terms of impact, VIC, HPG, and MSN were the top three contributors in the final session, adding a total of 4.6 points to the VN-Index. On the other hand, VPB exerted the most considerable downward pressure, taking away 1.2 points from the index.

The majority of sectors maintained their upward trajectory, with materials leading the market, increasing by 2.18%. Numerous stocks in this sector recorded gains of over 2%, including HPG, GVR, MSR, HSG, NTP, NKG, VCS, PHR, TVN, CSV, DPR, DDV, BFC, and KSB, which reached the maximum daily limit.

The consumer staples, industrials, and energy sectors also made notable contributions to the final session, all increasing by over 1%. The gains were broad-based, with prominent names such as MSN (+4.88%), VNM (+3.27%), VLC (+2.01%), MML (+4%); GEX (+3.97%), CII (+3.46%), VCG (+4.66%), HHV (+2.32%), LCG (+3.32%), HVN (+3.19%); PVD (+4.6%), PVS (+3.51%), and OIL (+4.39%).

Additionally, the real estate sector made a significant contribution to the overall index due to its large market capitalization. Strong buying interest was observed in VIC (+1.32%), PDR (+1.07%), DXG (+2.34%), DIG (+2.29%), TCH (+2.36%), NLG (+2.1%), along with IJC, SJS, and TDC, which all reached the daily upper limit.

On the other hand, information technology and financials were the only sectors that failed to join the rally, mainly due to pressure from a few large-cap stocks, including FPT (-0.39%); VPB (-2.02%), SSI (-1.3%), SHB (-1.4%), and SSB (-2.24%).

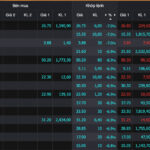

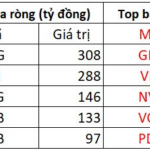

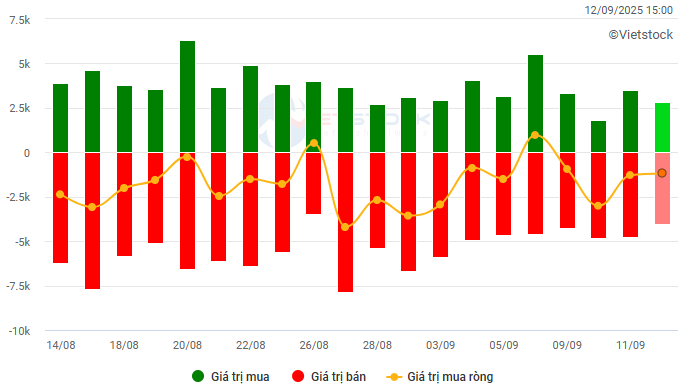

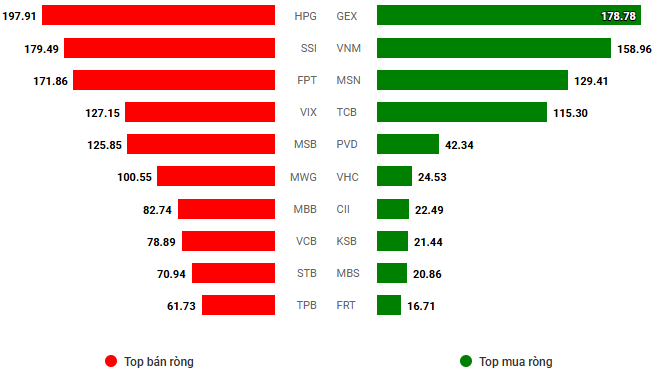

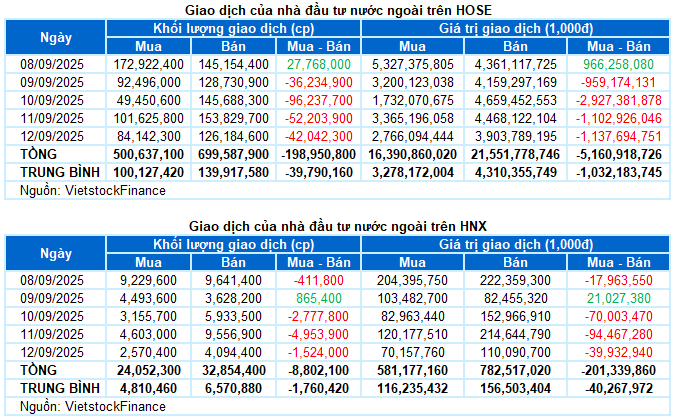

Foreign investors continued to be net sellers, offloading nearly VND 5.4 trillion on both exchanges during the week. They net sold nearly VND 5.2 trillion on the HOSE and VND 201 billion on the HNX exchange.

Trading value of foreign investors on HOSE, HNX, and UPCOM by date. Unit: VND billion

Net trading value by stock code. Unit: VND billion

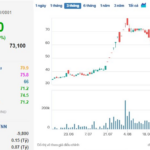

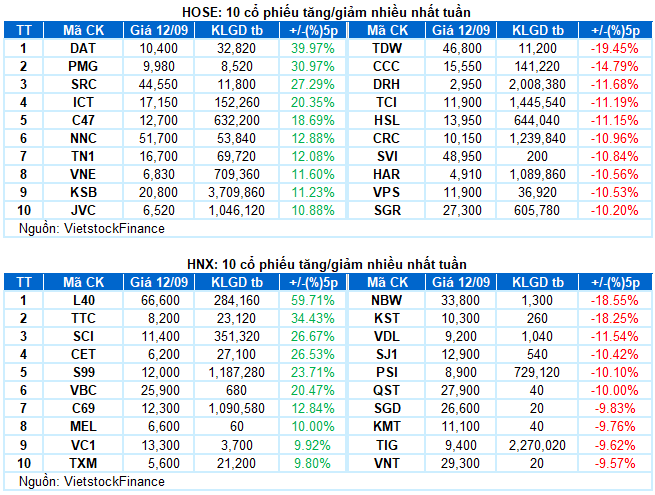

Stocks with notable performance during the week: KSB

KSB rose by 11.23%: KSB witnessed a strong breakout in the final session, accompanied by higher-than-average trading volume, indicating a return of positive sentiment.

Currently, the MACD indicator has given a buy signal by crossing above the signal line, and the Stochastic Oscillator also suggests a similar signal. If, in the upcoming sessions, the stock price can completely surpass the range of 20,000-21,000 (equivalent to the August 2025 and March 2025 highs), the short-term outlook will become even more positive.

Stocks with significant declines during the week: CRC

CRC fell by 10.96%: CRC continuously dropped after falling below the SMA 50-day moving average. The high trading volume during the sharp declines indicates a pessimistic investor sentiment.

At present, the Stochastic Oscillator has entered the oversold region, and the stock price is testing the SMA 100-day moving average. If it manages to hold above this level in the coming sessions, the situation may improve.

II. STOCK MARKET STATISTICS FOR THE PAST WEEK

Economic and Market Strategy Division, Vietstock Consulting Department

– 17:27 12/09/2025