Ms. Nguyen Thi Vui, LPBank’s Executive Board Member, receives the award and certificate of merit from the organizers.

On the morning of September 9, Hanoi hosted a grand ceremony to honor the country’s top tax-contributing enterprises in 2025. The event gathered senior leaders from government agencies, top economists, and representatives from nearly 200 outstanding enterprises nationwide. This annual event aims to recognize businesses that have made significant contributions to the national budget, affirming the leading role and strength of Vietnam’s business community.

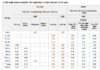

During the ceremony, LPBank (LPBank – stock code: LPB) was named among the Top 14 private enterprises and Top 6 private banks with the highest tax contributions in the country.

With its nationwide network and flexible development strategy, LPBank has affirmed its position as one of the most dynamic private banks, accompanying customers on their journey towards sustainable development.

Alongside its substantial tax contributions, LPBank reported impressive semi-annual business results for 2025. The bank achieved a pre-tax profit of VND 6,164 billion, completing 41.5% of its annual plan. Total operating income reached VND 9,601 billion, of which non-credit income accounted for 27% and grew by 17.3% compared to the previous year. The balanced income structure demonstrates the bank’s efforts in diversifying revenue streams, reducing dependence on traditional credit activities, and aligning with its sustainable development orientation.

In terms of scale, LPBank’s credit balance reached VND 368,727 billion, an 11.2% increase from the beginning of the year, significantly higher than the industry’s average growth rate. The bank’s total assets also increased by 16% year-on-year to VND 513,613 billion. This clearly showcases LPBank’s capacity for capital supply expansion, especially in the retail sector – an area of focus for the bank as it accompanies individual and small business customers, boosting consumption and production.

Operational efficiency and risk management capabilities remain standout features in LPBank’s financial picture. The bank’s cost-to-income ratio (CIR) was maintained at 28.92%, lower than the market average, reflecting its ability to control costs effectively. This allows LPBank to confidently reinvest in technology and strategic projects without compromising profits. The non-performing loan ratio was tightly managed at 1.74%, fully meeting the State Bank’s requirements and demonstrating safety and quality in asset management. Profitability ratios were also impressive, with ROE at 23.67% and ROA at 1.95% – well above the industry average.

This year, LPBank paid cash dividends for 2024 at a rate of 25% according to the resolution of the Annual General Meeting of Shareholders. The total value of dividends reached VND 7,468 billion, the highest in the banking industry today. This affirms the bank’s financial strength, transparency, and commitment to bringing practical value to its shareholders.

Being recognized among the Top 14 private enterprises and Top 6 private banks in Vietnam’s largest tax contributors in 2025 is not only an acknowledgment of LPBank’s financial efforts but also a source of pride and motivation for the bank to remain steadfast on its path to sustainable development. With its flexible strategy, effective governance, and spirit of serving society, LPBank affirms its continued accompaniment with the Government and the business community in building a prosperous Vietnam.

According to CafeF Lists 2025, the top 200 enterprises in the VNTAX 200 list contributed nearly VND 800,000 billion to the state budget in 2024, equivalent to 40% of the country’s total budget revenue. The private sector alone contributed nearly VND 245,000 billion, with several units contributing over VND 10,000 billion.

For the banking industry, 2024 was a breakthrough year, with the total tax contributions of the top 20 banks exceeding VND 95,400 billion, a 19% increase from the previous year and 68% higher than in 2022.

In the context of Vietnam’s accelerated economic development, the contributions of the business community in general and the banking industry, in particular, are considered crucial. These budget contributions not only reflect the financial health of enterprises but also demonstrate their social responsibility and accompaniment with the nation in key areas such as education, healthcare, infrastructure, national defense and security, and social welfare.

“NCB Bank Revolutionizes the Workplace with a Digital-First Culture”

With a strong focus on people and technology, National Commercial Joint Stock Bank (NCB) has made a significant breakthrough in its human resources strategy. The bank has redefined its work environment, embracing a modern and cohesive approach and fostering a digital culture to become the new “destination” for talent in the banking industry.

“Techcombank: Leading the Way in Vietnam’s Private Banking Sector with Unparalleled Fiscal Contributions”

Techcombank, Vietnam’s leading private bank, has once again proven its formidable stature at the 2025 Top Budget-Contributing Enterprises Ceremony held on September 9. For the third consecutive year, the bank has been hailed as the top private bank in terms of budget contribution to the country. This remarkable achievement cements Techcombank’s position as a pivotal financial institution in Vietnam’s thriving economy.

“Biometric Technology Slashes Bank Fraud by 60%”

The State Bank of Vietnam reported that as of August 15th, the banking industry had acquired nearly 124 million individual customer records and 1.3 million organizational customer records for entry and biometric data verification. This initiative has proven successful, resulting in a nearly 60% reduction in the number of customers falling victim to fraud and subsequent financial loss.

The Breakthrough Strategy to Make NCB the Go-To Destination for Banking Talent

With a strong focus on people and technology, National Commercial Joint Stock Bank (NCB) has made a significant breakthrough in its human resources strategy. The bank has redefined its work environment to be modern, cohesive, and digital, positioning itself as the new go-to destination for talent in the banking industry.

“SHB Honored with Prime Minister’s Commendation for Outstanding Contributions to the Eradication of Substandard Housing”

Prime Minister’s Commendation for SHB reaffirms the bank’s unwavering commitment to contributing to the nation’s sustainable and prosperous development.