Vietnam’s cement and clinker exports from January to July 2025 showed positive growth.

According to statistics from the Customs Department, Vietnam’s cement and clinker exports in the first seven months of 2025 reached 19.81 million tons, equivalent to over 744.74 million USD, up 8.7% in volume and 6.5% in value compared to the same period in 2024.

July 2025 alone is estimated at 3.01 million tons, equivalent to 116.32 million USD, with an average price of 38.6 USD/ton.

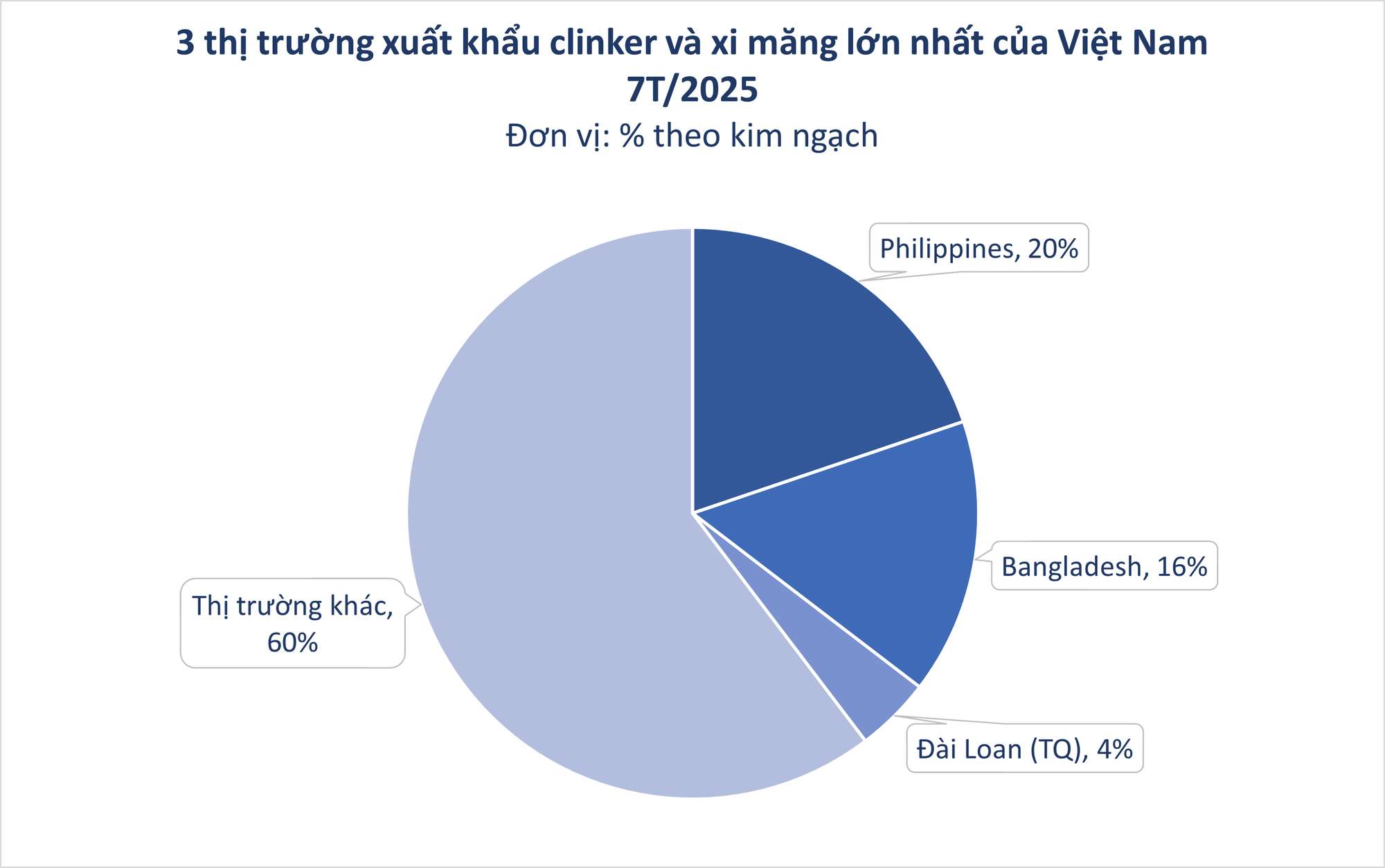

The Philippines was the largest importer of Vietnamese cement and clinker, accounting for nearly 20% of the country’s total export volume and value for this commodity. Exports to the Philippines reached 3.87 million tons, equivalent to over 147.36 million USD, with an average price of 38.1 USD/ton, down 16.5% in volume, 21.1% in value, and 5.5% in price compared to the same period in 2024.

Bangladesh was the second-largest market, with 3.53 million tons of cement and clinker exported, earning 115.79 million USD, a decrease of 9.7% in volume and 6.6% in value compared to 2024. Exports to Taiwan reached 851,273 tons, equivalent to 31.84 million USD, down 4.5% in volume and 0.9% in value.

Notably, Laos has been actively purchasing cement and clinker from Vietnam, with an import volume of 81,700 tons, equivalent to 6.2 million USD, a significant increase of 283% in volume and 323% in value. The price also increased by more than 10%.

The government has issued a decree to support the domestic cement industry.

Recently, the government issued Decree No. 108/2025/ND-CP amending and supplementing Decree No. 26/2023/ND-CP on export and import tax rates, list of goods, and absolute tax rates, mixed tax rates, and out-of-quota import tax rates.

The most notable content of the decree is the adjustment of the export tax rate for clinker cement from 10% to 5% to support the domestic cement industry, which is facing difficulties.

This preferential tax rate will be applied until December 31, 2026. From January 1, 2027, the tax rate will return to 10% as stipulated in the Export Tax Schedule issued together with Decree No. 26/2023/ND-CP.

According to the Ministry of Construction, there are currently 92 cement production lines in Vietnam with a total designed capacity of 122.34 million tons/year. However, the lines are operating at only about 77% capacity. 34 lines had to cease production for one to six months, some even for the entire year, resulting in losses for many cement enterprises…

In 2024, the total consumption of cement and clinker was approximately 95 million tons, a slight increase of 1% compared to 2023. Domestic consumption accounted for 65.3 million tons (up 3%), while exports reached 29.7 million tons (down 5%). The export value was estimated at 1.136 billion USD, a decrease of 14.2% compared to the previous year.

The reduction of the export tax rate for clinker cement from 10% to 5% until the end of 2026 will provide clinker and cement producers with more than a year to adjust their production and business plans and manage their inventories.

The Blue Unicorn: Can Vietnam’s Beloved Beverage Survive a Slump?

This enterprise boasts the largest market share in the southern region. With an unwavering commitment to excellence, it has firmly established itself as the preeminent leader in its industry. Through innovative strategies and a customer-centric approach, it has attained unparalleled success, leaving its competitors trailing in its wake. The company’s dominance is a testament to its unwavering dedication, exceptional services, and unwavering commitment to its clients.