The human resources required to operate the market, including personnel from government agencies, service providers, and those supporting market training, are all in a fragile state.

To shed light on the opportunities and challenges ahead, MarketTimes had a conversation with Mr. Phan Duc Trung, Chairman of the Vietnam Blockchain and Digital Asset Association (VBA) and Chairman of 1Matrix.

MarketTimes:

Sir,

The government’s Resolution 05/2025/NQ-CP on the pilot implementation of the encrypted asset market in Vietnam has garnered much attention. Could you share with us the process of drafting this resolution and the role played by the Association?

Mr. Phan Duc Trung:

The drafting process for this resolution took an entire year, and the Association was an integral part of it, even accompanying inter-ministerial agencies like the Ministry of Justice and the Ministry of Public Security to Hong Kong for research purposes.

We diligently selected information from international sources while keeping in mind the Vietnamese context. One notable aspect was the creation of a separation between foreign and domestic investors. Although the Association shared that this could reduce the market’s appeal, it serves to protect the domestic forex market.

MarketTimes:

One of the biggest concerns raised is the issue of human resources. What are the challenges in terms of human resources when it comes to implementing the encrypted asset market in Vietnam?

Mr. Phan Duc Trung:

Human resources are indeed the biggest concern. With the enactment of the resolution, we are faced with a spontaneous market involving tens of millions of people, many of whom are new to this market.

The current human resources are inadequate for coordination with the public security agencies in handling fraud cases, some of which involve tens to hundreds of millions of dollars.

The human resources required to operate the market, including personnel from government agencies, service providers, and those supporting market training, are all in a fragile state.

MarketTimes:

Resolution 05 aims to attract foreign investment. What are your thoughts on the likelihood of achieving this goal, especially with the restriction that only foreigners are allowed to purchase issued encrypted assets?

Mr. Phan Duc Trung:

The government’s intention is to promote the issuance of encrypted assets to attract substantial foreign investment.

Indeed, during this issuance, only foreigners are permitted to purchase these assets, while domestic individuals are not. This demonstrates the government’s desire to attract capital, and as we open our doors to foreign investors, we must also face international competition.

The question arises as to whether the quality of our issued assets is internationally appealing and competitive, and if our market maturity can provide a large enough playing field. While this restriction helps ensure forex safety, it diminishes the market’s appeal to international investors, who anticipate Vietnam to be a significant player.

MarketTimes:

Regarding the maturity of Vietnam’s encrypted asset market, how long do you predict it will take to reach the necessary level to comply with the law and achieve sustainable development?

Mr. Phan Duc Trung:

I believe it will take around three to five years for the market to mature. If we compare it to the Vietnamese stock market, which started developing in 2007 but is still in its infancy, the global encrypted asset market is even younger.

However, if we approach this with comprehensive and effective strategies, we can shorten this developmental period to two to three years. This pilot phase also allows the government to establish a sound legal framework rather than a complete one from the outset.

MarketTimes:

The resolution requires domestic organizations participating in the market to have a minimum chartered capital of VND 10,000 billion. What are your thoughts on this requirement, especially since other countries typically don’t set such a high capital threshold?

Mr. Phan Duc Trung:

The resolution stipulates that only domestic organizations with a minimum chartered capital of VND 10,000 billion are eligible to participate. In other countries, they typically focus on factors like technology approval, insurance (with an average of around $230 million for encrypted asset exchanges), physical infrastructure standards, and human resources, without setting such high capital requirements.

However, in Vietnam’s context, we have to rely on enterprises with sufficient financial capacity and capital scale to ensure insurance coverage. The VND 10,000 billion threshold demonstrates a serious commitment to investment, but it is also a bold requirement for businesses, even when raising capital in the traditional stock market.

Ultimately, the crucial question is whether this investment will yield profits and value for service providers and serve as a channel for capital mobilization for the economy.

MarketTimes:

Regarding the role of encrypted asset exchanges in this pilot market, how do you envision their operational model, especially given that the government does not yet have a standardized exchange?

Mr. Phan Duc Trung:

This is a significant point of differentiation and challenge. The government does not yet have a standardized exchange like the stock market. Instead, the five licensed companies will establish their own rules of engagement, trading regulations, and compliance with the state’s general provisions. These exchanges will not only connect with each other but also with international markets. It is imperative for the exchanges to proactively work with the regulatory authorities to establish technical and operational standards, including comprehensive services such as custody, segregation of customer assets, and management of hot/cold wallets (with hot wallets accounting for only 2-5% of assets).

For an exchange to function effectively, it needs a substantial customer base, competitive fees, safety measures, and, most importantly, the ability to compensate for financial losses. I assess that during this pilot phase, no more than three exchanges will possess the requisite capabilities for efficient execution.

To attain the first 10,000 customers, a minimum threshold for generating trading activities, we might have to wait until 2026-2027. The core element is for service providers to survive this period, comply with the law, acquire customers, and train their teams.

MarketTimes:

The issue of anti-money laundering and handling abnormal transactions is a significant concern. Does Resolution 05 address this, sir?

Mr. Phan Duc Trung:

Absolutely. The requirement for personnel to hold ACAMS-certified anti-money laundering qualifications showcases Vietnam’s seriousness in combating money laundering.

In the global context of anti-money laundering efforts, determining what constitutes a suspicious transaction in the crypto market is complex, especially with P2P or decentralized (DeFi) transactions. Our exchanges are centralized, so we will have distinct standards. These regulations are essential to ensure the security and safety of the market.

MarketTimes:

Regarding taxes and transaction fees for encrypted assets, there has been a proposal to impose a 0.1% tax on crypto transactions, similar to securities. Do you think this will affect the market’s appeal?

Mr. Phan Duc Trung:

The proposal to levy a 0.1% tax on crypto transactions, akin to securities, warrants careful consideration. The highest transaction fees on major global exchanges typically range from 0.1% to 0.05%.

If we impose a 0.1% tax on transactions without considering profits and losses, investors might perceive the tax as excessively high, even surpassing the transaction fees. We need to reconsider our taxation approach.

Perhaps during this pilot phase, waiving transaction fees could be a prudent choice to attract investors. The ultimate goal is to strike a balance between attracting investors and promoting policies, ensuring that service providers can operate sustainably.

MarketTimes:

Thank you for your valuable insights!

Nearly VND 70,000 billion in bonds due in the last four months of the year

In the remaining four months of 2025, an estimated VND 69.74 trillion in bonds will mature, with real estate bonds accounting for the lion’s share at VND 29.883 trillion, or 43%.

“HAGL’s Subsidiary Reworks Bond Terms to Venture into Sericulture and Coffee Cultivation”

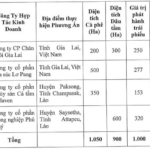

HGLC, a prominent agricultural enterprise majority-owned by Hoang Anh Gia Lai (HAGL), has refinanced its bond offering of 1,000 billion VND. This strategic move will redirect capital allocation towards an ambitious endeavor: expanding silkworm and coffee cultivation projects across Vietnam and Laos.

“Paris Baguette: A Tasty New Venture for the Founder of Highlands Coffee”

Paris Baguette, a delightful culinary gem, is owned by the renowned SPC Group, a leading food and confectionery conglomerate in South Korea. With a global revenue of approximately $5.7 billion in 2020, SPC Group has established itself as a powerhouse in the industry. Paris Baguette, a shining star in their portfolio, captivates patrons with its exquisite offerings.

The Philippines Halts Rice Imports: “If We Can’t Sell in This Market, We Can Sell in Others,” Says Chairman of Vietnam’s Largest Rice Exporter.

“The Philippines remains a significant importer of Vietnamese rice. Their demand is expected to remain stable, and any import suspensions will likely be short-lived,” said Ms. Tam.