Vietnam Pilots a Regulatory Framework for the Crypto Asset Market

On September 9, 2025, the Vietnamese government issued Resolution No. 05/2025/NQ-CP, piloting a regulatory framework for the crypto asset market over a five-year period. This resolution applies to both service providers, issuers, and investors, both domestic and foreign. It marks a significant step in establishing a legal framework for the crypto asset market in Vietnam.

Stringent Requirements for Crypto Service Providers

According to the resolution, all crypto transactions must be conducted through licensed entities authorized by the Ministry of Finance, moving away from the previous freedom of exchange. Enterprises seeking to provide crypto market services must meet seven stringent conditions, notably a minimum chartered capital of VND 10,000 billion, with at least 65% domestic ownership. Additionally, they must employ personnel with professional qualifications and implement technology that meets the safety standard level 4.

The resolution also mandates that crypto asset issuers must be Vietnamese companies, operating as limited liability or joint-stock companies. Importantly, crypto assets must be backed by real assets, excluding securities and legal tender, and can only be offered to foreign investors.

A notable aspect of Resolution 05 is the requirement for issuers to publish a prospectus at least 15 days before the offering and adhere to stringent processes for custody, trading, anti-money laundering, risk management, and information disclosure. The pilot program is being conducted on the principles of “prudence, tight control, safety assurance, transparency, and protection of legitimate rights and interests of investors.” This approach strikes a balance between fostering financial innovation and maintaining strict oversight of this nascent market.

Resolution No. 5/2025/NQ-CP on the Pilot Implementation of the Crypto Asset Market in Vietnam takes effect on September 9, 2025.

Onboarding Investors onto Domestic Exchanges

On September 10, financial expert Phan Dũng Khánh shared his insights with the NLD reporter regarding Resolution No. 5/2025/NQ-CP. He highlighted the presence of numerous investors willing to pay taxes and transact on official digital asset platforms to seek legal protection from Vietnamese laws.

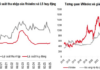

With the vision of establishing two international financial centers in Ho Chi Minh City and Danang, the development of digital finance is a crucial component alongside traditional finance. Data from Chainalysis in 2025 ranked Vietnam at the forefront in terms of Crypto Acceptance, with a TSS (token and coin) adoption rate three to four times higher than the global average.

Additionally, a 2024 report by Triple-A revealed that over 20% of Vietnam’s population owns crypto assets. During the 2023-2024 period, Vietnam attracted approximately $105 billion in capital inflows from the blockchain market.

“The data from Chainalysis and Triple-A indicate a significant number of digital asset owners in Vietnam,” said Mr. Phan Dũng Khánh. “Many investors are willing to pay taxes and transact on official Vietnamese platforms to seek legal protection. Conversely, many investors have stayed on the sidelines due to legal concerns, and the introduction of a regulatory framework will likely attract them to participate.”

Meanwhile, Mr. Phan Đức Nhật, Chairman of Coin.Help & BHO Network, a Web3, Blockchain, and AI project support organization, noted that under the new regulations, all crypto transactions in Vietnam must be conducted through exchanges licensed by the Ministry of Finance. Investors currently trading on international exchanges should proactively transfer their assets to domestic exchanges once the system becomes operational.

Mr. Nhật advised investors to familiarize themselves with the regulations and comply with information disclosure and risk management obligations similar to those in the securities market, until specific tax policies are formulated for the crypto asset market. After six months from the effective date of this resolution, if individuals still conduct transactions on unlicensed platforms, they may face administrative sanctions or even criminal liability according to Resolution 05/2025 on the management of transactions outside the system.

The Crypto Conundrum: Vietnam’s Trillion-Dollar Opportunity Stalls Over Human Capital and Capital Hurdles

Resolution 05/2025/NQ-CP, which stipulates that only domestic organizations with a minimum charter capital of VND 10,000 billion are eligible to participate, poses a significant challenge for businesses, even when mobilizing capital in the traditional stock market.

“HAGL’s Subsidiary Reworks Bond Terms to Venture into Sericulture and Coffee Cultivation”

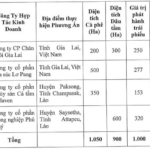

HGLC, a prominent agricultural enterprise majority-owned by Hoang Anh Gia Lai (HAGL), has refinanced its bond offering of 1,000 billion VND. This strategic move will redirect capital allocation towards an ambitious endeavor: expanding silkworm and coffee cultivation projects across Vietnam and Laos.

“Paris Baguette: A Tasty New Venture for the Founder of Highlands Coffee”

Paris Baguette, a delightful culinary gem, is owned by the renowned SPC Group, a leading food and confectionery conglomerate in South Korea. With a global revenue of approximately $5.7 billion in 2020, SPC Group has established itself as a powerhouse in the industry. Paris Baguette, a shining star in their portfolio, captivates patrons with its exquisite offerings.