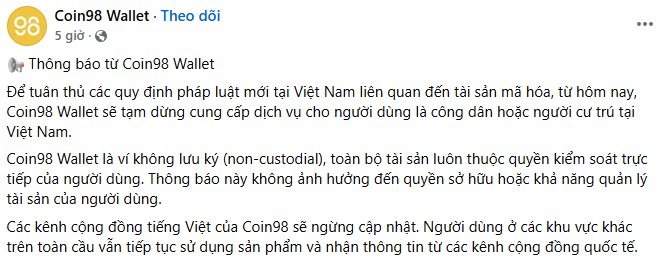

In its latest announcement to users, Coin98 Wallet – a non-custodial wallet service provided by Ninety Eight, a Vietnamese blockchain startup – stated that it would temporarily suspend its services to users who are citizens or residents of Vietnam.

Ninety Eight’s decision is aimed at complying with new legal regulations in Vietnam regarding crypto assets.

Ninety Eight (formerly known as Coin98), established in 2017, is a Vietnamese technology startup specializing in Blockchain/Web3. They have built a diverse ecosystem with over 20 products, including the prominent Coin98 Super Wallet, a multi-chain wallet serving over 10 million global users.

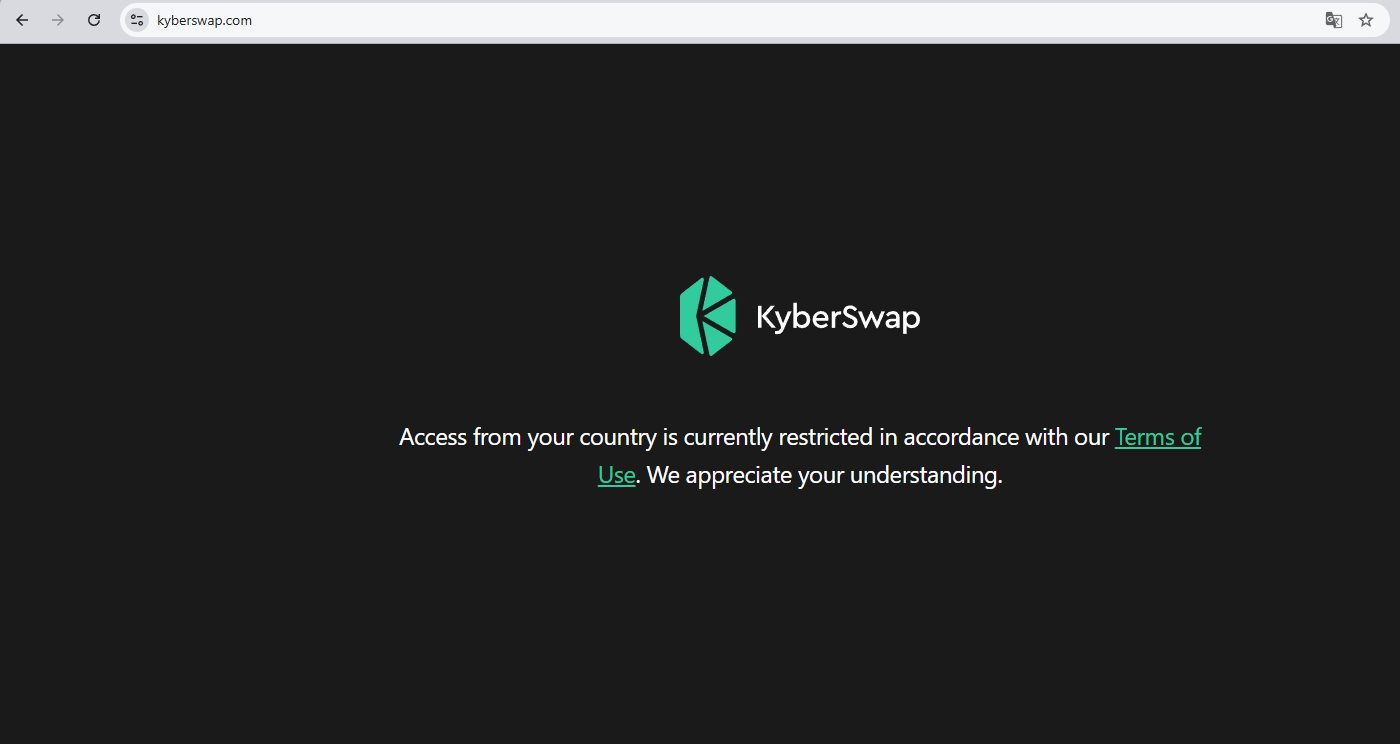

In a separate development, users of KyberSwap, a Vietnamese DEX platform, encountered difficulties accessing the service. While international users could access KyberSwap without issues, the platform appeared to be blocked for domestic network addresses.

KyberSwap is one of the decentralized financial platforms based on blockchain technology developed by Kyber Network, a pioneering blockchain project globally, fully owned by Vietnamese technologists, and established in 2017.

These developments regarding digital and crypto assets follow the recent issuance of Resolution No. 5/2025/NQ-CP by the Deputy Prime Minister, Ho Duc Phoc, on September 9, 2025. The resolution outlines the government’s plans for a pilot program for the crypto asset market in Vietnam, effective from September 9, 2025.

The resolution includes provisions for the pilot sale and issuance of crypto assets, the organization of crypto asset exchanges, and the provision of related services. It also outlines the government’s regulatory framework for the market.

Notably, after a six-month grace period from the licensing of the first crypto asset service provider, domestic investors who trade crypto assets without going through licensed service providers will face administrative or criminal penalties, depending on the nature and severity of their violations.

A slew of conditions for operating a crypto asset exchange: It’s not just about the 10 trillion VND capital requirement.

The resolution also specifies the conditions for obtaining a license to operate a crypto asset exchange.

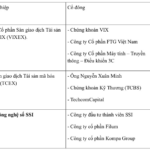

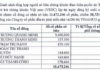

First , the organization must be a Vietnamese enterprise registered to operate in the crypto asset sector as a limited liability or joint-stock company under Vietnamese law.

Second , the chartered capital must be contributed in Vietnamese Dong, and the paid-up chartered capital must be at least 10 trillion VND (Vietnamese Dong).

Third , regarding shareholder or capital contributor requirements, it is noteworthy that a minimum of 65% of the chartered capital must be contributed by institutional shareholders or members, including at least 35% by a minimum of two institutions such as commercial banks, securities companies, fund management companies, insurance companies, or enterprises in the technology field.

Additionally, institutional shareholders or members must have legal entity status and have been profitable for the two years preceding the license application. Their financial reports for the previous two years must be audited with an unqualified opinion.

Organizations and individuals are only permitted to contribute capital to one crypto asset service provider licensed by the Ministry of Finance.

The total capital contribution or shareholding of foreign investors in the licensed crypto asset service provider must not exceed 49% of its chartered capital.

Fourth , the organization must have a physical office and adequate facilities, equipment, and technology suitable for crypto asset service operations.

Fifth , regarding human resources: The General Director (or Director) must have a minimum of two years of experience working in the professional departments of financial, securities, banking, insurance, or fund management organizations.

The Director of Technology (or equivalent position) must have at least five years of experience working in the information technology departments of financial, securities, banking, insurance, fund management, or technology enterprises.

The organization must employ a minimum of ten personnel in the technology department with network information security training certificates as stipulated in Article 50 of the Law on Network Information Security. Additionally, a minimum of ten personnel with securities practice certificates must work in other professional departments.

Sixth , the enterprise must have the following business processes in place: (1) Risk management and information security processes; (2) Processes for providing token issuance infrastructure services; (3) Custody and customer asset management processes; (4) Trading and settlement processes; (5) Proprietary trading processes; (6) AML/CFT/CPF processes; (7) Information disclosure processes; (8) Internal control processes; (9) Transaction monitoring processes; (10) Conflict of interest prevention, customer complaint handling, and compensation processes.

Seventh , the information technology system of the crypto asset service provider must meet the standards for Level 4 information system security specified in the law on information security before being put into operation.

Dragon Capital: Vietnam’s Crypto Asset Holdings Estimated at $100 Billion

“Dragon Capital hails Resolution 05/2025 as a pivotal move to propel the digital asset market forward in a rapid and well-directed manner.”

Unlocking the Potential: Removing Barriers to Foreign Investment in the Stock Market

Introducing a transformative initiative: the proposal to abolish the regulation permitting general shareholder meetings to lower foreign ownership ratios below the statutory limit. This move empowers shareholders, fostering a dynamic and inclusive business environment. By removing this regulation, we unlock the potential for greater foreign investment, driving innovation and growth.

The Crypto Investor’s Guide to Navigating the New Regulatory Landscape: Unlocking Opportunities Post-Resolution 05.

Investing in cryptocurrencies is a risky business, especially when done on an illegal platform. Investors who engage in such activities may face stiff financial penalties or even criminal prosecution.